Key Highlights:

- Seagate Technology (STX, Financial) registered lower-than-expected third-quarter earnings, impacting short-term outlook.

- Analysts project a potential 21.11% upside, with a strong "Outperform" consensus rating.

- Current market price suggests a slight overvaluation based on GuruFocus's GF Value estimation.

Seagate Technology (STX) recently announced its financial results for the third quarter, revealing a non-GAAP EPS of $1.90. This figure fell short by $0.46, while the company's revenue reached $2.16 billion, missing expectations by $210 million. Looking ahead, the company anticipates its fiscal Q4 2025 revenue will be approximately $2.40 billion, with an EPS forecasted around $2.40.

Wall Street Analysts' Forecast

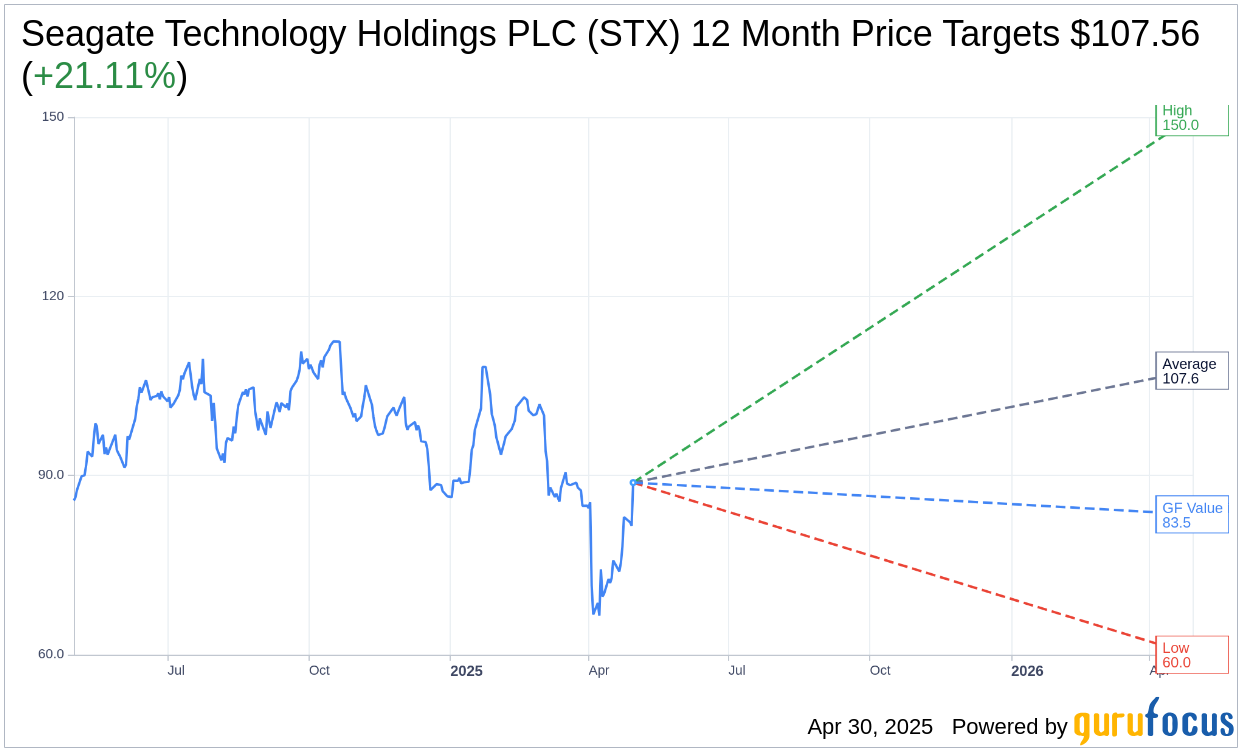

Wall Street analysts have presented one-year price targets for Seagate Technology Holdings PLC (STX, Financial), averaging at $107.56. These projections vary widely, with a high estimate of $150.00 and a low of $60.00. This average target suggests a potential 21.11% upside from the current trading price of $88.82. Investors seeking more detailed forecast information can visit the Seagate Technology Holdings PLC (STX) Forecast page.

According to recommendations from 24 brokerage firms, the consensus rating for Seagate Technology Holdings PLC stands at 2.2, indicating an "Outperform" status. The rating scale ranges from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell.

Valuation Analysis

GuruFocus's analysis provides a GF Value estimation for Seagate Technology Holdings PLC (STX, Financial) at $83.49 for the upcoming year. This value indicates a potential downside of 6% from the current price of $88.815. The GF Value represents what the stock's fair trading value should be, calculated based on historical trading multiples, past business growth, and future business performance estimates. For more comprehensive data, investors can explore the Seagate Technology Holdings PLC (STX) Summary page.