Key Insights:

- Xerox (XRX, Financial) is anticipated to show a decline in EPS, while revenue is expected to see a modest increase for Q1.

- Analysts offer a mixed one-year price target, hinting at significant potential upside from the current share value.

- GuruFocus estimates suggest a substantial discrepancy between current pricing and the stock's GF Value.

Xerox (XRX) is set to announce its first-quarter earnings on May 1st, with analysts forecasting a decrease in earnings per share (EPS) to -$0.01, alongside a slight rise in revenue to $1.52 billion. Historically, the company has outperformed EPS expectations 38% of the time, yet only surpassed revenue estimates 13% of the time.

Wall Street Analysts Forecast

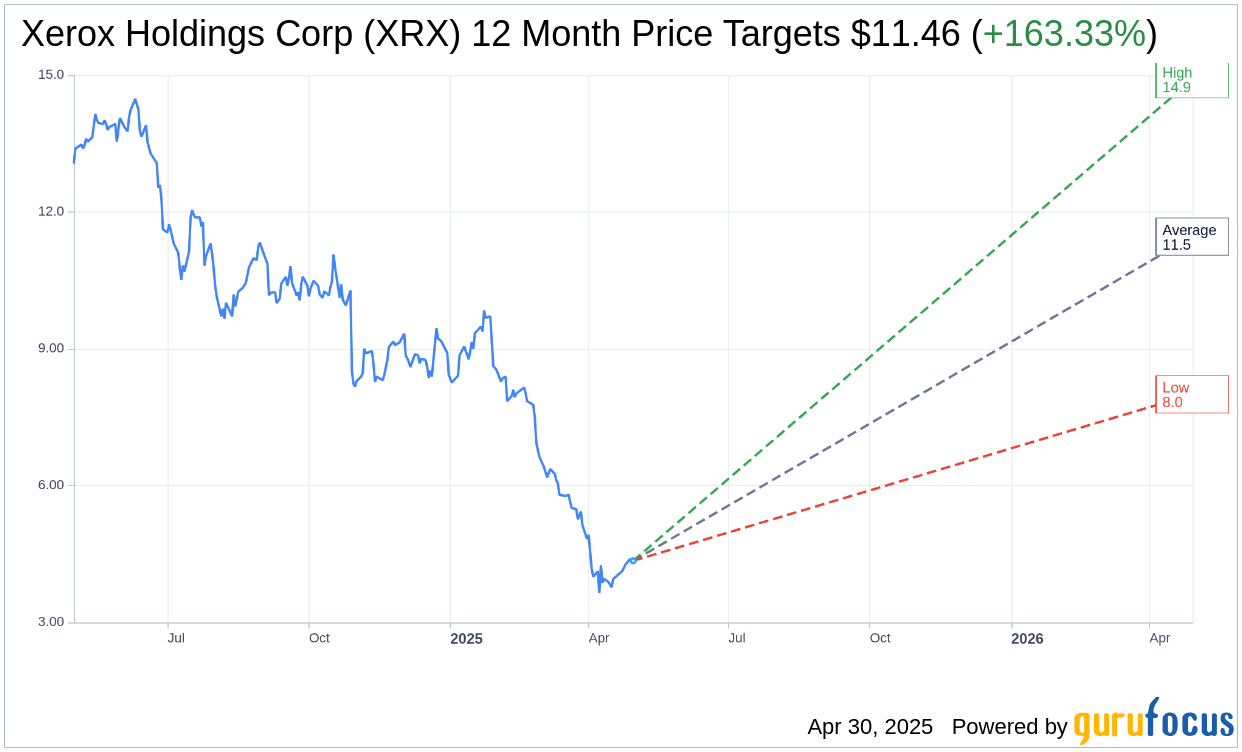

The one-year price targets set by two analysts suggest that Xerox Holdings Corp (XRX, Financial) could reach an average price of $11.46, with the highest estimate at $14.91 and the lowest at $8.00. This average target indicates a potential upside of 163.33% from the current share price of $4.35. Investors looking for more detailed estimate data can visit the Xerox Holdings Corp (XRX) Forecast page.

According to four brokerage firms, the average recommendation for Xerox Holdings Corp (XRX, Financial) stands at 2.8, suggesting a "Hold" status. This recommendation utilizes a scale from 1 to 5, where 1 indicates a Strong Buy and 5 signifies Sell.

GuruFocus Valuation Insights

The GF Value estimation by GuruFocus posits that in one year, Xerox Holdings Corp (XRX, Financial) could achieve a value of $17.90. This estimate suggests an impressive 311.49% upside potential from the current price of $4.35. The GF Value represents GuruFocus' calculated fair value, derived from historical trading multiples, past business growth, and projections of future business performance. For more comprehensive data, visit the Xerox Holdings Corp (XRX) Summary page.