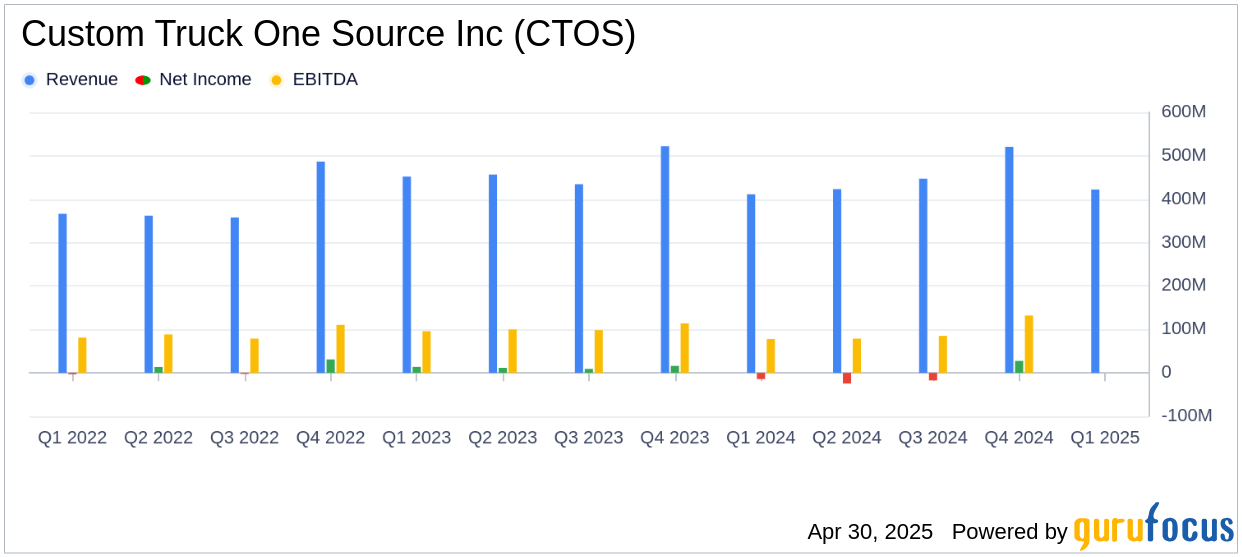

On April 30, 2025, Custom Truck One Source Inc (CTOS, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. The company, a leading provider of specialty equipment across various infrastructure-related markets in North America, reported a total revenue of $422.2 million, which fell short of the analyst estimate of $437.03 million. The net loss for the quarter was $17.8 million, widening from the $14.3 million loss reported in the same period last year.

Company Overview

Custom Truck One Source Inc is a comprehensive provider of specialty equipment serving the electric utility, telecom, rail, forestry, waste management, and other infrastructure end-markets in North America. The company operates through three segments: Equipment Rental Solutions (ERS), Truck and Equipment Sales (TES), and Aftermarket Parts and Services (APS), with the TES segment generating the majority of its revenue. The company primarily derives its revenue from the United States.

Performance Highlights and Challenges

Custom Truck One Source Inc reported a 2.7% increase in total revenue compared to the first quarter of 2024, driven by strong fundamentals in its primary end markets. However, the company faced challenges with a decrease in gross profit by 5.7% to $85.5 million and a decline in adjusted EBITDA by 5.1% to $73.4 million. The net loss increased by $3.5 million compared to the previous year, primarily due to decreased gross profit and higher interest expenses on variable-rate debt.

Financial Achievements and Industry Impact

The company achieved a 9.5% increase in consolidated rental revenue, attributed to higher original equipment cost (OEC) on rent and improved fleet utilization. The ERS segment saw a 9.4% increase in rental revenue, driven by increased rental volume and improved fleet utilization. Despite these achievements, the TES segment experienced a 3.1% decrease in revenue due to pricing pressures and a high-interest rate environment.

Key Financial Metrics

Custom Truck One Source Inc's financial statements reveal several important metrics:

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenue | $422.2 million | $411.3 million |

| Gross Profit | $85.5 million | $90.7 million |

| Net Loss | $(17.8) million | $(14.3) million |

| Adjusted EBITDA | $73.4 million | $77.4 million |

These metrics are crucial for evaluating the company's operational efficiency and financial health, particularly in the business services industry where capital-intensive operations are common.

Management Commentary

“In the first quarter, we achieved year-over-year revenue growth, driven by continued strong fundamentals across our primary end markets: utility, infrastructure, rail, and telecom. Despite ongoing challenges to economic activity being posed by the implementation of the new tariff policy, we remain cautiously optimistic about fiscal 2025 and continue to believe Custom Truck is well-positioned to benefit from secular tailwinds driven by data center investments, manufacturing onshoring, electrification, and utility grid upgrades,” said Ryan McMonagle, Chief Executive Officer of CTOS.

Analysis and Outlook

Custom Truck One Source Inc's performance in Q1 2025 reflects both growth opportunities and challenges. The increase in rental revenue and fleet utilization indicates strong demand in core markets. However, the widening net loss and decreased gross profit highlight the impact of economic pressures, including high-interest rates and tariff policies. The company's reaffirmation of its 2025 guidance suggests confidence in its strategic positioning and market potential, despite these challenges.

Explore the complete 8-K earnings release (here) from Custom Truck One Source Inc for further details.