- Biogen (BIIB, Financial) is set to announce its Q1 financials with expected declines in both EPS and revenue.

- Analysts anticipate a significant upside potential, marking a possible 50.35% increase from the current stock price.

- Biogen maintains an "Outperform" status, with its GF Value suggesting a 76.87% upside.

Biogen Inc. (NASDAQ: BIIB) is on the brink of unveiling its first-quarter financial performance on May 1. Market analysts have set the stage by forecasting an 18.5% decline in earnings per share (EPS) to $2.99, alongside a 2.6% dip in revenue, bringing it down to $2.23 billion. Despite these anticipated challenges, Biogen has a history of exceeding Wall Street's expectations in 75% of its previous earnings and revenue announcements.

Wall Street Analysts' Forecast

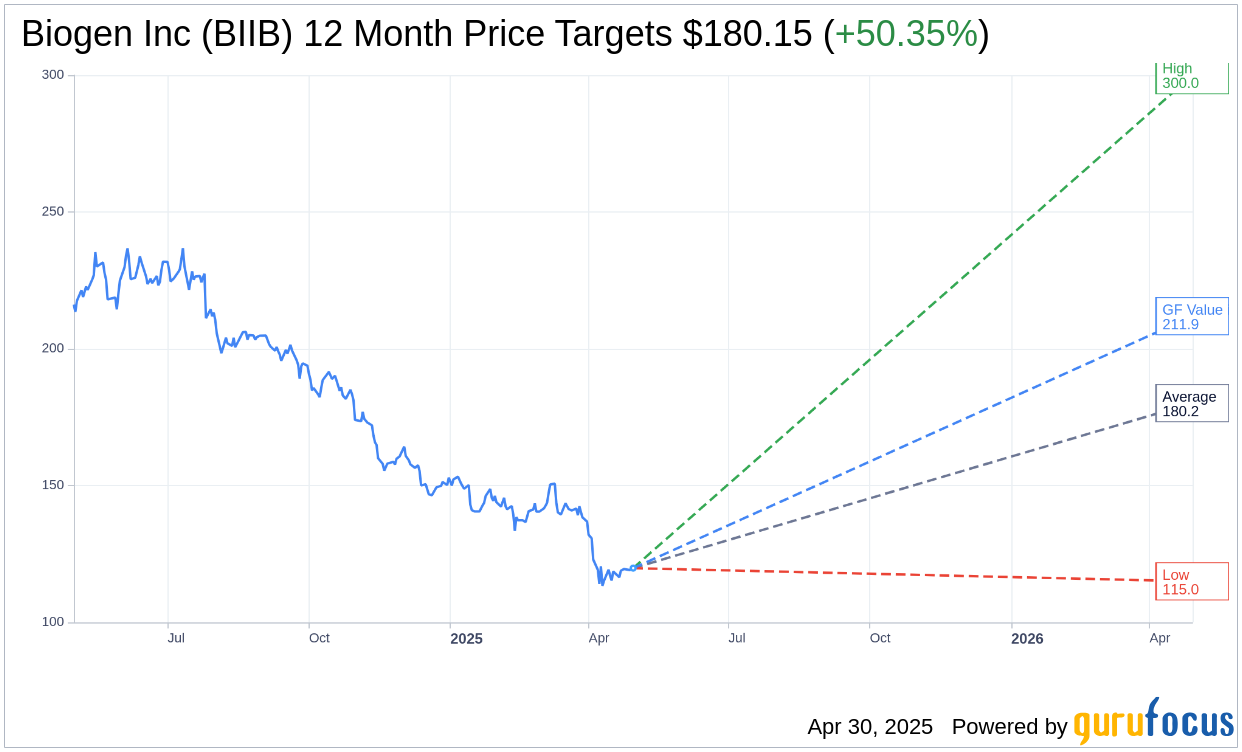

Insights from 29 market analysts reveal a varied outlook on Biogen's path forward. The average price target for Biogen Inc. (BIIB, Financial) stands at $180.15. This includes a high estimate of $300.00 and a low of $115.00, pointing to a potential upside of 50.35% from its current valuation of $119.82. Interested investors can explore a more in-depth breakdown of these estimates on the Biogen Inc (BIIB) Forecast page.

Furthermore, Biogen Inc. (BIIB, Financial) has caught the attention of 37 brokerage firms, which collectively rate the stock with an average recommendation of 2.5, classifying it under the "Outperform" category. This scale spans from 1, denoting a Strong Buy, to 5, indicating a Sell.

Evaluating Biogen's GF Value

According to GuruFocus, the projected GF Value for Biogen Inc. (BIIB, Financial) in the coming year is estimated to be $211.92. This suggests a robust upside potential of 76.87% from its current trading price of $119.82. The GF Value metric reflects GuruFocus' calculation of the stock's fair trading value. It hinges on historical trading multiples, past business growth, and predictive assessments of future business performance. For investors aiming for deeper insights, detailed data is available on the Biogen Inc (BIIB) Summary page.