Key Takeaways:

- Guggenheim initiates coverage on Edgewise Therapeutics with a buy rating, citing a robust drug pipeline.

- The firm has set an ambitious price target of $41, forecasting a potential 165% gain.

- Wall Street analysts suggest a significant upside with an average price target of $40.75.

Guggenheim's Bullish Stance on Edgewise Therapeutics

Guggenheim has launched coverage on Edgewise Therapeutics (EWTX, Financial) with a compelling buy rating, underscoring the promising innovations in their drug development pipeline. With a price target set at $41, the firm anticipates a striking upside potential of 165%. Key candidates in their lineup include EDG-7500 and sevasemten, which are targeting critical conditions such as hypertrophic cardiomyopathy and muscular dystrophies.

Wall Street Analysts' Forecast

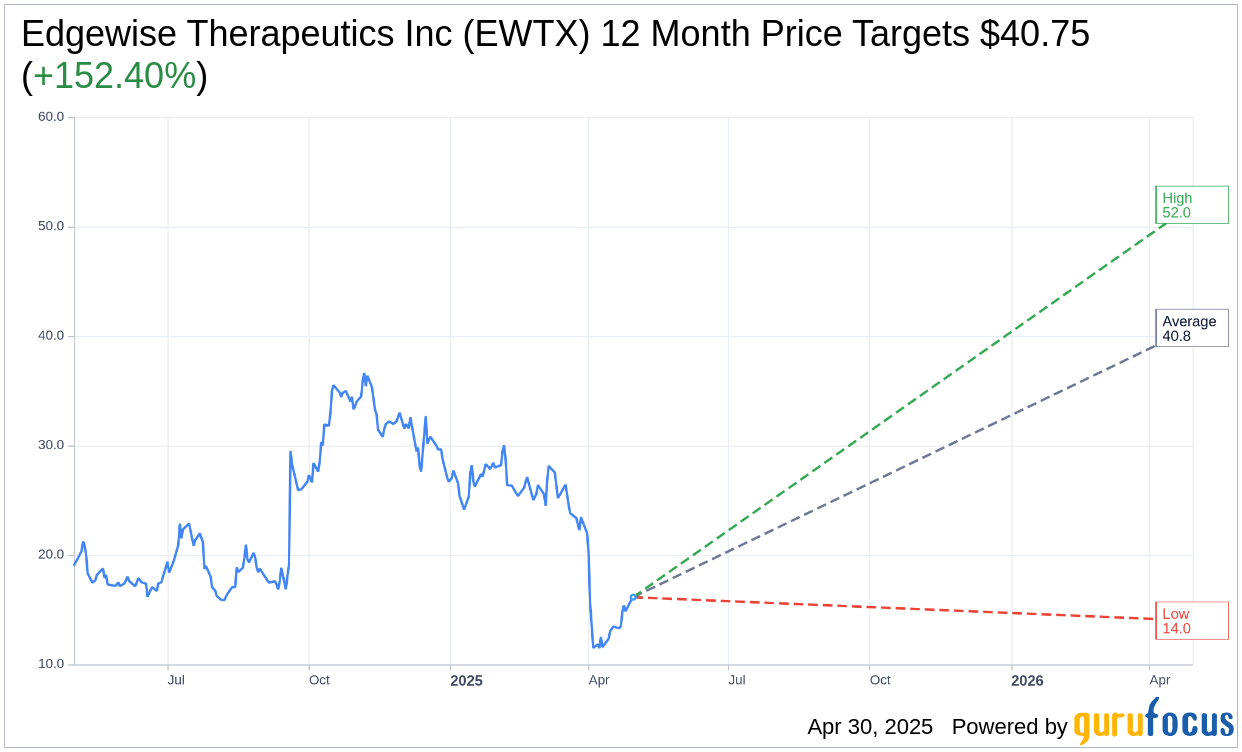

According to forecasts from eight analysts, the average price target for Edgewise Therapeutics Inc (EWTX, Financial) stands at $40.75. Projections extend from a high of $52.00 to a low of $14.00. This average target suggests a remarkable upside of 152.40% from the current share price of $16.15. Investors can explore more details on the Edgewise Therapeutics Inc (EWTX) Forecast page.

Brokerage Firm Recommendations

The consensus recommendation from nine brokerage firms places Edgewise Therapeutics Inc (EWTX, Financial) at an average brokerage recommendation of 2.0, indicating an "Outperform" status. This rating sits on a scale from 1 to 5, where 1 is a Strong Buy, and 5 is a Sell.

This analysis suggests that Edgewise Therapeutics shows significant promise both in terms of drug development and investor potential. With a notable consensus from respected analysts and brokerage firms, EWTX presents a compelling opportunity for those considering investment in the pharmaceutical sector.