Snap (SNAP, Financials) shares tumbled more than 15% Wednesday after the company skipped second-quarter guidance, citing weak ad demand and macro uncertainty. Despite growing sales, Snap is still burning cash — and piling on debt.

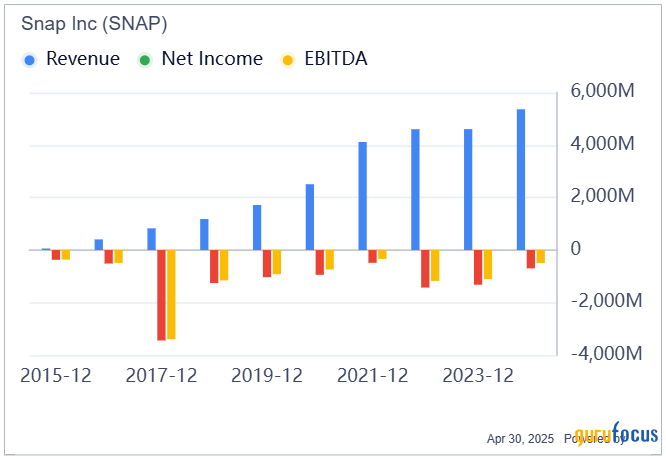

Snap brought in $1.36 billion in revenue, up from $1.19 billion a year ago. Ads made up $1.21 billion of that. Net loss improved to $140 million from $305 million, but a $70 million restructuring charge added to the drag.

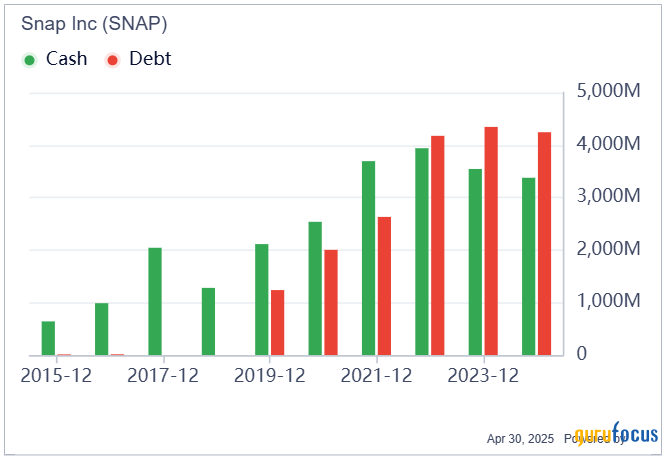

The bigger worry: Snap's debt has climbed to roughly $4.6 billion, while cash has fallen far behind.

Snapchat is adding users and seeing more ad and subscription revenue. But high costs — especially for cloud services and R&D — are keeping it in the red. Snap has never turned a full-year profit.

The company blamed early Q2 weakness on changes to the U.S. import tax exemption and tariff uncertainty under President Donald Trump.

Snap is still chasing profitability, even as it leans into AI, AR, and premium subscriptions. With debt now outweighing cash, the runway to turn things around is getting tighter.

Investors will be watching whether Snap's big bets — and cost cuts — can finally deliver earnings before the balance sheet bites back.