On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant reduction in its holdings of The RMR Group Inc. The transaction involved a decrease of 684,491 shares, representing a 37.13% reduction in BlackRock's position in RMR. This move reflects a strategic decision by the firm, which is known for its substantial equity holdings and diverse portfolio. The transaction was executed at a trade price of $16.65 per share, leaving BlackRock with a total of 1,159,076 shares in RMR, accounting for 7.30% of the firm's holdings in the traded stock.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

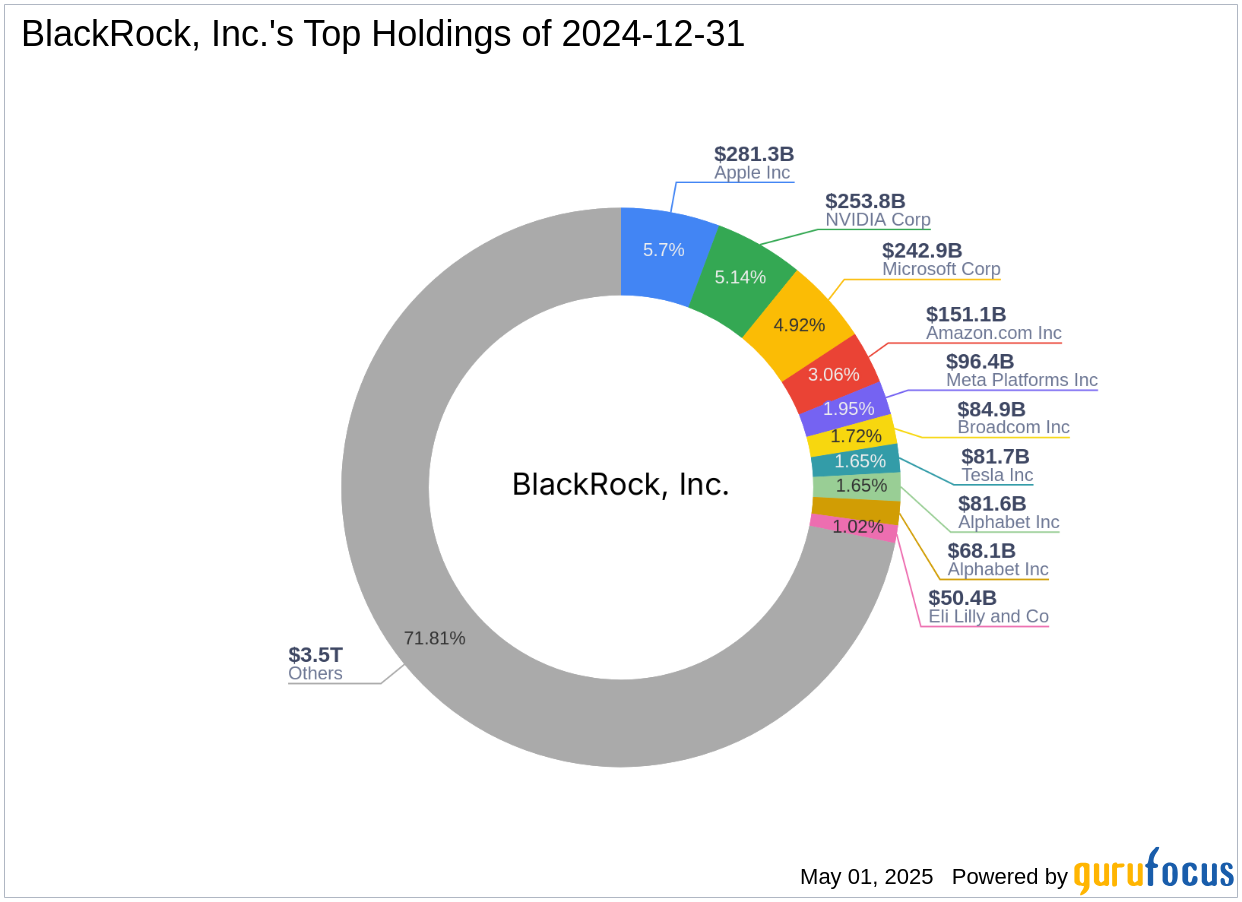

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, is a prominent investment firm with a vast portfolio. The firm is renowned for its significant equity holdings, particularly in major technology companies such as Apple Inc., Amazon.com Inc., and Microsoft Corp. With an equity value of $4,939.25 trillion, BlackRock's investment strategy predominantly focuses on the technology and financial services sectors. This strategic focus is evident in the firm's top holdings, which include industry giants like Meta Platforms Inc. and NVIDIA Corp.

An Overview of The RMR Group Inc.

The RMR Group Inc., based in the USA, operates as an alternative asset management firm with a focus on real estate investments. The company provides management services to publicly owned real estate investment trusts (REITs) and real estate-related businesses. With a market capitalization of $247.282 million, RMR derives its revenue from business and property management services, as well as advisory and other services. The company is currently trading at $14.65, which is significantly undervalued compared to its GF Value of $30.55, indicating a Price to GF Value ratio of 0.48.

