Udemy (UDMY, Financial) reported impressive financial results for the first quarter, achieving a revenue of $200.3 million, surpassing the market expectation of $197.2 million. This outperformance was complemented by better-than-anticipated adjusted EBITDA figures. Hugo Sarrazin, the President and CEO, highlighted Udemy's pivotal role in revolutionizing education by offering expert-led content on a large scale. With the rise of generative AI, the demand for reskilling is intensifying as companies face economic challenges and shifts in the labor market.

Udemy is strategically positioned to meet these evolving market needs through its extensive marketplace, business solutions, and AI-driven features. As organizations seek rapid development of AI skills, Udemy's resources have become increasingly vital. The company's robust offerings and strategic positioning not only enhance its value proposition but also reinforce confidence in its capacity to deliver substantial long-term value for stakeholders.

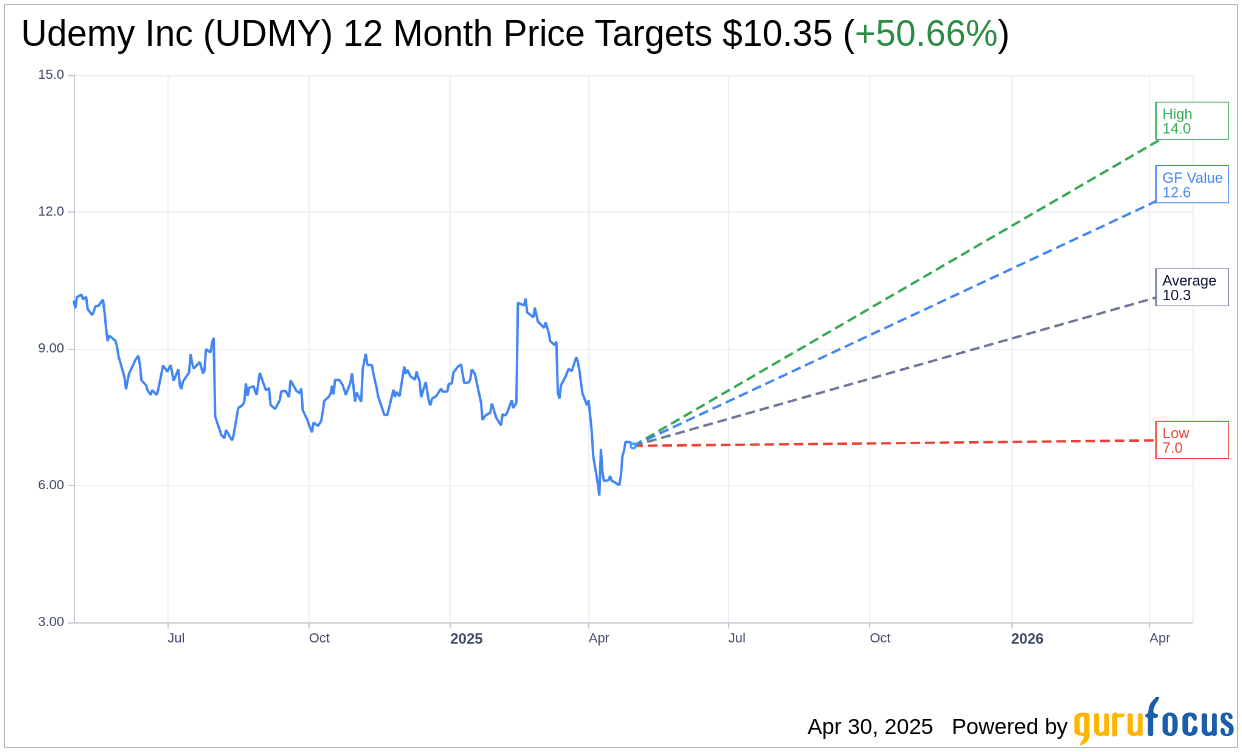

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Udemy Inc (UDMY, Financial) is $10.35 with a high estimate of $14.00 and a low estimate of $7.00. The average target implies an upside of 50.66% from the current price of $6.87. More detailed estimate data can be found on the Udemy Inc (UDMY) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, Udemy Inc's (UDMY, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Udemy Inc (UDMY, Financial) in one year is $12.61, suggesting a upside of 83.55% from the current price of $6.87. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Udemy Inc (UDMY) Summary page.

UDMY Key Business Developments

Release Date: February 13, 2025

- Full Year Revenue: $787 million, an 8% increase year over year, including a 2% negative impact from FX.

- Udemy Business Revenue Growth: 18% increase for the year.

- Consumer Revenue Decline: Down 5% for the year, including a 2% negative impact from FX.

- Adjusted EBITDA: $43 million, representing a 5% margin.

- Fourth Quarter Revenue: Nearly $200 million, a 5% increase year over year, with a 2% negative impact from FX.

- Udemy Business ARR: $517 million, up 11% from the previous year.

- Large Enterprise ARR Growth: Up 12% year over year.

- Udemy Business Revenue for Q4: $130 million, a 13% increase year over year, including a 2% negative impact from FX.

- Net New Udemy Business Customers in Q4: Approximately 250, increasing the global customer base by 9% year over year.

- Gross Margin for Udemy Business Segment: 75% for Q4, up 600 basis points from the prior year.

- Fourth Quarter Consumer Revenue: $70 million, down 7% year over year, including a 2% negative impact from FX.

- Total Company Gross Margin for Q4: 64%, a 500 basis point improvement from Q4 2023.

- Net Income for Q4: Approximately $60 million, or 8% of revenue.

- Adjusted EBITDA for Q4: Approximately $190 million, or 10% of revenue, representing a nearly 800 basis point expansion year over year.

- Cash and Equivalents at Year-End: $356 million.

- Free Cash Flow for the Year: Positive $38 million.

- Share Repurchase Program: $150 million used to buy back 60 million shares during the year.

- 2025 Revenue Guidance: $787 to $803 million, representing flat to 2% growth year over year, including a 2% negative impact from FX.

- 2025 Adjusted EBITDA Guidance: $75 to $85 million, approximately 10% of revenue at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Udemy Inc (UDMY, Financial) reported full-year revenue growth of 8% year over year, exceeding expectations.

- The company achieved a significant increase in adjusted EBITDA, moving from a loss in 2022 to a positive margin in 2024.

- Udemy Inc (UDMY) saw a 10x increase in generative AI course consumption, highlighting strong demand for AI-related content.

- The company closed nearly 50 deals over $100,000 in ARR, the highest for any quarter in 2024, indicating strong enterprise engagement.

- Udemy Inc (UDMY) is focusing on large enterprise customers, which show higher retention rates and offer better upsell and cross-sell opportunities.

Negative Points

- Consumer revenue declined by 5% year over year, impacted by lower individual course purchases.

- The company anticipates 2025 to be a transition year with flat to modest revenue growth, reflecting ongoing challenges.

- Udemy Inc (UDMY) faces a 2% point headwind from foreign exchange rates, affecting revenue growth.

- The company is experiencing a decline in net dollar retention rate, though it has stabilized compared to prior periods.

- There is a reduction in SMB sales capacity, which is expected to impact revenue growth in 2025.