Recent data from inSpectrum highlights notable shifts in memory contract pricing for April. Prices for 8Gb DDR4 DRAM saw a decline of 3.1% compared to the previous month and a 6% drop from the prior quarter. Similarly, 8GB DDR5 DRAM prices decreased by 6.9% both month-over-month and quarter-over-quarter. In contrast, 512Gb NAND prices rose significantly, increasing by 11.5% month-over-month and 16% quarter-over-quarter.

KeyBanc interprets these mixed results as neutral for DRAM but positive for NAND. The firm foresees a potential rebound in prices for both types of memory in the latter half of 2025, attributing this to disciplined production and a shift towards higher-value offerings. Over the long term, KeyBanc considers the DRAM market, bolstered by industry consolidation to three main players—Micron (MU, Financial), Samsung, and SK Hynix—to be healthier and more profitable than NAND. This outlook is supported by strong demand drivers, controlled capacity growth, and extended equipment lead times.

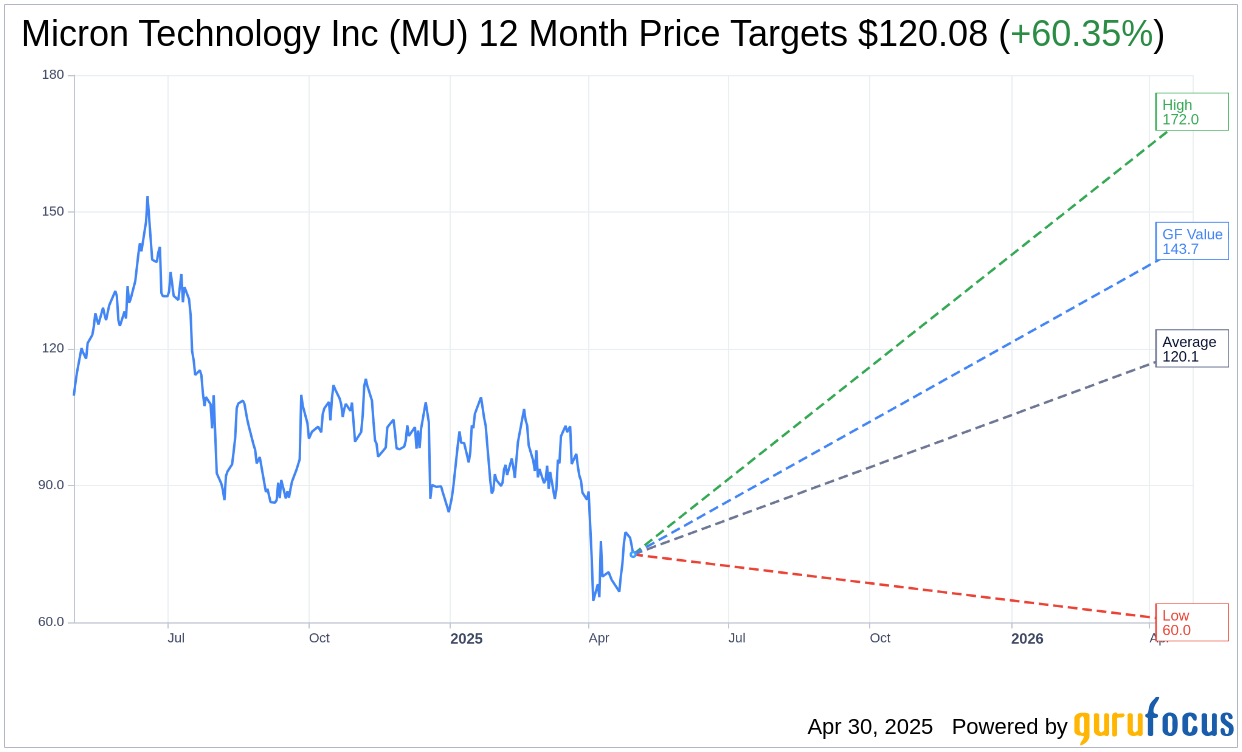

Wall Street Analysts Forecast

Based on the one-year price targets offered by 33 analysts, the average target price for Micron Technology Inc (MU, Financial) is $120.08 with a high estimate of $172.00 and a low estimate of $60.00. The average target implies an upside of 60.35% from the current price of $74.89. More detailed estimate data can be found on the Micron Technology Inc (MU) Forecast page.

Based on the consensus recommendation from 40 brokerage firms, Micron Technology Inc's (MU, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Micron Technology Inc (MU, Financial) in one year is $143.65, suggesting a upside of 91.81% from the current price of $74.89. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Micron Technology Inc (MU) Summary page.

MU Key Business Developments

Release Date: March 20, 2025

- Total Revenue: $8.1 billion, down 8% sequentially, up 38% year-over-year.

- DRAM Revenue: $6.1 billion, up 47% year-over-year, 76% of total revenue.

- NAND Revenue: $1.9 billion, up 18% year-over-year, 23% of total revenue.

- Gross Margin: 37.9%, down 160 basis points sequentially.

- Operating Income: $2 billion, operating margin of 24.9%.

- Adjusted EBITDA: $4.1 billion, EBITDA margin of 50.7%.

- Non-GAAP EPS: $1.56, above guidance range.

- Operating Cash Flow: Over $3.9 billion.

- Capital Expenditures: $3.1 billion, net of government incentives.

- Free Cash Flow: $857 million.

- Ending Inventory: $9.0 billion or 158 days.

- Total Debt: $14.4 billion, with a weighted average maturity of 2032.

- Liquidity: $12.1 billion, including untapped credit facility.

- Fiscal Q3 Revenue Guidance: $8.80 billion, plus or minus $200 million.

- Fiscal Q3 Gross Margin Guidance: 36.5%, plus or minus 100 basis points.

- Fiscal Q3 EPS Guidance: $1.57 per share, plus or minus $0.10.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Micron Technology Inc (MU, Financial) achieved record revenues in data center DRAM, with HBM revenue growing more than 50% sequentially to over $1 billion.

- The company remains the only one globally to ship low-power DRAM into the data center in high volume, showcasing its pioneering innovation.

- Micron's 1-beta DRAM technology leads the industry, and the launch of the 1-gamma node has shown significant improvements in power, performance, and bit-density.

- The company is making disciplined investments to capitalize on AI-driven growth opportunities, including expanding HBM capacity and constructing new facilities.

- Micron's HBM3E delivers a 30% power reduction compared to competitors, and the company has begun volume production of HBM3E 12 high, focusing on ramping capacity and yield.

Negative Points

- Fiscal Q2 revenue was down 8% sequentially, and the gross margin decreased due to pricing in consumer-oriented segments, especially in NAND.

- NAND revenue decreased 17% sequentially, with prices decreasing in the high-teens percentage range.

- The company faces challenges with NAND underutilization, which continues to weigh on gross margins.

- Operating expenses are projected to increase by over 10% in fiscal 2025 to support high-value products, impacting profitability.

- Micron's inventory days increased to 158 days, up from the prior quarter, indicating potential inefficiencies in inventory management.