Significant Transaction by BlackRock, Inc. (Trades, Portfolio)

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a notable reduction in its holdings of DexCom Inc., a leading company in the medical devices sector. The transaction involved a decrease of 7,095,461 shares, marking a 17.92% change in BlackRock's position in the company. This move reflects a strategic adjustment in BlackRock's investment portfolio, impacting its overall stake in DexCom. The shares were traded at a price of $68.29, resulting in a minor impact of -0.01% on BlackRock's extensive portfolio. Post-transaction, BlackRock holds 32,504,140 shares of DexCom, which constitutes 8.30% of its holdings in the traded stock.

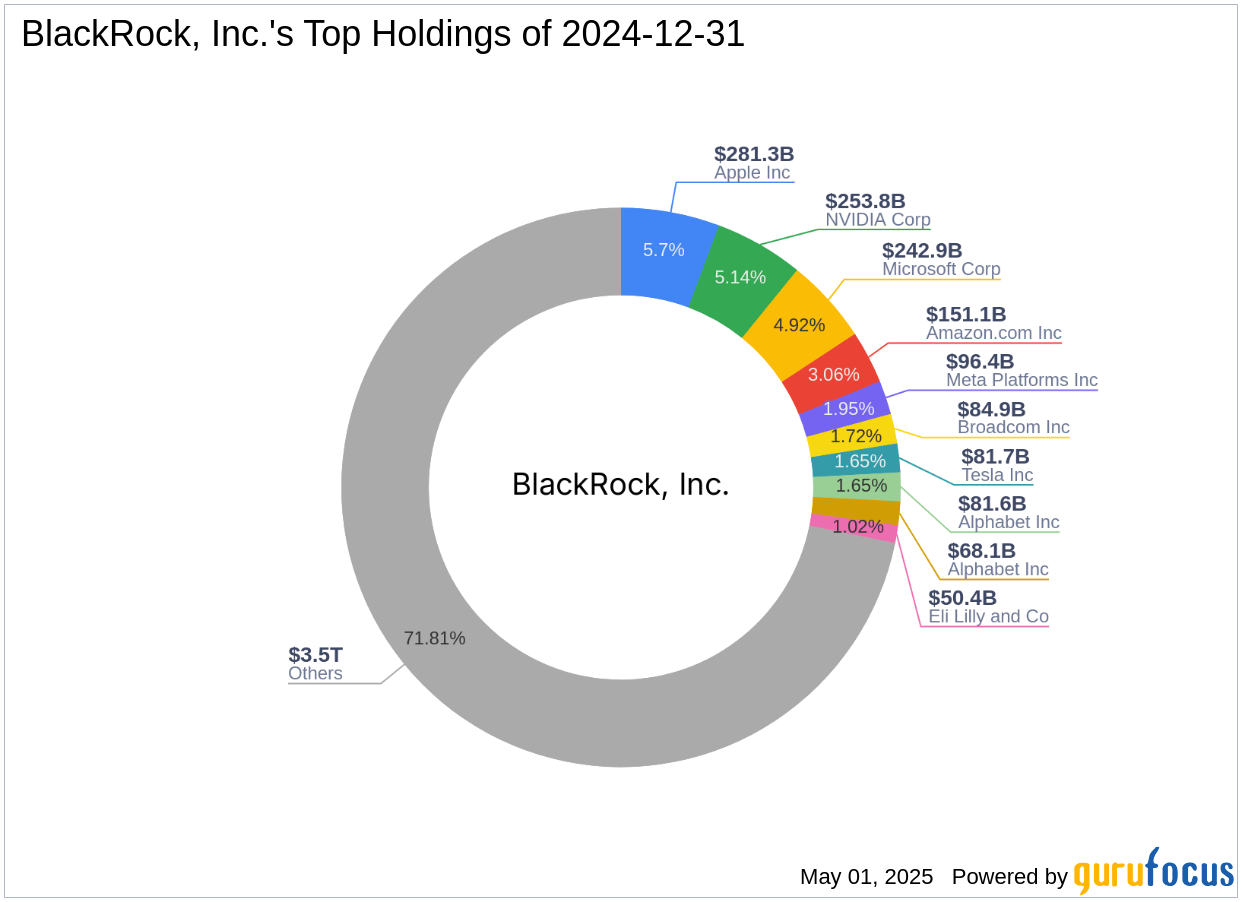

About BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, is a prominent investment firm renowned for its substantial equity holdings and diversified investment philosophy. The firm is known for its top holdings in major technology companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). With an equity value of $4,939.25 trillion, BlackRock's investment strategy is heavily weighted towards the technology and financial services sectors, reflecting its confidence in these industries' growth potential.

DexCom Inc.: A Leader in Medical Devices

DexCom Inc., based in the USA, specializes in designing and commercializing continuous glucose monitoring (CGM) systems for diabetic patients. Since its IPO in 2005, DexCom has been at the forefront of medical technology, providing alternatives to traditional blood glucose meters. The company is evolving its CGM systems to integrate with insulin pumps for automatic insulin delivery. With a market capitalization of $27.99 billion, DexCom is considered significantly undervalued, boasting a GF Value of $150.65. The current stock price is $71.38, with a price-to-GF Value ratio of 0.47, indicating substantial undervaluation.

