On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction involving Cadence Design Systems Inc (CDNS, Financial). The firm reduced its holdings in Cadence Design Systems by 8,085,237 shares, marking a 26.97% change in its position. This strategic move reflects BlackRock's ongoing portfolio management and investment strategy adjustments. The transaction was executed at a price of $254.33 per share, resulting in a -0.04% impact on BlackRock's overall portfolio. Post-transaction, BlackRock retains 21,898,161 shares of Cadence Design Systems, which now constitutes 8.00% of its total holdings.

BlackRock, Inc. (Trades, Portfolio): A Leading Investment Firm

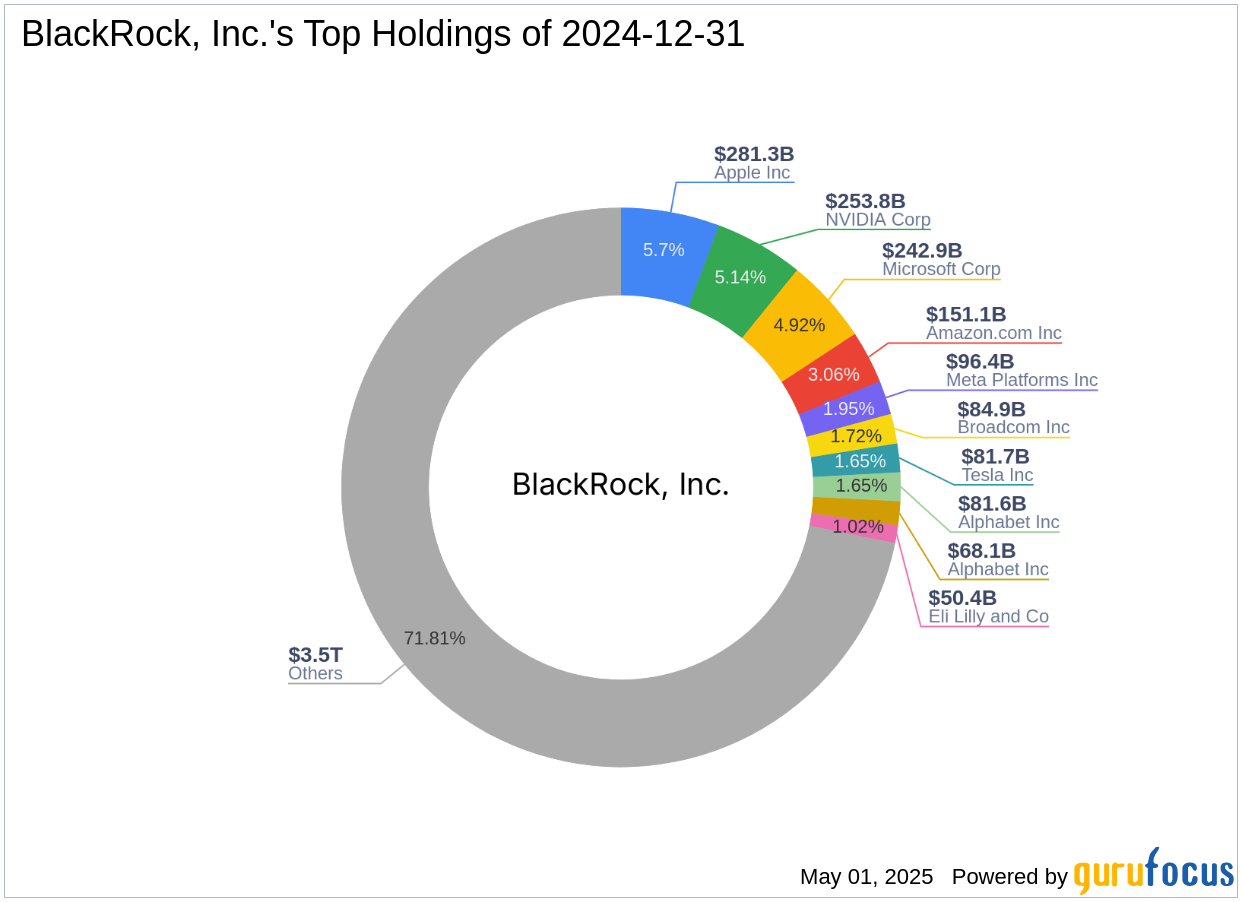

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, is a prominent investment firm renowned for its substantial equity holdings. The firm follows a diversified investment philosophy, with top holdings in major technology companies such as Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial). BlackRock's investment strategy is characterized by a focus on long-term growth and value creation, leveraging its extensive resources and expertise to manage a vast portfolio valued at $4,939.25 trillion. The firm's top sectors include technology and financial services, reflecting its strategic emphasis on high-growth industries.

Cadence Design Systems Inc: Company Overview

Cadence Design Systems, a USA-based company, specializes in electronic design automation software and system design products. With a market capitalization of $81.67 billion, Cadence is recognized for its robust profitability and growth, boasting a Profitability Rank of 10/10. The company provides a comprehensive suite of products that enhance design accuracy, productivity, and complexity in chip design processes. Cadence's offerings include custom integrated circuit design, digital IC design, functional verification, and system design and analysis, positioning it as a leader in the electronic design automation industry.

