Overview of BlackRock's Recent Transaction

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio), a leading investment firm, executed a transaction involving Pulmonx Corp (LUNG, Financial), reducing its holdings by 155,156 shares. The shares were traded at a price of $6.73, resulting in a total holding of 2,694,998 shares in Pulmonx Corp. This transaction reflects a strategic decision by BlackRock, Inc. (Trades, Portfolio) to adjust its portfolio, with Pulmonx Corp now representing 6.80% of the firm's holdings in the stock. The reduction in shares indicates a potential reevaluation of the firm's investment strategy concerning Pulmonx Corp.

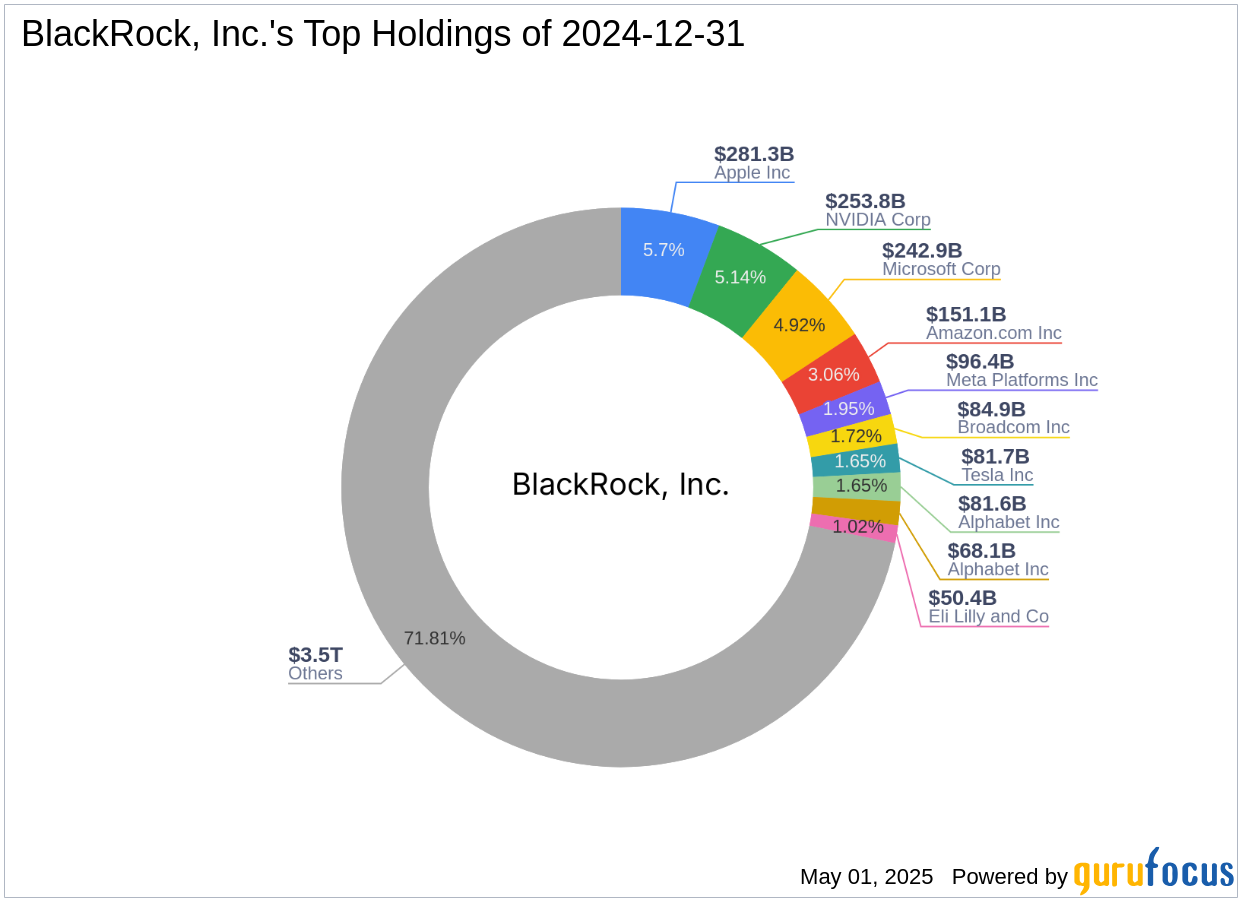

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a prominent investment firm known for its extensive equity holdings, particularly in the technology and financial services sectors. The firm's investment philosophy emphasizes diversification and long-term growth, with significant stakes in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). With an equity value of $4,939.25 trillion, BlackRock, Inc. (Trades, Portfolio) is a formidable player in the global investment landscape, leveraging its expertise to manage a diverse portfolio.

Pulmonx Corp: A Medical Technology Innovator

Pulmonx Corp is a commercial-stage medical technology company based in the USA, specializing in minimally invasive treatments for severe emphysema, a form of chronic obstructive pulmonary disease (COPD). The company's key products include the Zephyr Endobronchial Valve, the Chartis Pulmonary Assessment System, and the StratX Lung Analysis Platform. Pulmonx Corp generates revenue through product sales to distributors and hospitals across various regions, including the United States, Europe, the Middle East, Africa, and Asia Pacific.

