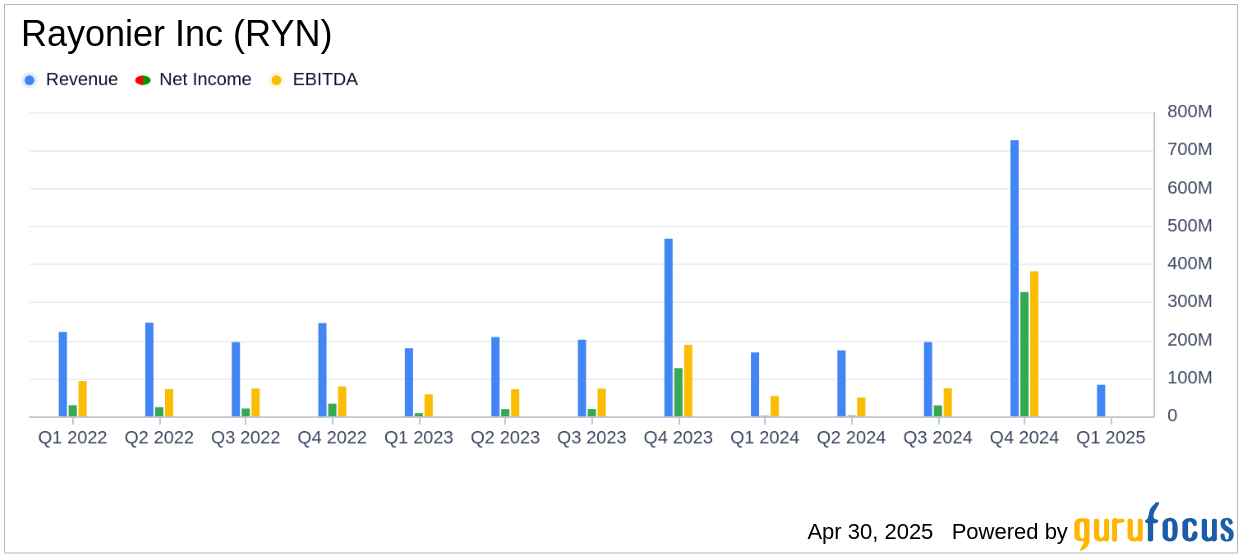

On April 30, 2025, Rayonier Inc (RYN, Financial) released its 8-K filing for the first quarter of 2025, reporting a net loss attributable to Rayonier of $3.4 million, or ($0.02) per share, on revenues of $82.9 million. This performance fell short of analyst estimates, which projected earnings per share of $0.08 and revenue of $153.12 million. Rayonier, a leading timberland real estate investment trust, owns and manages over 2 million acres of timberland in the United States and New Zealand, making it one of the largest private landowners in North America.

Performance and Challenges

Rayonier's first quarter results reflect the reclassification of its New Zealand operations to discontinued operations following an agreement to sell its New Zealand joint venture interest. This strategic move has impacted the company's financial metrics, with prior year periods adjusted retrospectively. The net loss of $3.4 million compares to a net income of $1.4 million in the same quarter last year, highlighting the challenges faced by the company in maintaining profitability amid strategic shifts.

Financial Achievements and Industry Context

Despite the challenges, Rayonier reported an Adjusted EBITDA of $27.1 million, although this represents a 39% decline compared to the prior year period. The company's strategic initiatives, including the sale of its New Zealand joint venture interest, are aimed at reducing leverage and returning capital to shareholders. This is crucial for a real estate investment trust (REIT) like Rayonier, which benefits from tax advantages on earnings generated by timber harvest activities.

Key Financial Metrics

The first quarter operating income was $0.1 million, a significant drop from $8.6 million in the prior year period. Cash provided by operating activities was $27.7 million, down from $52.3 million in the previous year. Cash available for distribution (CAD) was $20.3 million, reflecting a decrease due to lower Adjusted EBITDA, partially offset by lower capital expenditures and higher cash interest received.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenues | $82.9 million | $113.7 million |

| Net (Loss) Income | ($3.4) million | $1.4 million |

| Adjusted EBITDA | $27.1 million | $44.6 million |

Analysis and Outlook

Rayonier's performance in the first quarter underscores the impact of strategic reclassifications and challenging market conditions. The company's Southern Timber segment faced reduced volumes and pricing pressures, while the Pacific Northwest Timber segment showed stronger results. The Real Estate segment experienced limited transaction activity, consistent with prior guidance.

“We continued to advance key strategic initiatives during the first quarter, underscored by our announcement of an agreement to sell our New Zealand joint venture interest in March,” said Mark McHugh, President and CEO. “Following the anticipated closing of the New Zealand transaction later this year, we expect to have significant additional capital allocation capacity, which we plan to deploy toward value-enhancing uses, including additional share repurchases.”

Rayonier's revised full-year 2025 guidance reflects the exclusion of New Zealand operations, with expectations for net income attributable to Rayonier of $424 to $458 million and Adjusted EBITDA of $215 to $235 million. The company anticipates a stronger performance in the latter half of the year, particularly in its Real Estate segment.

Explore the complete 8-K earnings release (here) from Rayonier Inc for further details.