MiMedx (MDXG, Financial) announced its first-quarter revenue for 2025, reaching $88.21 million, exceeding the anticipated $86.32 million. The company achieved a 4% increase in total net sales compared to the same period last year. Additionally, MiMedx's adjusted EBITDA margin stood at 20%. The firm's surgical products experienced robust double-digit growth, demonstrating the ongoing success of their initiatives to enhance clinical evidence, which in turn is opening up significant market opportunities for these products.

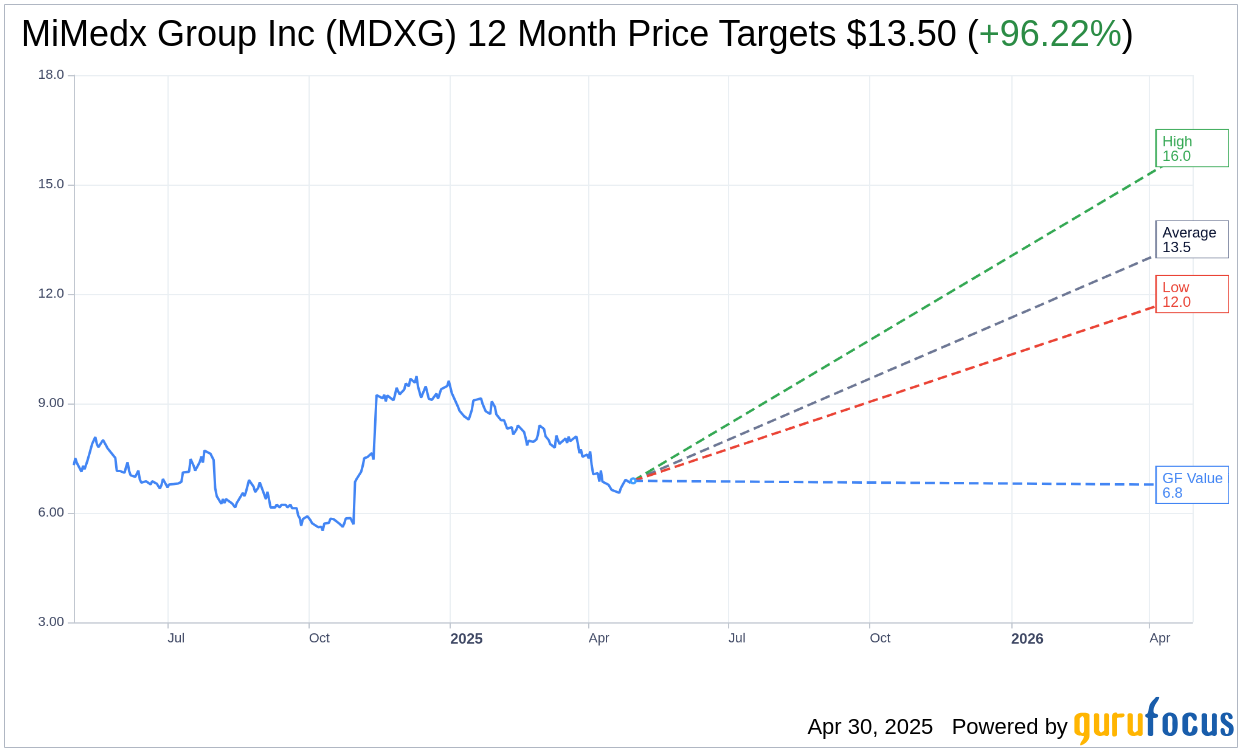

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for MiMedx Group Inc (MDXG, Financial) is $13.50 with a high estimate of $16.00 and a low estimate of $12.00. The average target implies an upside of 96.22% from the current price of $6.88. More detailed estimate data can be found on the MiMedx Group Inc (MDXG) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, MiMedx Group Inc's (MDXG, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MiMedx Group Inc (MDXG, Financial) in one year is $6.77, suggesting a downside of 1.6% from the current price of $6.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MiMedx Group Inc (MDXG) Summary page.

MDXG Key Business Developments

Release Date: February 26, 2025

- Q4 Net Sales: $93 million, a 7% year-over-year growth.

- Full-Year Sales: $349 million, up 9% over the prior year.

- Gross Profit Margin: 82% in Q4.

- Adjusted EBITDA: $20 million or 21% of sales in Q4; $76 million or 22% of sales for the full year.

- Cash Balance: Ended the year with $104 million, an increase of $16 million during the quarter.

- Wound Sales: $61 million in Q4, a 10% increase year-over-year.

- Surgical Sales: $32 million in Q4, up 2% as reported; 6% increase excluding certain impacts.

- SG&A Expenses: $61 million in Q4, up from $54 million in the prior year.

- R&D Expenses: $3 million in Q4, representing 4% of net sales, up 38% year-over-year.

- GAAP Net Income: $7 million or $0.05 per share in Q4.

- Adjusted Net Income: $11 million or $0.07 per share in Q4.

- Free Cash Flow: $19 million in Q4, a $9 million increase over the same period in 2023.

- 2025 Guidance: Net sales growth expected in high-single digits; adjusted EBITDA margin above 20%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MiMedx Group Inc (MDXG, Financial) reported a 9% increase in full-year revenue for 2024, with Q4 net sales growing by 7% to $93 million.

- The company maintained a strong gross profit margin of 82% in Q4 and achieved an adjusted EBITDA of $20 million, representing 21% of sales.

- MiMedx Group Inc (MDXG) ended the year with $104 million in cash, an increase of $16 million during the quarter, highlighting strong cash flow generation.

- The company continued the market release of HELIOGEN, its first xenograft, and began enrollment for a randomized controlled trial for EPIEFFECT.

- MiMedx Group Inc (MDXG) experienced significant growth in its EPIFIX business in Japan, with sales nearly tripling in 2024.

Negative Points

- The company faced challenges due to Medicare reimbursement issues and above-average sales force turnover in select markets.

- Gross margin slightly decreased from 84% in the previous year to 82% in Q4 2024, partly due to acquisition-related amortization expenses.

- Selling, general, and administrative expenses increased to $61 million in Q4, up from $54 million in the prior year, primarily due to higher commissions and adjusted commission rates.

- Research and development expenses rose by 38% compared to the prior year, driven by increased costs associated with ongoing trials and future product development.

- The implementation of new Medicare reimbursement guidelines (LCDs) could lead to short-term market disruption and uncertainty in physician ordering patterns.