AXIS Capital (AXS, Financial) announced its first quarter 2025 financial results, revealing revenue of $1.52 billion, which fell short of the anticipated $1.83 billion. Despite this, the company demonstrated robust financial health, achieving an annualized operating return-on-equity of 19.2% and a record book value per diluted common share of $66.48 as of March 31st.

The company maintained a resilient portfolio with a combined ratio of 90.2% during a quarter marked by significant natural catastrophes like wildfires, with AXIS' share of industry catastrophe losses at just 0.09%. In its business segments, AXIS saw targeted growth in specialty markets. Its Insurance sector posted an 86.7% combined ratio and produced $1.7 billion in gross premiums, bolstered by its strong performance in the Excess & Surplus lines, particularly in North America.

Additionally, AXIS' Reinsurance division continued to deliver steady and profitable results, showcasing a 92.3% combined ratio and securing $1.1 billion in premiums. The company underscores its commitment to progress by enhancing operations with advanced data analytics, technology, and AI, laying the groundwork for continued improvement and growth.

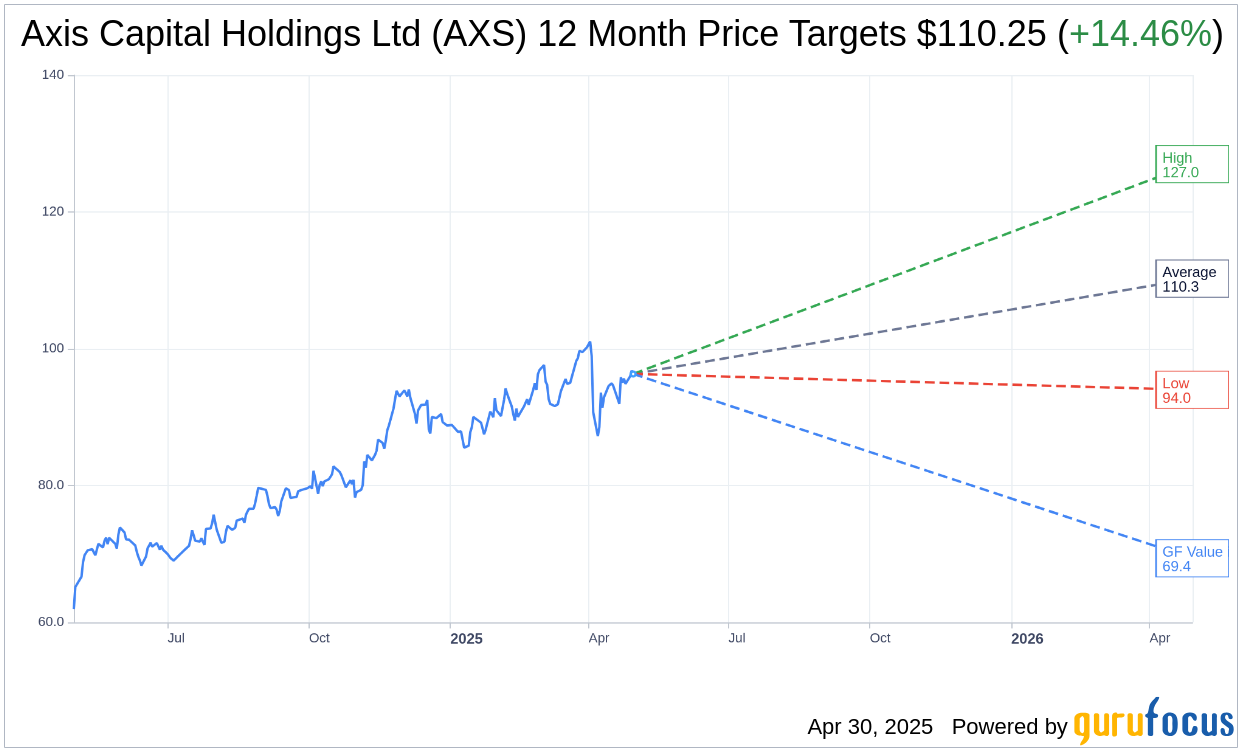

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Axis Capital Holdings Ltd (AXS, Financial) is $110.25 with a high estimate of $127.00 and a low estimate of $94.00. The average target implies an upside of 14.46% from the current price of $96.32. More detailed estimate data can be found on the Axis Capital Holdings Ltd (AXS) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Axis Capital Holdings Ltd's (AXS, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Axis Capital Holdings Ltd (AXS, Financial) in one year is $69.37, suggesting a downside of 27.98% from the current price of $96.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Axis Capital Holdings Ltd (AXS) Summary page.

AXS Key Business Developments

Release Date: January 30, 2025

- Operating Return on Equity: 18.6% for the full year 2024.

- Book Value: $65.27 per share, representing 20.7% growth compared to the prior year.

- Operating Earnings Per Share: $11.18, a 98% increase over the prior year.

- Combined Ratio: 92.3% for the year, with a 7.6 point improvement over the prior year.

- Full Year Premiums: $9 billion, up 7.8% over the prior year.

- Net Investment Income: $759 million for the year.

- Share Repurchase Program: $200 million utilized over the course of the year.

- Insurance Combined Ratio: 89.1% for 2024.

- Insurance Premiums: $6.6 billion, up 7.7% over the prior year.

- Reinsurance Combined Ratio: 91.8% for 2024.

- Reinsurance Premiums: $2.4 billion, growing nearly 8% over the prior year.

- Net Income Available to Common Shareholders: $1.05 billion for the full year, or $12.35 per diluted common share.

- Gross Premiums Written: Exceeded $9 billion for the full year, with 8% growth.

- Quarterly Combined Ratio: 94.2% for the fourth quarter.

- Quarterly Net Income: $286 million or $3.38 per diluted common share.

- Quarterly Operating Income: $252 million or $2.97 per diluted common share.

- Investment Income: $196 million for the fourth quarter, up 5% over the prior year quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Axis Capital Holdings Ltd (AXS, Financial) reported a strong operating return on equity of 18.6% for 2024.

- The company achieved a record operating earnings per share of $11.18, marking a 98% increase over the prior year.

- Gross premiums written exceeded $9 billion for the year, reflecting an 8% growth.

- The insurance segment delivered a combined ratio of 89.1% for the year, indicating strong underwriting performance.

- Net investment income reached a record $759 million, driven by higher yields on a larger fixed income portfolio.

Negative Points

- The company noted increasing competition in global markets, particularly within property, marine, and aviation units.

- There is a continued impact of social inflation on liability lines, posing challenges for the industry.

- The cyber risk landscape is evolving with more sophisticated attacks, requiring constant adaptation.

- The expense ratio for the quarter was higher than expected at 13.7%, partly due to accruals for variable compensation.

- The reinsurance segment faced greater competition in the UK motor class, impacting rate levels.