Compass Point has revised its rating for Horizon Technology (HRZN, Financial), downgrading it to Sell from Neutral. The financial services firm also adjusted its price target for the company to $6.50, a reduction from the previous target of $7.75. This decision follows the recent first-quarter report.

The downgrade is primarily driven by a persistent decline in the company’s net asset value (NAV), which has been decreasing consecutively for the past 11 quarters. Analysts highlight the ongoing strain on the company's long-term performance, attributing significant risk to the NAV in the quarters ahead, particularly due to the historical impact of distressed credits.

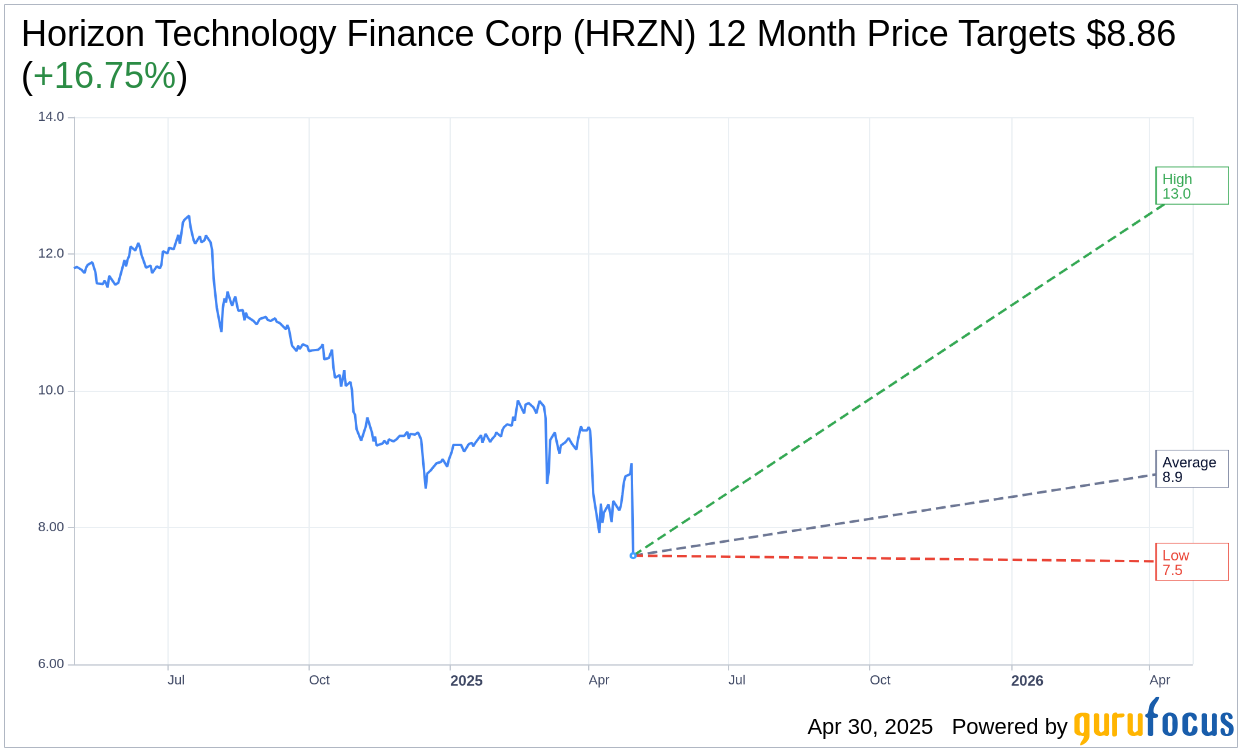

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Horizon Technology Finance Corp (HRZN, Financial) is $8.86 with a high estimate of $13.00 and a low estimate of $7.50. The average target implies an upside of 16.75% from the current price of $7.59. More detailed estimate data can be found on the Horizon Technology Finance Corp (HRZN) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Horizon Technology Finance Corp's (HRZN, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

HRZN Key Business Developments

Release Date: March 05, 2025

- Net Investment Income (NII): $1.32 per share for 2024, covering regular monthly distributions.

- Portfolio Yield: Nearly 16% on debt investments for the full year 2024.

- Net Asset Value (NAV): $8.43 per share as of December 31, 2024.

- Portfolio Size: $698 million at the end of 2024, up 2% from September 30, 2024.

- Committed and Approved Backlog: $207 million at year-end 2024.

- New Loan Commitments: $106 million in the fourth quarter of 2024.

- Debt Portfolio Yield: 14.9% for the fourth quarter of 2024.

- Available Liquidity: $131 million as of December 31, 2024.

- Debt-to-Equity Ratio: 1.4:1 as of December 31, 2024.

- Investment Income: $24 million for the fourth quarter of 2024.

- Total Expenses: $12.8 million for the fourth quarter of 2024.

- Net Investment Income (Q4 2024): $0.27 per share.

- Undistributed Spillover Income: $1.06 per share as of December 31, 2024.

- Monthly Distributions: $0.11 per share declared for April, May, and June 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Horizon Technology Finance Corp (HRZN, Financial) achieved a portfolio yield of nearly 16% on debt investments for the full year, placing it among the top in the BDC industry.

- The company ended 2024 with a committed and approved backlog of $207 million, indicating strong future growth potential.

- Horizon strengthened its balance sheet by closing a new $100 million senior secured credit facility with Nuveen and raising additional capital through a $20 million convertible debt offering.

- The company successfully raised over $66 million at a premium to NAV from the sale of equity through its at-the-market program.

- Horizon declared regular monthly distributions of $0.11 per share payable through June 2025, supported by undistributed spillover income of $1.06 per share as of year-end.

Negative Points

- The net asset value (NAV) decreased to $8.43 per share at the end of 2024, primarily due to fair value markdowns of investments.

- The company experienced underperformance in stressed investments due to ongoing stress in the venture capital ecosystem and tightened capital availability.

- Net investment income (NII) for the fourth quarter was $0.27 per share, down from $0.32 in the previous quarter and $0.45 in the fourth quarter of 2023.

- The portfolio yield for the fourth quarter was 14.9%, a decline from 16.8% in the same period last year.

- The company faced challenges in the fundraising and exit market for some portfolio companies, leading to sizable markdowns primarily on debt investments.