Truist has lifted its price target for Parsons (PSN, Financial) from $70 to $80 while maintaining a Buy rating on the company's stock. This decision comes in light of Parsons' recent first-quarter performance. The firm highlights Parsons' strategic advantage, with only 56% of its funding tied to U.S. Federal sources and minimal involvement in consulting projects.

Truist points out that Parsons is well-positioned to capitalize on more than 50% of the funding allocations specified in the FY25 Department of Defense budget reconciliation. This alignment is anticipated to enable Parsons to achieve growth surpassing that of its industry peers, according to the firm's research note to investors.

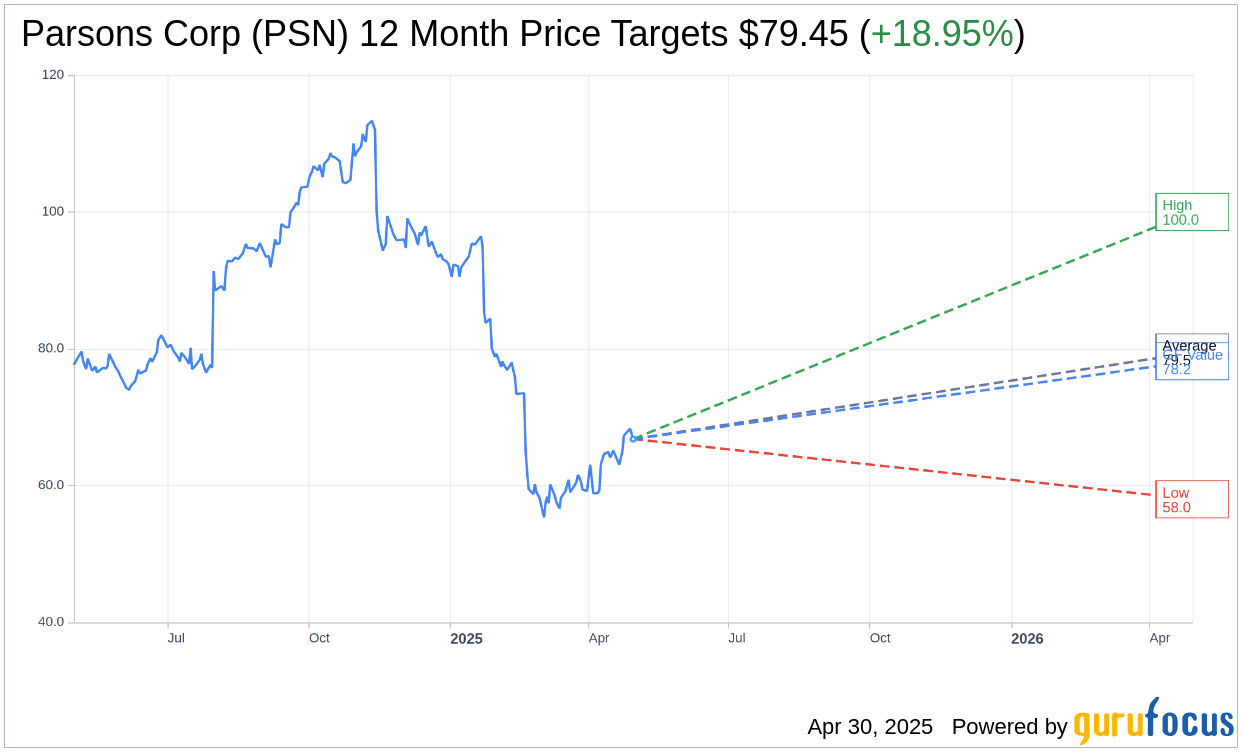

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Parsons Corp (PSN, Financial) is $79.45 with a high estimate of $100.00 and a low estimate of $58.00. The average target implies an upside of 18.95% from the current price of $66.80. More detailed estimate data can be found on the Parsons Corp (PSN) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Parsons Corp's (PSN, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Parsons Corp (PSN, Financial) in one year is $78.18, suggesting a upside of 17.04% from the current price of $66.795. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Parsons Corp (PSN) Summary page.

PSN Key Business Developments

Release Date: February 19, 2025

- Total Revenue: Exceeded $6.7 billion for the full year, with a 22% organic growth rate.

- Adjusted EBITDA: $605 million for the full year, a 30% increase from 2023, with a margin expansion of 50 basis points to 9%.

- Contract Awards: Record $7 billion for the full year, a 17% increase over 2023.

- Free Cash Flow Conversion Rate: 116% of adjusted net income for the full year.

- Fourth Quarter Revenue: $1.7 billion, a 16% increase from the prior year period, with 14% organic growth.

- Fourth Quarter Adjusted EBITDA: $147 million, a 14% increase from the fourth quarter of 2023.

- Net Debt Leverage Ratio: 1.3 times at the end of the year.

- Backlog: $8.9 billion at the end of the fourth quarter, up 4% from the previous year.

- 2025 Revenue Guidance: Expected to be between $7.0 and $7.5 billion.

- 2025 Adjusted EBITDA Guidance: Expected to be between $640 and $710 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Parsons Corp (PSN, Financial) achieved record results for total revenue, adjusted EBITDA, and contract awards in both the fourth quarter and full fiscal year 2024.

- The company delivered organic revenue growth of 22% and adjusted EBITDA growth of 30% for the fiscal year 2024.

- Parsons Corp (PSN) reported a strong balance sheet, enabling continued investment in high-growth areas such as artificial intelligence, cyber, and environmental remediation.

- The company secured record contract awards of $7 billion for the full year, with a 17% increase over 2023, demonstrating strong demand across its portfolio.

- Parsons Corp (PSN) successfully integrated two acquisitions in 2024, enhancing its capabilities in offensive cyber operations and infrastructure leadership.

Negative Points

- The company's adjusted EBITDA margin for the fourth quarter was negatively impacted by $29 million of adjustments on two critical infrastructure programs.

- Parsons Corp (PSN) faces uncertainty regarding a confidential contract, with potential impacts on revenue if related work does not resume.

- The procurement environment is experiencing slower cadence, which may affect the timing of contract awards.

- The company's 2025 cash flow guidance is impacted by a one-time $30 million effect due to a change in 401k match benefits.

- Parsons Corp (PSN) anticipates lower volumes on certain contracts, affecting its 2025 growth projections.