Key Highlights:

- Riot Platforms (RIOT, Financial) is projected to post revenue growth of 102.1% year-over-year.

- Analysts have set a consensus price target that suggests significant upside potential.

- The stock holds an "Outperform" rating from the majority of brokerage firms.

Riot Platforms Inc. (RIOT) prepares to unveil its first-quarter earnings on May 1st, following market close. Projections indicate an expected EPS of -$0.21, alongside an impressive revenue climb of 102.1% year-over-year, hitting a forecasted $160.3 million. Historical performance reveals that Riot has managed to exceed EPS expectations 75% of the time.

Analyst Predictions and Stock Performance

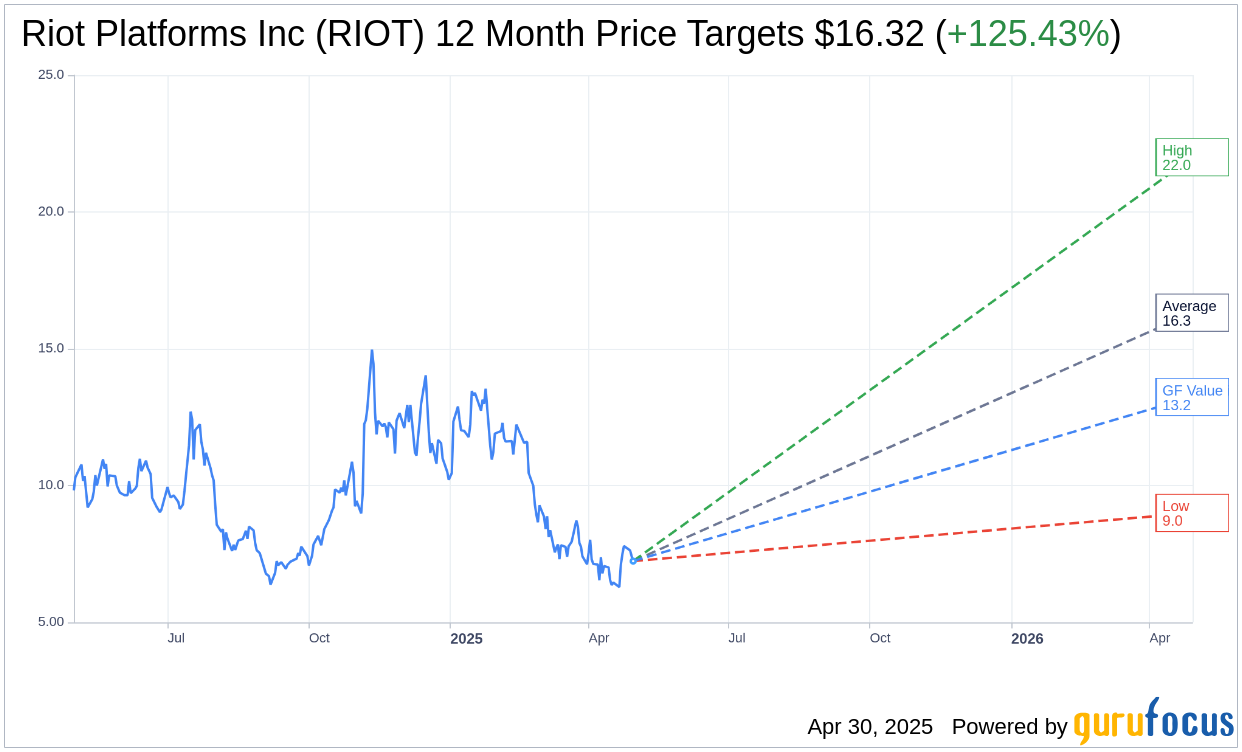

Looking at the next twelve months, 14 analysts have projected an average price target of $16.32 for Riot Platforms Inc (RIOT, Financial). These estimates range from a low of $9.00 to a high of $22.00. This forecast suggests a substantial upside of 125.43% from its current trading price of $7.24. For more comprehensive insights, visit the Riot Platforms Inc (RIOT) Forecast page.

Brokerage Recommendations and GF Value

The consensus from 16 brokerage houses rates Riot Platforms Inc (RIOT, Financial) with an average recommendation score of 1.9. This categorizes the stock under the "Outperform" bracket, using a scale from 1 (Strong Buy) to 5 (Sell).

According to GuruFocus' proprietary metrics, the one-year forecasted GF Value for Riot Platforms Inc is $13.24. This value indicates a potential 82.87% upside from its current share price of $7.24. The GF Value is GuruFocus’ assessment of a stock's fair trading value, derived from historical trading averages, business growth trends, and projected future performance. Additional details are accessible on the Riot Platforms Inc (RIOT, Financial) Summary page.