Teladoc Health (TDOC, Financial) has finalized its purchase of UpLift Health Technologies, investing $30 million in an all-cash deal. The agreement also includes the possibility of an additional $15 million in contingent earnout payments. UpLift is recognized for its innovative approach in providing virtual mental health therapy, psychiatry, and medication management services. This acquisition aims to enhance the strategic initiatives of Teladoc's BetterHelp segment by increasing accessibility for consumers seeking mental health services and ensuring they can utilize their benefit coverage more effectively.

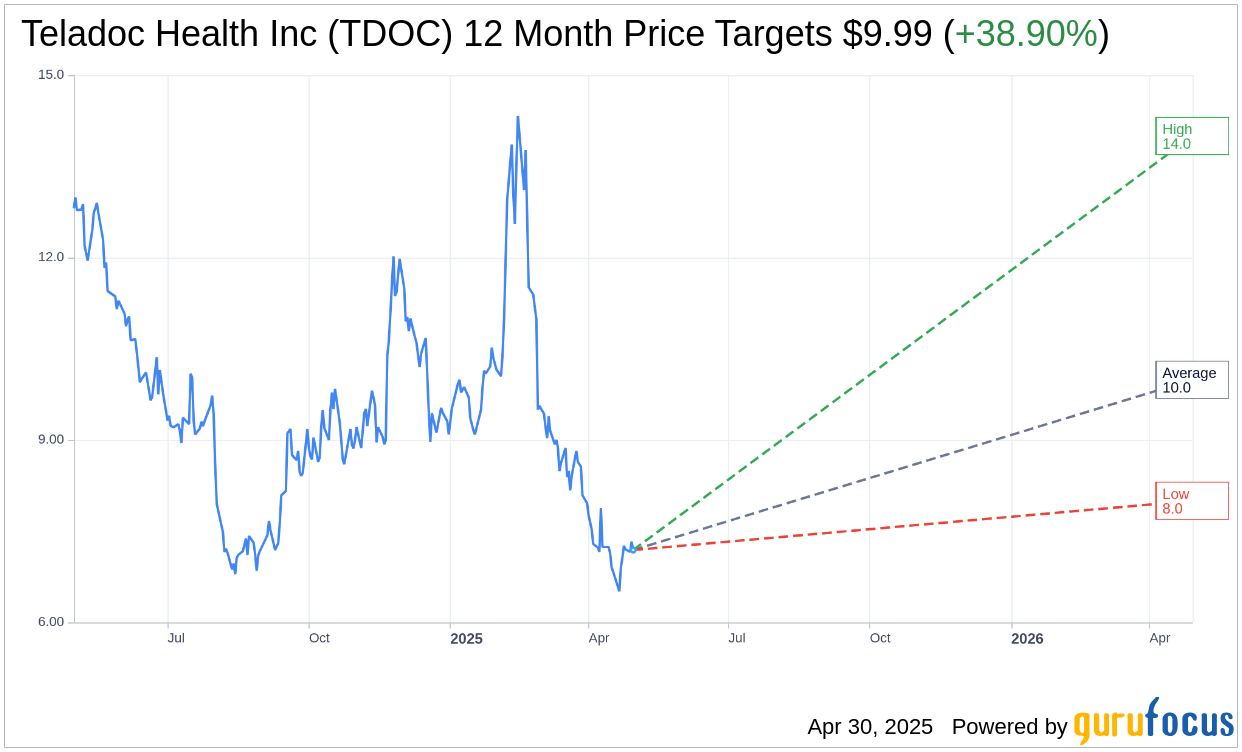

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for Teladoc Health Inc (TDOC, Financial) is $9.99 with a high estimate of $14.00 and a low estimate of $8.00. The average target implies an upside of 38.90% from the current price of $7.19. More detailed estimate data can be found on the Teladoc Health Inc (TDOC) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Teladoc Health Inc's (TDOC, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teladoc Health Inc (TDOC, Financial) in one year is $21.69, suggesting a upside of 201.67% from the current price of $7.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teladoc Health Inc (TDOC) Summary page.

TDOC Key Business Developments

Release Date: February 26, 2025

- Q4 2024 Revenue: $640 million.

- Q4 2024 Adjusted EBITDA: $75 million, representing an 11.7% margin.

- Q4 2024 Net Loss Per Share: $0.28.

- Full Year 2024 Revenue: $2.6 billion, a decrease of 1% versus 2023.

- Full Year 2024 Adjusted EBITDA: $311 million, representing a 12.1% margin.

- Full Year 2024 Net Loss Per Share: $5.87, including a noncash goodwill impairment charge.

- Full Year 2024 Free Cash Flow: $170 million.

- Cash and Cash Equivalents at Year-End 2024: Nearly $1.3 billion.

- Integrated Care Q4 2024 Revenue: $391 million, a 2% increase year-over-year.

- Integrated Care Q4 2024 Adjusted EBITDA: $53 million, representing a 13.6% margin.

- BetterHelp Q4 2024 Revenue: $250 million, down 9.5% year-over-year.

- BetterHelp Q4 2024 Adjusted EBITDA: $22 million, with an 8.7% margin.

- BetterHelp Full Year 2024 Revenue: $1 billion, an 8% decline versus the prior year.

- BetterHelp Full Year 2024 Adjusted EBITDA: $78 million, representing a 7.5% margin.

- 2025 Revenue Guidance: $2.47 billion to $2.58 billion.

- 2025 Adjusted EBITDA Guidance: $278 million to $319 million.

- 2025 Free Cash Flow Guidance: $190 million to $220 million.

- Q1 2025 Revenue Guidance: $608 million to $629 million.

- Q1 2025 Adjusted EBITDA Guidance: $47 million to $59 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teladoc Health Inc (TDOC, Financial) added over 4 million members in the US in 2024, with a 6% increase in visit volumes, indicating strong customer growth and engagement.

- The company reported a successful implementation season with over 800 new clients launched on January 1, showcasing effective operational execution.

- Teladoc Health Inc (TDOC) achieved mid-teens revenue growth in its International Integrated Care business, highlighting strong performance in global markets.

- The acquisition of Catapult Health is expected to enhance Teladoc Health Inc (TDOC)'s Chronic Care management offerings, providing new growth opportunities.

- BetterHelp, a segment of Teladoc Health Inc (TDOC), served over 1 million unique paying users in 2024, demonstrating its significant market presence and consumer appeal.

Negative Points

- Teladoc Health Inc (TDOC) reported a full-year revenue decline of 1% in 2024 compared to 2023, indicating challenges in maintaining growth.

- The company faced a net loss per share of $5.87 for the full year, including a significant noncash goodwill impairment charge.

- BetterHelp's revenue declined by 8% in 2024, reflecting challenges in the competitive environment and impacting overall financial performance.

- The health plan channel is experiencing pressures, creating headwinds for Teladoc Health Inc (TDOC) in this segment.

- Teladoc Health Inc (TDOC) anticipates a more extended visit ramp for TRICARE, impacting expected visit volumes and revenue growth in the first half of 2025.