On April 30, 2025, NACCO Industries Inc (NC, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. NACCO Industries Inc, a holding company operating in the mining and natural resource industries, reported a notable increase in operating profit, driven by its coal mining segment, despite facing challenges in other areas.

Company Overview

NACCO Industries Inc operates through three main segments: coal mining, North American mining (NA mining), and minerals management. The coal mining segment, which generates the majority of the company's revenue, operates surface coal mines under long-term contracts. The NA mining segment provides contract mining services, while minerals management focuses on income from royalty-based leases. The company is actively diversifying beyond coal mining due to pressures related to carbon emissions.

First Quarter 2025 Financial Highlights

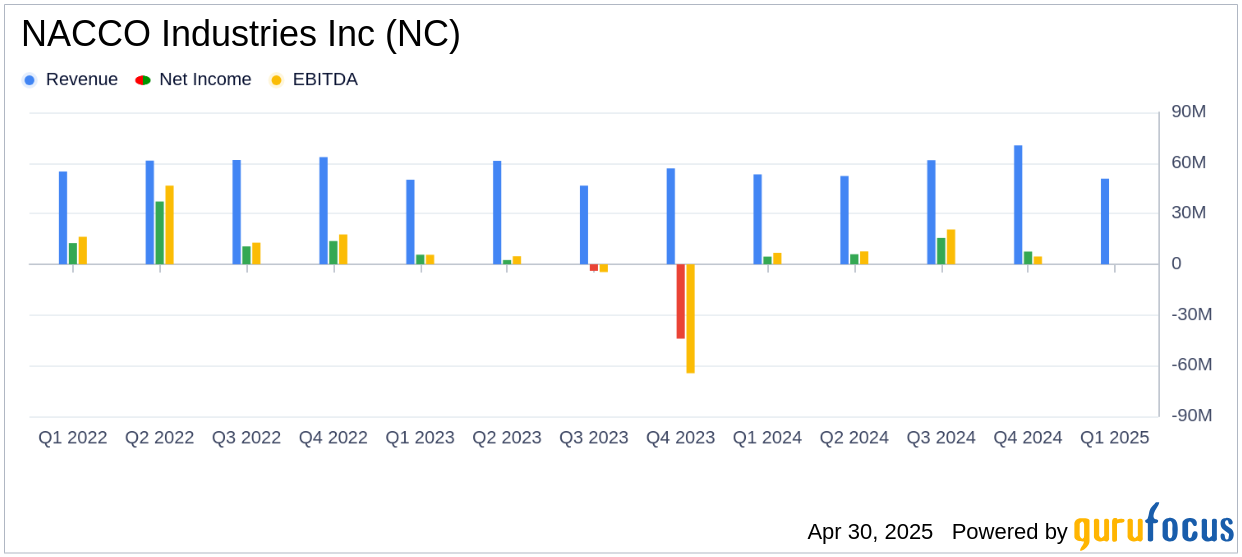

For the first quarter of 2025, NACCO Industries Inc reported an operating profit of $7.7 million, a significant increase from $4.8 million in the same period of 2024. However, income before taxes decreased by 8% to $5.1 million, while net income rose by 7.2% to $4.9 million. The diluted earnings per share (EPS) improved to $0.66 from $0.61 in the previous year. The company's EBITDA also saw a 14% increase, reaching $12.8 million.

Segment Performance and Challenges

The coal mining segment experienced a substantial improvement in operating profit, primarily due to higher earnings from unconsolidated operations and improved results at the Mississippi Lignite Mining Company. However, the North American mining segment faced challenges, with a decrease in operating profit attributed to lower delivery volumes and increased employee-related costs. The minerals management segment saw a modest revenue increase, driven by higher natural gas prices, despite a reduction in oil and coal royalties.

Financial Achievements and Metrics

NACCO Industries Inc's financial achievements are crucial for its position in the Other Energy Sources industry. The company's ability to increase operating profit and EBITDA highlights its operational efficiency and strategic focus on diversifying revenue streams. Key metrics such as the increase in tons of coal delivered and the growth in revenues across segments underscore the company's resilience and adaptability in a challenging market environment.

| Metric | Q1 2025 | Q1 2024 | % Change |

|---|---|---|---|

| Operating Profit | $7.7 million | $4.8 million | 60.4% |

| Net Income | $4.9 million | $4.57 million | 7.2% |

| Diluted EPS | $0.66 | $0.61 | 8.2% |

| EBITDA | $12.8 million | $11.2 million | 14.3% |

Analysis and Outlook

NACCO Industries Inc's performance in the first quarter of 2025 reflects its strategic efforts to enhance profitability and diversify its operations. The company's focus on improving operational efficiencies and expanding its portfolio in minerals management and mitigation resources positions it well for future growth. However, challenges in the North American mining segment and potential regulatory changes in the fossil fuel industry could impact future performance.

Overall, NACCO Industries Inc's first-quarter results demonstrate its capability to navigate a complex market environment while pursuing long-term growth opportunities. The company's strategic initiatives and financial achievements are likely to attract the attention of value investors seeking exposure to the mining and natural resource sectors.

Explore the complete 8-K earnings release (here) from NACCO Industries Inc for further details.