FormFactor (FORM, Financial) announced its first-quarter revenue, achieving $171.36 million, surpassing analysts' expectations of $170.03 million. Despite a predicted decline in revenue and profits attributed to decreased demand for DRAM probe cards and systems, the company's CEO, Mike Slessor, remains optimistic about FormFactor's future prospects. He emphasizes the company's confidence in long-term growth, supported by key developments in advanced packaging, high-bandwidth memory, and co-packaged optics within the semiconductor sector.

Wall Street Analysts Forecast

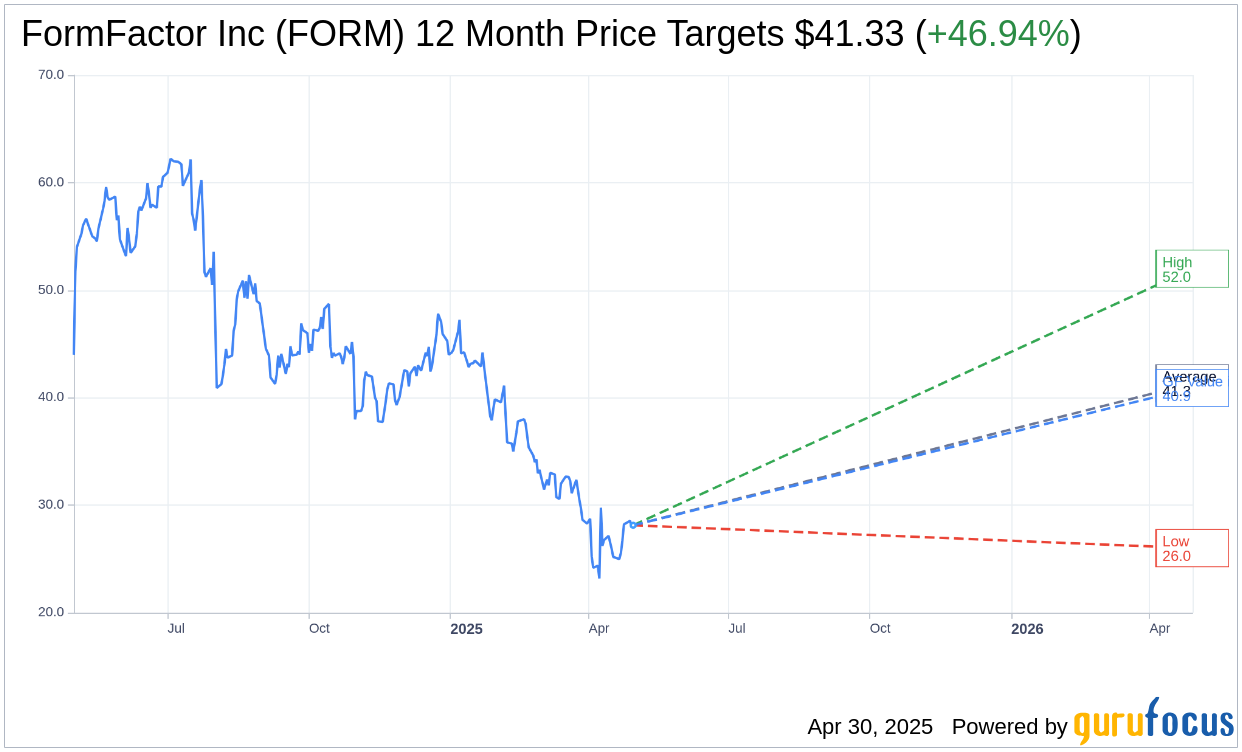

Based on the one-year price targets offered by 9 analysts, the average target price for FormFactor Inc (FORM, Financial) is $41.33 with a high estimate of $52.00 and a low estimate of $26.00. The average target implies an upside of 46.94% from the current price of $28.13. More detailed estimate data can be found on the FormFactor Inc (FORM) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, FormFactor Inc's (FORM, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FormFactor Inc (FORM, Financial) in one year is $40.91, suggesting a upside of 45.43% from the current price of $28.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FormFactor Inc (FORM) Summary page.

FORM Key Business Developments

Release Date: February 05, 2025

- Q4 Revenue: $189.5 million, a 9% decrease from Q3 and a 12.7% increase year-over-year.

- Fiscal 2024 Revenue: $764 million, up 15.2% from fiscal 2023.

- Non-GAAP Gross Margin Q4: 40.2%, down from 42.2% in Q3.

- Non-GAAP EPS Q4: $0.27, $0.02 below the midpoint of the outlook range.

- Probe Card Segment Revenue Q4: $150.3 million, a 12.7% decrease from Q3.

- Systems Segment Revenue Q4: $39.2 million, an increase from Q3.

- DRAM Revenue Q4: $63.3 million, a record high, with HBM contributing $32 million.

- GAAP Net Income Q4: $9.7 million or $0.12 per share.

- Non-GAAP Net Income Fiscal 2024: $90.2 million or $1.15 per share, a 58% increase year-over-year.

- Free Cash Flow Q4: $28.8 million, up from $20 million in Q3.

- Capital Expenditures Q4: $7.7 million.

- Cash and Investments at Quarter End: $367 million.

- Q1 2025 Revenue Outlook: $170 million, plus or minus $5 million.

- Q1 2025 Non-GAAP EPS Outlook: $0.19, plus or minus $0.04.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FormFactor Inc (FORM, Financial) reported record DRAM probe card revenue for the third consecutive quarter, driven by strong DDR5 and HBM demand.

- The company experienced significant growth in generative AI and high bandwidth memory, adding $100 million in revenue over 2023.

- FormFactor Inc (FORM) announced strategic acquisitions and partnerships, including acquiring a stake in FICT Limited and agreements with Advantest Corporation, to strengthen its position in advanced packaging.

- The Systems segment showed sequential revenue growth, driven by innovation in quantum computing and high-performance compute.

- FormFactor Inc (FORM) expects growth in demand for its products in 2025, particularly with the transition to HBM4 designs and new customer qualifications in the foundry and logic market.

Negative Points

- Sequentially lower fourth-quarter revenue, gross margin, and non-GAAP earnings per share were reported due to reduced foundry and logic probe card revenue.

- The company faces challenges from export controls limiting shipments of advanced node DRAM designs to China, impacting non-HBM DRAM probe card demand.

- Weak demand persists in high unit volume markets like client PCs and mobile handsets, affecting foundry and logic probe card sales.

- Gross margins are below the target due to a challenging product mix, with a DRAM-rich mix impacting profitability.

- Visibility into the timing of recovery in client PCs and mobile handsets is limited, affecting the company's ability to forecast demand accurately.