Prudential Financial's (PRU, Financial) asset management arm, PGIM, reported a 3% increase in assets under management, reaching $1.385 trillion compared to the same quarter last year. This growth was attributed to improvements in fixed income and equity markets, alongside positive net inflows and robust investment results.

During the quarter, the company recorded total net inflows of $4.3 billion. This figure was predominantly influenced by third-party net inflows amounting to $4.4 billion, though it was slightly reduced by $0.1 billion due to affiliated net outflows. Specifically, third-party institutional investors contributed $4.6 billion in new funds, finding opportunities across fixed income, private alternatives, and equity sectors. Meanwhile, third-party retail saw net outflows of $0.2 billion, with equity outflows nearly balanced by fixed income inflows.

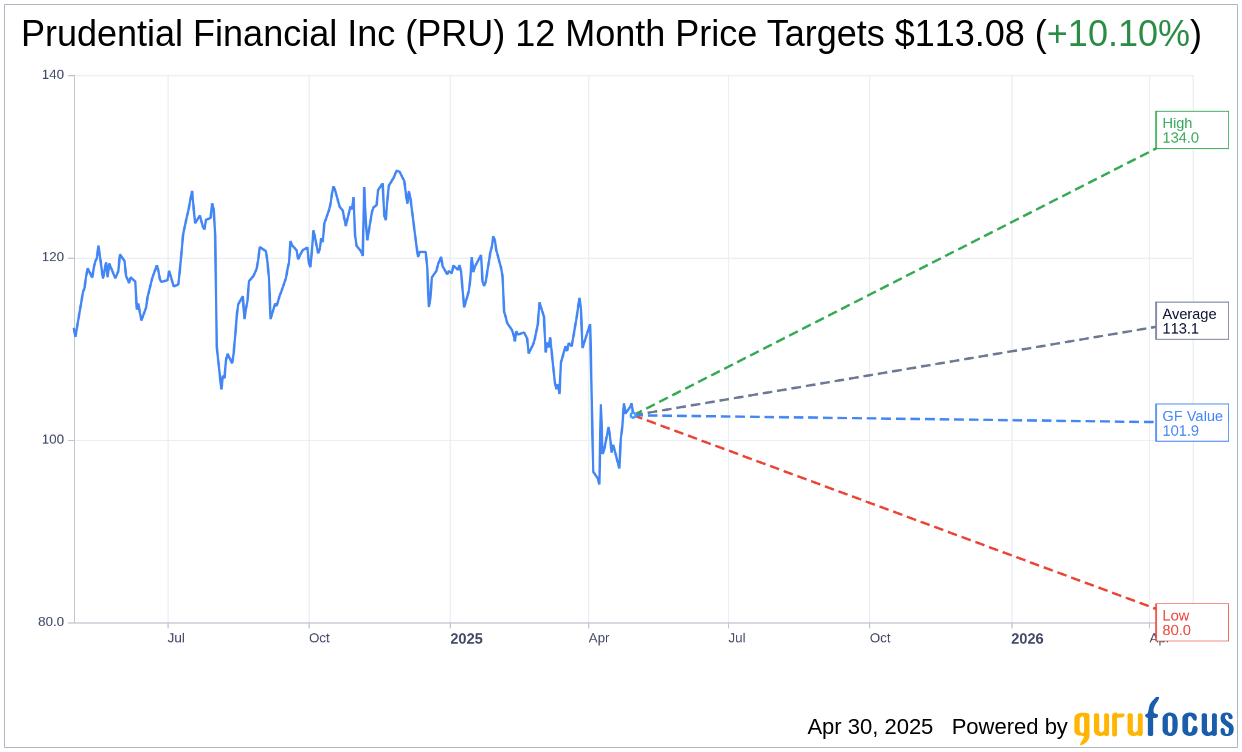

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Prudential Financial Inc (PRU, Financial) is $113.08 with a high estimate of $134.00 and a low estimate of $80.00. The average target implies an upside of 10.10% from the current price of $102.71. More detailed estimate data can be found on the Prudential Financial Inc (PRU) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Prudential Financial Inc's (PRU, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Prudential Financial Inc (PRU, Financial) in one year is $101.91, suggesting a downside of 0.78% from the current price of $102.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Prudential Financial Inc (PRU) Summary page.

PRU Key Business Developments

Release Date: February 05, 2025

- Pretax Adjusted Operating Income (Q4 2024): $1.4 billion or $2.96 per share.

- Pretax Adjusted Operating Income (Full Year 2024): $5.9 billion or $12.62 per share, up 6% from 2023.

- GAAP Net Loss (Q4 2024): $57 million.

- Adjusted Operating Return on Equity (2024): 13.1%, improved by 70 basis points from 2023.

- PGIM Assets Under Management: Increased by 6% to $1.4 trillion from year-end 2023.

- Total Net Flows (Q4 2024): $8.6 billion.

- Total Net Flows (Full Year 2024): $38 billion.

- Retirement Strategies Institutional Sales (2024): $36 billion, up 27% from the prior year.

- Individual Retirement Sales (Q4 2024): $3.6 billion, best quarter in over a decade.

- Individual Retirement Sales (2024): Over $14 billion, up 84% from the prior year.

- Group Insurance Sales (2024): $550 million, up 4% from the prior year.

- Individual Life Sales (Q4 2024): $326 million, a quarterly record high.

- International Business Sales (2024): Up 6% compared to the prior year.

- Cash and Liquid Assets: $4.6 billion, above the minimum liquidity target.

- Share Repurchase Authorization (2025): Up to $1 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Prudential Financial Inc (PRU, Financial) reported strong full-year sales across its Retirement and Insurance businesses, with significant positive flows in PGIM.

- The company maintained a disciplined approach to capital deployment, returning nearly $3 billion to shareholders in 2024 and authorizing up to $1 billion in share repurchases for 2025.

- Prudential Financial Inc (PRU) achieved a 6% increase in assets under management at PGIM, driven by market appreciation, net flows, and strong investment performance.

- The company successfully executed transactions that enhanced capital flexibility, including two guaranteed universal life reinsurance transactions and a $7 billion block reinsurance of Japanese whole life policies.

- Prudential Financial Inc (PRU) maintained a strong AA rating, reflecting a healthy capital position with over $4 billion in highly liquid assets.

Negative Points

- Earnings for the fourth quarter were lower than anticipated, primarily due to adverse underwriting experience driven by elevated large individual life claims.

- The company's US businesses faced higher expenses related to one-time transaction impacts and less favorable underwriting results.

- International businesses experienced less favorable underwriting results due to elevated U.S. dollar product surrenders and higher expenses.

- The GAAP net loss for the quarter was $57 million, primarily due to interest rate-driven realized losses on the investment portfolio.

- Prudential Financial Inc (PRU) faces near-term headwinds due to new business strain and the impact of runoff blocks, affecting cash flow conversion.