Financial Metrics and Valuation

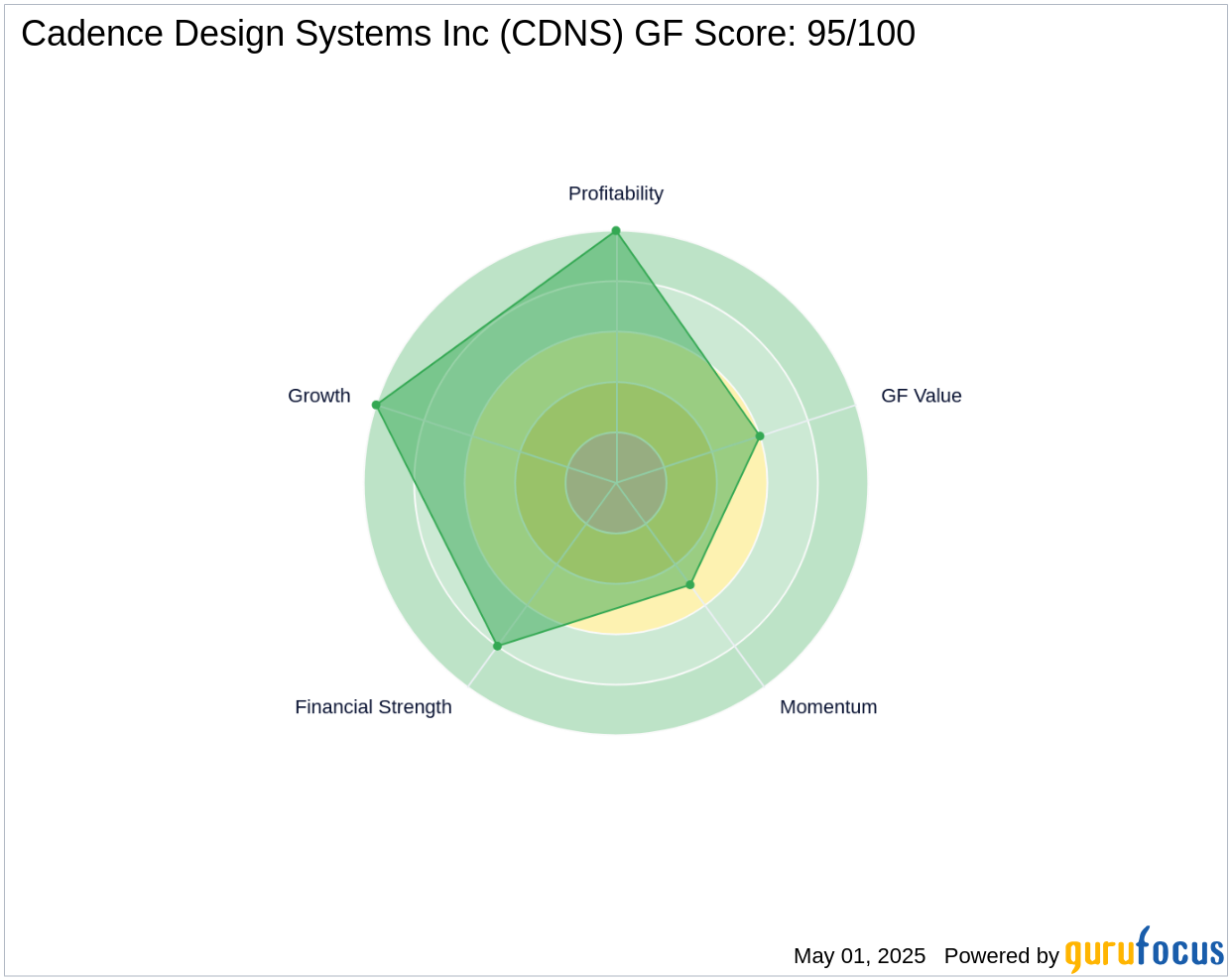

Cadence Design Systems is currently trading at $297.74, with a PE ratio of 75.38, indicating a fairly valued status according to GuruFocus. The GF Value of the stock is $305.56, with a GF Score of 95/100, suggesting a high potential for long-term outperformance. The company's financial strength is underscored by its Balance Sheet Rank of 8/10 and an Altman Z score of 13.20, indicating strong financial health and stability.

Market Performance and Growth Indicators

Since the transaction, Cadence Design Systems' stock has experienced a 17.07% gain, and a remarkable 16,081.52% increase since its IPO in 1990. The company demonstrates strong growth metrics, with a 3-year revenue growth rate of 16.50% and an EBITDA growth rate of 22.80%. Cadence's Growth Rank of 10/10 further highlights its robust expansion capabilities. The company's Operating Margin growth of 7.30% and a Piotroski F-Score of 5 indicate efficient operational management and financial performance.

Other Notable Investors in Cadence Design Systems

Besides BlackRock, other prominent investors in Cadence Design Systems include Joel Greenblatt (Trades, Portfolio), Ron Baron (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio). Dodge & Cox holds the largest share percentage among the gurus invested in Cadence Design Systems, reflecting the stock's attractiveness to institutional investors. These investors recognize Cadence's potential for sustained growth and profitability, aligning with their long-term investment strategies.

Transaction Analysis

The reduction in BlackRock's stake in Cadence Design Systems reflects a strategic portfolio adjustment, potentially aimed at reallocating resources to other high-growth opportunities. Despite the reduction, Cadence remains a significant component of BlackRock's portfolio, indicating continued confidence in the company's long-term prospects. The transaction's impact on Cadence's stock has been positive, with a notable increase in its market value, underscoring investor confidence in the company's growth trajectory and financial health.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.