InvenTrust Properties Corp (IVT, Financial) released its 8-K filing on April 30, 2025, reporting impressive financial results for the first quarter ended March 31, 2025. The company, a U.S.-based Real Estate Investment Trust (REIT) specializing in multi-tenant retail properties, demonstrated significant growth in key financial metrics, surpassing analyst expectations.

Company Overview

InvenTrust Properties Corp is a prominent REIT focused on owning, leasing, redeveloping, acquiring, and managing a multi-tenant retail platform. The company's portfolio includes grocery-anchored community and neighborhood centers, as well as power centers, primarily classified as necessity-based. Operating through a single segment, InvenTrust is strategically positioned in the Sun Belt region, capitalizing on favorable demographics and limited new supply.

Financial Performance and Challenges

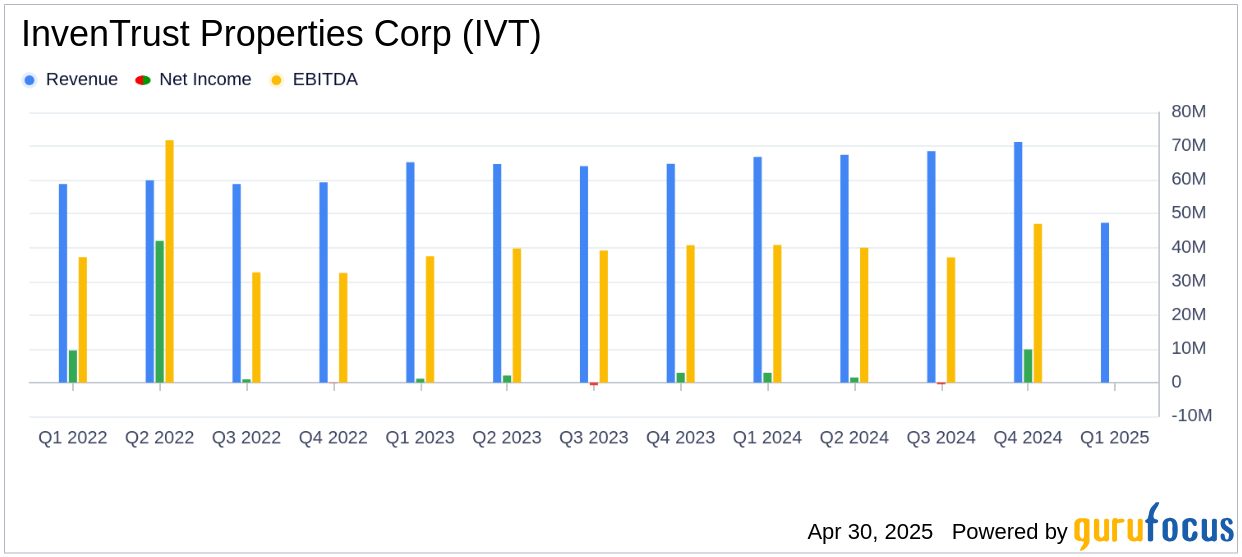

For the first quarter of 2025, InvenTrust reported a net income of $6.8 million, or $0.09 per diluted share, a significant increase from $2.9 million, or $0.04 per diluted share, in the same period of 2024. This performance exceeded the analyst estimate of $0.08 per share. The company's revenue details were not explicitly provided, but the strong net income growth indicates robust operational performance.

Despite the positive results, InvenTrust faces challenges such as economic uncertainty and moderating consumer spending. However, the company's focus on necessity-based retail and strategic location in the Sun Belt region provides a buffer against these challenges.

Key Financial Achievements

InvenTrust's financial achievements are noteworthy, particularly in the context of the REIT industry. The company reported Nareit Funds From Operations (FFO) of $0.48 per diluted share and Core FFO of $0.46 per diluted share, both showing growth from the previous year. Same Property Net Operating Income (NOI) grew by 6.1%, reflecting the strength of the company's portfolio.

These achievements are crucial for REITs as they indicate the company's ability to generate stable cash flows and support dividend distributions, which are key attractions for investors in this sector.

Detailed Financial Metrics

InvenTrust's financial statements reveal a strong balance sheet with $577.4 million in total liquidity, including $77.4 million in cash and cash equivalents. The company's debt profile is manageable, with a weighted average interest rate of 4.03% and a remaining term of 3.1 years.

Leased occupancy stood at an impressive 97.3%, with anchor tenant occupancy at 99.5% and small shop occupancy at 93.4%. The company's ability to maintain high occupancy rates is a testament to its strategic focus on necessity-based retail properties.

Commentary and Strategic Outlook

“Our results demonstrate the strength of our necessity-based, Sun Belt-focused platform,” said DJ Busch, President and CEO of InvenTrust. “Driven by favorable demographics, limited new supply, and resilient, albeit moderating, consumer spending, our portfolio continues to perform well despite recent economic developments and uncertainty.”

Analysis and Conclusion

InvenTrust Properties Corp's strong first-quarter performance underscores its strategic positioning and operational excellence in the REIT sector. The company's focus on necessity-based retail and its presence in the Sun Belt region provide a competitive edge, allowing it to navigate economic uncertainties effectively.

With a robust financial position and strategic acquisitions, InvenTrust is well-positioned to continue delivering value to its shareholders. The company's reaffirmed 2025 guidance further reflects confidence in its growth trajectory, making it an attractive prospect for value investors seeking stable returns in the real estate sector.

Explore the complete 8-K earnings release (here) from InvenTrust Properties Corp for further details.