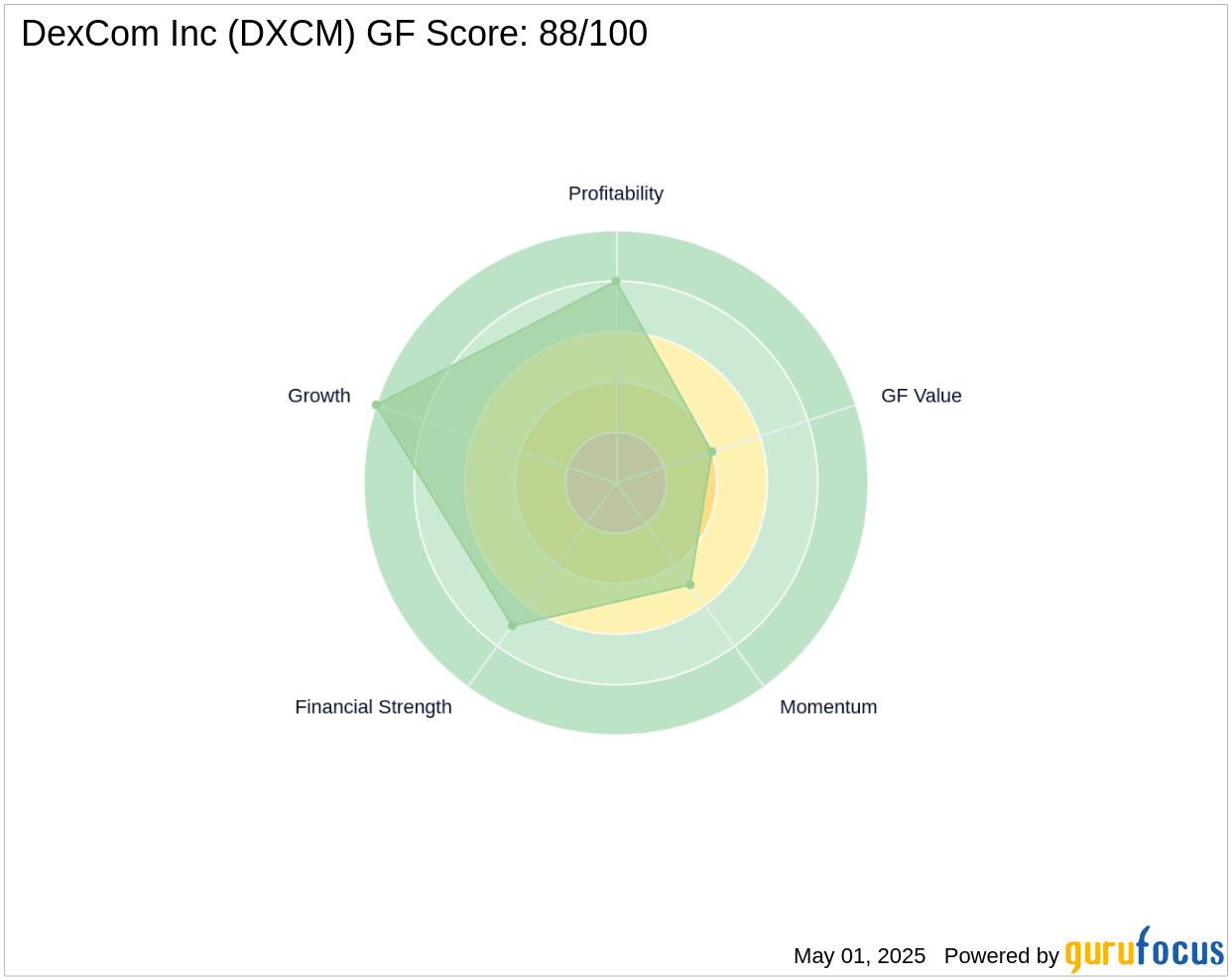

Financial Metrics and Valuation

DexCom's financial metrics highlight its strong market position and growth potential. The company has a robust GF Score of 88/100, reflecting good outperformance potential. Over the past three years, DexCom has demonstrated impressive growth metrics, including a 37.50% EBITDA growth. Despite a year-to-date price change of -9.07%, the stock has experienced a substantial price increase of 2,263.58% since its IPO. DexCom's profitability rank is high at 8/10, and its growth rank is a perfect 10/10, underscoring its strong financial health.

Market Performance and Investor Interest

DexCom's market performance has been noteworthy, with a Financial Strength rank of 7/10 and an interest coverage of 31.58. The company's Altman Z score of 5.42 indicates a strong financial position. Other notable investors in DexCom include Ken Fisher (Trades, Portfolio), Ron Baron (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio), with the largest holder being the Vanguard Health Care Fund (Trades, Portfolio). This highlights the stock's appeal among institutional investors, further solidifying its market position.

Transaction Analysis

The reduction in BlackRock's stake in DexCom reflects a strategic portfolio adjustment, possibly to reallocate resources or manage risk. Despite the reduction, DexCom remains a significant part of BlackRock's holdings, constituting 8.30% of its position in the traded stock. The transaction's impact on BlackRock's portfolio was minimal at -0.01%, indicating a well-balanced investment strategy. DexCom's strong financial metrics and growth potential continue to make it an attractive investment for institutional investors, despite the recent reduction by BlackRock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: