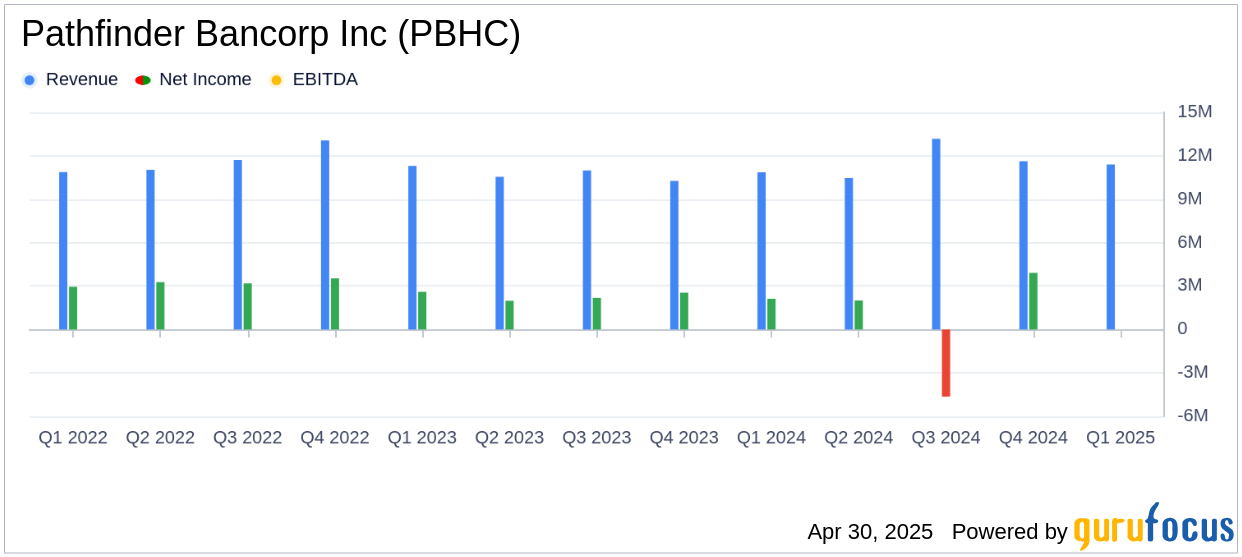

Pathfinder Bancorp Inc (PBHC, Financial) released its 8-K filing on April 30, 2025, announcing its financial results for the first quarter ended March 31, 2025. The company, a holding entity for Pathfinder Bank, reported a net income attributable to common shareholders of $3.0 million, or $0.41 per diluted share, marking an increase from $2.1 million, or $0.34 per share, in the same quarter of the previous year.

Company Overview

Pathfinder Bancorp Inc is the parent company of Pathfinder Bank, a commercial bank that attracts deposits from the public and invests these funds in various loans and securities. The bank's primary income source is interest from loans and investment securities.

Performance Highlights

Pathfinder Bancorp Inc demonstrated robust performance in the first quarter of 2025, driven by improvements in operating efficiency and growth in net interest income, net interest margin, core deposits, and commercial loans. Total deposits reached $1.26 billion, reflecting a 5.0% increase from the previous quarter and a 10.3% rise from the same period last year. Core deposits grew to 78.31% of total deposits, up from 69.17% a year ago.

Financial Achievements

The company's net interest income rose to $11.4 million, a $1.0 million increase from the previous quarter and a $2.0 million increase from the first quarter of 2024. The net interest margin expanded to 3.31%, up from 2.75% in the year-ago period. These improvements were attributed to strategic deposit pricing and reductions in higher-cost borrowings.

Income Statement and Key Metrics

Pathfinder Bancorp Inc's pre-tax, pre-provision net income increased by 26.0% from the previous quarter to $4.2 million. The efficiency ratio improved to 66.84%, down from 68.29% in the same quarter last year, indicating better management of non-interest expenses relative to total revenue.

“Pathfinder’s solid first quarter results reflect the strength of our balance sheet and our growing core deposit franchise. Our continued focus on disciplined loan and deposit pricing has helped expand net interest margin in a challenging economic environment while our efforts toward optimizing non-interest expenses have improved our efficiency measures,” said President and Chief Executive Officer James A. Dowd.

Balance Sheet and Asset Quality

As of March 31, 2025, Pathfinder Bancorp Inc reported total assets of $1.50 billion. Loans totaled $912.2 million, with commercial loans making up 59.5% of the total loan portfolio. Nonperforming loans decreased significantly to $13.2 million, representing 1.45% of total loans, down from 2.20% a year ago.

Liquidity and Capital Management

The company maintained a strong liquidity profile with total deposits of $1.26 billion and reduced borrowings to $44.6 million. Pathfinder Bancorp Inc's capital ratios remained robust, with a tangible common equity to tangible assets ratio of 7.68% and a total core capital to risk-weighted assets ratio of 15.89%.

Conclusion

Pathfinder Bancorp Inc's first quarter results highlight its strategic focus on enhancing core deposits and managing interest margins effectively. The company's strong financial performance and improved asset quality position it well for future growth, despite the challenges posed by the economic environment.

Explore the complete 8-K earnings release (here) from Pathfinder Bancorp Inc for further details.