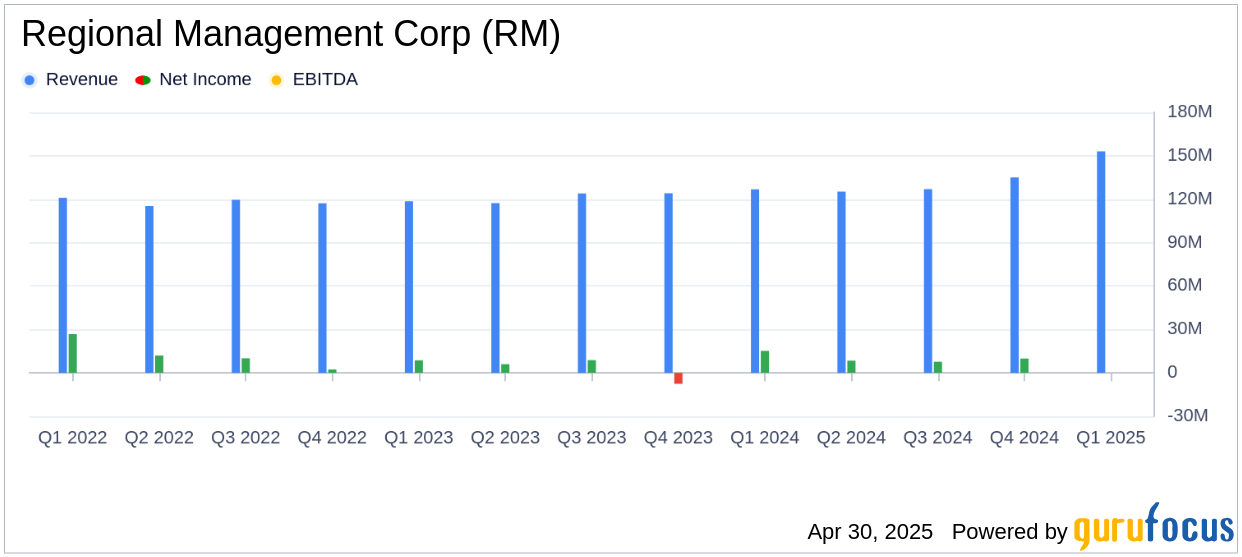

On April 30, 2025, Regional Management Corp (RM, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The company, a diversified consumer finance entity, reported a net income of $7.0 million and diluted earnings per share (EPS) of $0.70, falling short of the analyst estimate of $0.73. However, the company achieved record first-quarter revenue of $153 million, surpassing the estimated revenue of $151.07 million.

Company Background

Regional Management Corp is a consumer finance company that offers installment loan products to customers with limited access to traditional credit sources. The company's core offerings include small and large installment loans, along with optional payment and collateral protection insurance. Its primary revenue stream is derived from interest and fee income on outstanding loans.

Performance and Challenges

Regional Management Corp's performance in the first quarter of 2025 was marked by a 6.0% year-over-year increase in revenue, driven by a 20.2% rise in originations. Despite these achievements, the company's net income and EPS were lower than the previous year due to the absence of benefits from the sale of non-performing loans in the prior period. The company's net credit loss rate increased to 12.4%, highlighting ongoing challenges in credit performance.

Financial Achievements

The company reported a significant 8.4% growth in net finance receivables, reaching $1.9 billion, attributed to the opening of 15 new branches and the execution of its barbell strategy. This strategy focuses on expanding high-quality, auto-secured products alongside higher-margin small loan portfolios. These achievements are crucial for sustaining growth in the competitive credit services industry.

Key Financial Metrics

Regional Management Corp's income statement revealed a total revenue of $152.97 million, a 6.0% increase from the previous year. The provision for credit losses rose by 24.9% to $58.0 million, reflecting portfolio growth. The company's balance sheet showed total assets of $1.9 billion, with a debt of $1.5 billion. The allowance for credit losses was $199.1 million, representing 10.5% of net finance receivables.

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Total Revenue | $152.97 million | $144.31 million | +6.0% |

| Net Income | $7.0 million | $15.21 million | -53.9% |

| Diluted EPS | $0.70 | $1.56 | -55.1% |

| Net Finance Receivables | $1.9 billion | $1.74 billion | +8.4% |

Analysis and Commentary

Regional Management Corp's first-quarter results reflect a mixed performance. While the company achieved record revenue and significant growth in receivables, the decline in net income and EPS highlights the challenges posed by increased credit losses and the absence of prior-year benefits. The company's strategic expansion through new branches and its focus on high-margin portfolios are positive indicators for future growth.

We are very pleased with how we have begun the new year," said Robert W. Beck, President and Chief Executive Officer of Regional Management Corp. "We delivered $7.0 million of net income and 70 cents of diluted EPS in the first quarter, with record first quarter revenue of $153 million."

Looking ahead, Regional Management Corp plans to continue its growth initiatives while carefully monitoring economic conditions to optimize credit and margin outcomes. The company's ability to balance growth with credit risk management will be crucial in navigating the challenges of the consumer finance industry.

Explore the complete 8-K earnings release (here) from Regional Management Corp for further details.