Maxeon (MAXN, Financial) reported a significant drop in its fourth-quarter revenue, achieving $48.8 million compared to $228.8 million in the previous year. Additionally, the company's solar panel shipments fell to 211,000 megawatts from 653,000 megawatts year-over-year. This downturn is largely attributed to ongoing restrictions imposed by U.S. Customs & Border Protection, which have prevented the import of Maxeon's solar panels since July 2024.

The company highlighted that despite their efforts to comply with the Uyghur Forced Labor Prevention Act through detailed supply chain documentation, U.S. authorities have yet to lift the ban. Consequently, Maxeon has initiated legal proceedings to challenge this decision, arguing that their supply chains meet all compliance requirements.

In response to these challenges, Maxeon is actively restructuring its operations for better competitiveness within the U.S. market. This includes identifying new domestic component suppliers and expanding partnerships in the U.S. Moreover, the company is streamlining operations to boost efficiency and cut costs, ensuring that they continue to offer top-tier solar energy solutions to residential, commercial, and utility customers. These initiatives aim to solidify Maxeon's market presence and adaptability in the long run.

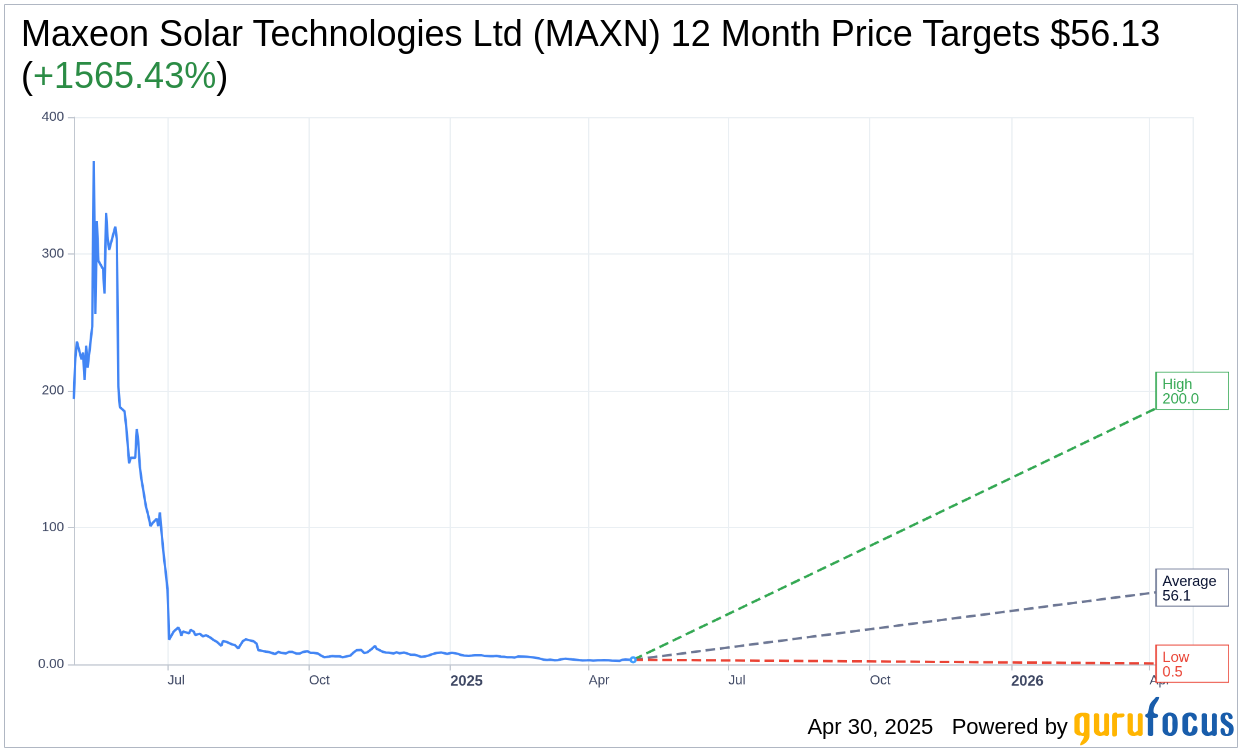

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Maxeon Solar Technologies Ltd (MAXN, Financial) is $56.13 with a high estimate of $200.00 and a low estimate of $0.50. The average target implies an upside of 1,565.43% from the current price of $3.37. More detailed estimate data can be found on the Maxeon Solar Technologies Ltd (MAXN) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Maxeon Solar Technologies Ltd's (MAXN, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Maxeon Solar Technologies Ltd (MAXN, Financial) in one year is $62.77, suggesting a upside of 1762.61% from the current price of $3.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Maxeon Solar Technologies Ltd (MAXN) Summary page.