Financial Performance and Valuation of Pulmonx Corp

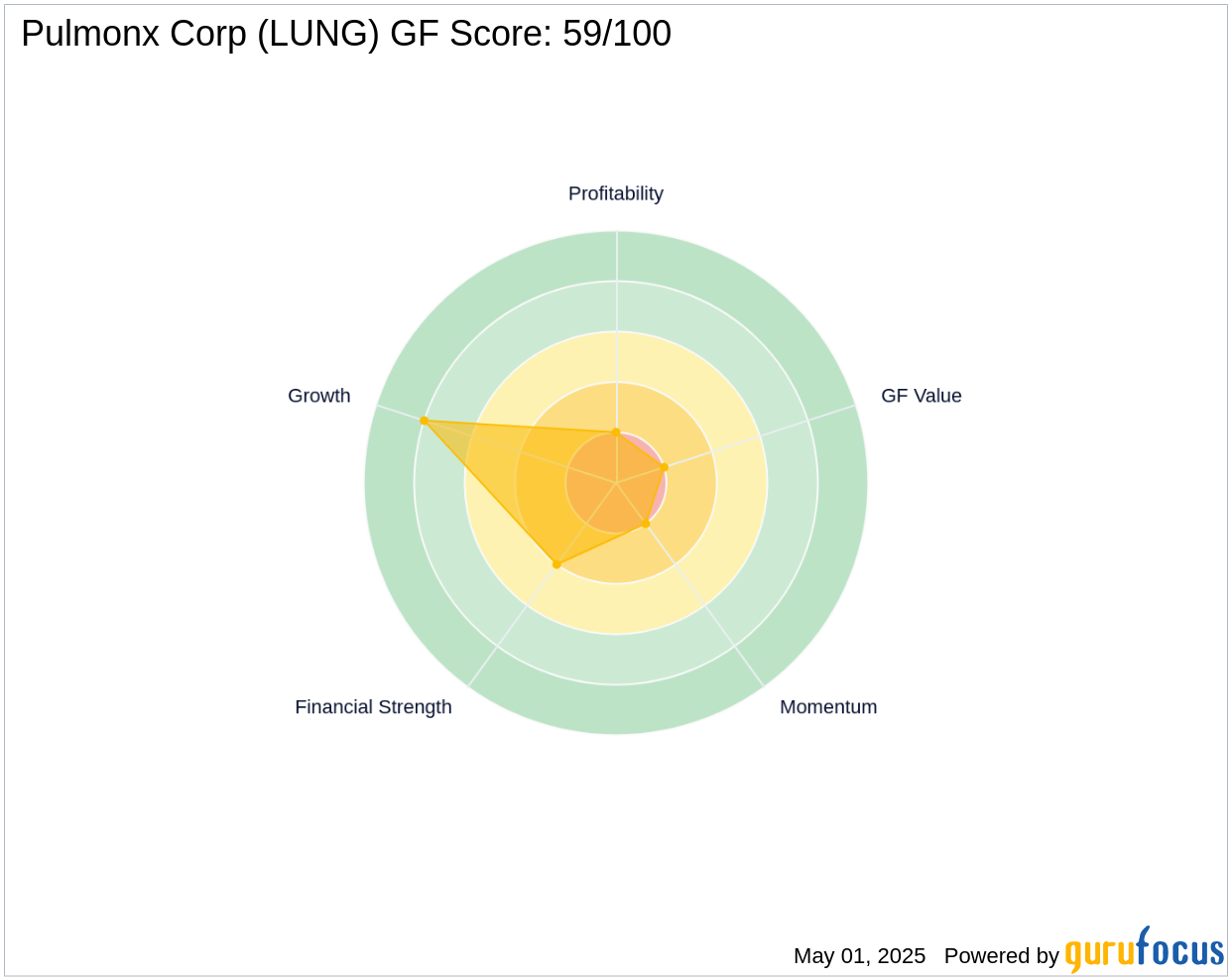

As of May 1, 2025, Pulmonx Corp has a market capitalization of $193.590 million, with a current stock price of $4.81. The company's financial metrics reveal a challenging landscape, with a PE percentage of 0.00, indicating a loss. The [GF Value](https://www.gurufocus.com/term/gf-score/LUNG) of $14.37 suggests a possible value trap, urging investors to think twice before investing. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/LUNG) is ranked 4/10, and its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/LUNG) is 2/10, reflecting the financial hurdles it faces.

Stock Performance and Growth Metrics

Pulmonx Corp's stock performance has been underwhelming, with a -28.53% change since the transaction and a -87.98% decline since its IPO. Despite these challenges, the company has achieved a 16.90% revenue growth over three years, indicating potential for future growth. The [GF Score](https://www.gurufocus.com/term/gf-score/LUNG) of 59/100 suggests poor future performance potential, while the [Growth Rank](https://www.gurufocus.com/term/rank-growth/LUNG) is 8/10, highlighting the company's ability to grow its revenue despite financial difficulties.

Impact on BlackRock, Inc. (Trades, Portfolio)'s Portfolio

The reduction in Pulmonx Corp shares has a notable impact on BlackRock, Inc. (Trades, Portfolio)'s portfolio, with the stock now accounting for 6.80% of the firm's holdings in Pulmonx Corp. This adjustment aligns with BlackRock, Inc. (Trades, Portfolio)'s broader portfolio strategy, which includes top holdings in technology giants like Apple Inc, Amazon.com Inc, and Microsoft Corp. These holdings significantly influence the firm's overall investment approach, emphasizing stability and growth in high-performing sectors.

Conclusion and Market Implications

BlackRock, Inc. (Trades, Portfolio)'s decision to reduce its stake in Pulmonx Corp may signal a cautious approach towards the company's future prospects. Given Pulmonx Corp's current financial and market indicators, including its [Altman Z score](https://www.gurufocus.com/term/zscore/LUNG) of -2.19 and [Piotroski F-Score](https://www.gurufocus.com/term/fscore/LUNG) of 3, the market may perceive this as a prudent move. As Pulmonx Corp navigates its financial challenges, its future performance will depend on its ability to leverage its innovative products and achieve sustainable growth in the competitive medical technology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.