Financial Metrics and Valuation of RMR

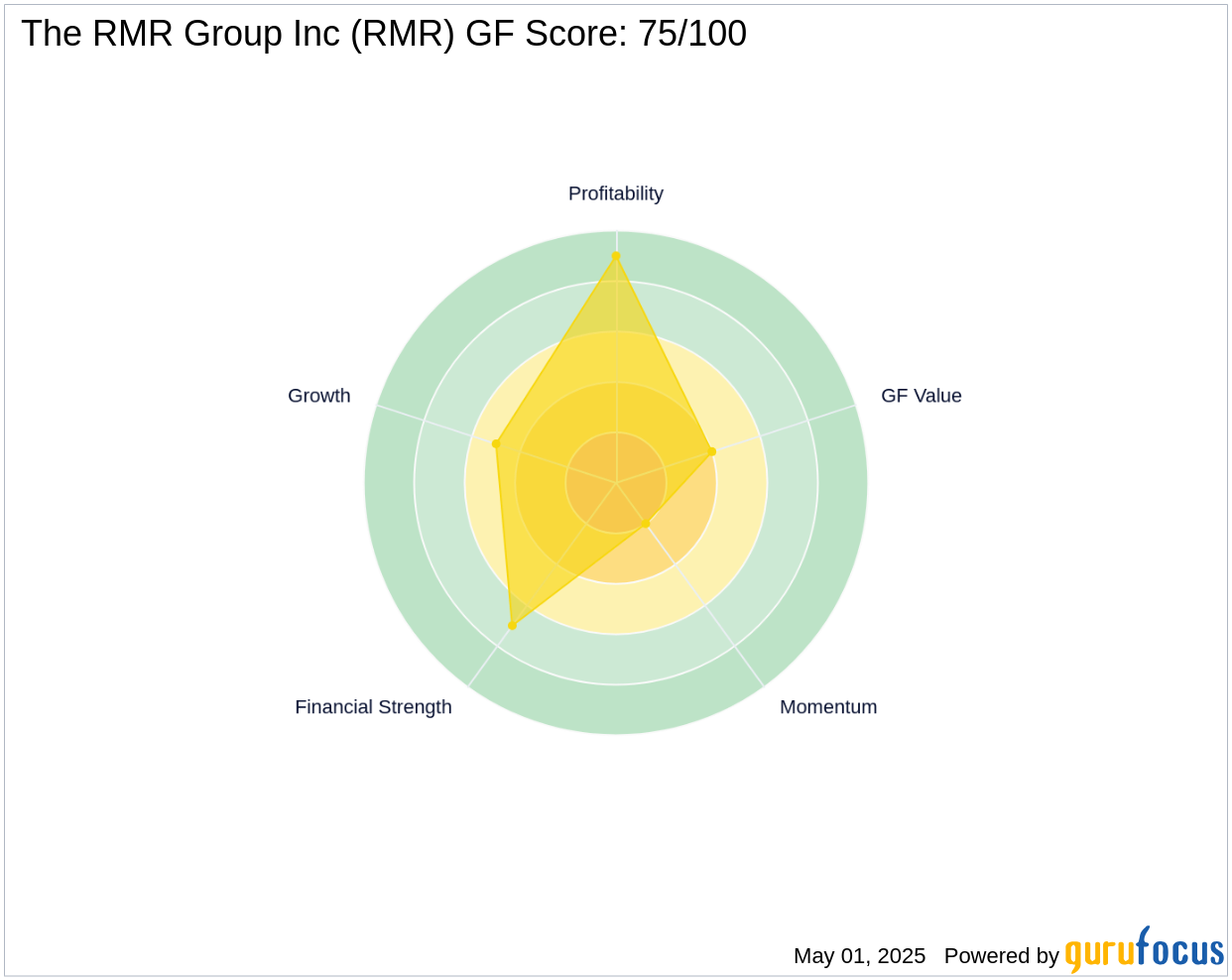

RMR's financial metrics reveal a [PE ratio](https://www.gurufocus.com/term/pe/RMR) of 11.04 and a [GF Score](https://www.gurufocus.com/term/gf-score/RMR) of 75/100, suggesting likely average performance. The company has experienced a year-to-date price decline of 27.73% and a 12.01% decrease since the transaction. Despite these challenges, RMR has shown a robust 40.90% revenue growth over the past three years. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/RMR) is ranked 7/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/RMR) is 9/10, indicating a strong financial position.

Performance and Growth Indicators

RMR's performance indicators highlight a mixed outlook. The company has a [Growth Rank](https://www.gurufocus.com/term/rank-growth/RMR) of 5/10, reflecting moderate growth potential. Its [Operating Margin](https://www.gurufocus.com/term/operating-margin/RMR) growth has declined by 19.30%, while the [Altman Z score](https://www.gurufocus.com/term/zscore/RMR) stands at 3.26, suggesting a stable financial condition. The [Piotroski F-Score](https://www.gurufocus.com/term/fscore/RMR) is 5, indicating average financial health. Additionally, RMR's [interest coverage](https://www.gurufocus.com/term/interest-coverage/RMR) is 37.15, demonstrating its ability to meet interest obligations.

BlackRock's Portfolio Strategy and Transaction Analysis

The reduction in RMR shares aligns with BlackRock's focus on technology and financial services sectors, which dominate its portfolio. This decision may reflect a strategic reallocation of resources towards higher-performing sectors. The transaction's impact on RMR's stock has been notable, with a 12.01% decline in stock price since the transaction. This move by BlackRock could signal a shift in confidence towards RMR's future performance, prompting other investors to reassess their positions.

Other Notable Holders of RMR

Besides BlackRock, other investment firms such as Third Avenue Management (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss also hold positions in RMR. Hotchkis & Wiley Capital Management LLC is identified as the largest holder of RMR shares among gurus. These firms' continued investment in RMR suggests a belief in the company's long-term potential, despite recent challenges.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.