Overview of BlackRock's Recent Transaction

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction involving Repligen Corp (RGEN, Financial), reducing its holdings by 1,659,153 shares. This transaction was conducted at a trade price of $127.24 per share, leaving BlackRock with a total of 5,198,107 shares in Repligen. This move reflects a strategic adjustment in BlackRock's portfolio, with the current position of Repligen in the firm's portfolio standing at 0.01. The transaction's impact on BlackRock's overall holdings in Repligen is notable, as it now represents 9.30% of the firm's total holdings in the stock.

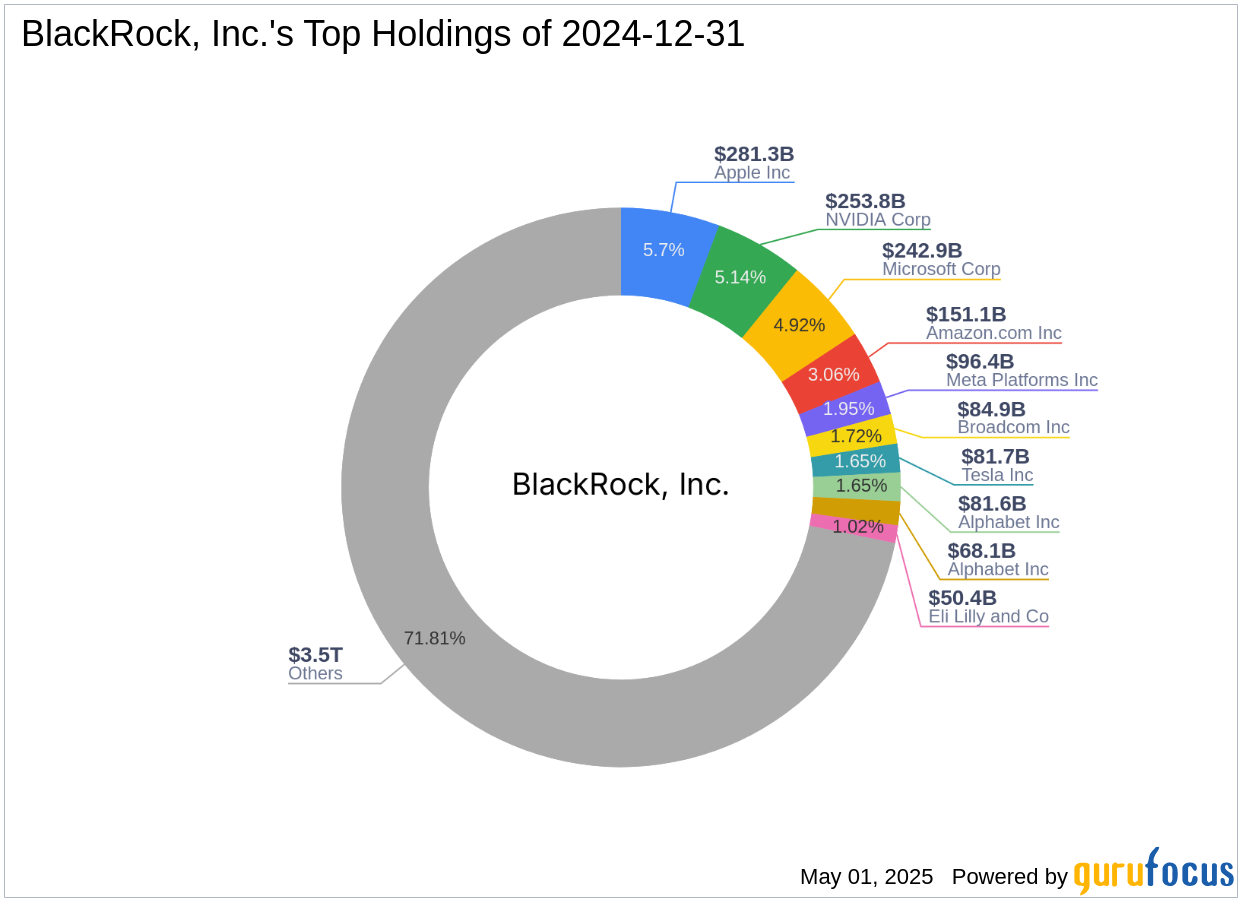

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, NY, is a leading global investment firm known for its substantial influence in the financial markets. With an impressive equity of $4,939.25 trillion, BlackRock's investment philosophy emphasizes diversification and long-term growth. The firm holds significant positions in major technology and financial services companies, including Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These top holdings underscore BlackRock's strategic focus on sectors with robust growth potential.

Repligen Corp: A Leader in Life Sciences

Repligen Corp, based in Waltham, Massachusetts, is a prominent player in the global life sciences industry. The company specializes in developing and selling bioprocessing equipment and supplies essential for biologic drug manufacturing. Repligen's product offerings are categorized into filtration, chromatography, proteins, and process analytics, with filtration being the largest revenue contributor at 58% of 2024 revenue. The company's geographical revenue distribution is diverse, with North America, Europe, and Asia Pacific contributing 44%, 37%, and 19% of revenue, respectively.

Impact of the Transaction on BlackRock's Portfolio

The reduction in Repligen shares by BlackRock has implications for both the firm's portfolio and the stock's market performance. Following the transaction, Repligen's stock price experienced an 8.45% gain, reflecting positive market sentiment. Despite the reduction, Repligen remains a part of BlackRock's diversified portfolio, albeit with a smaller position. The transaction highlights BlackRock's dynamic approach to portfolio management, adjusting holdings in response to market conditions and strategic objectives.

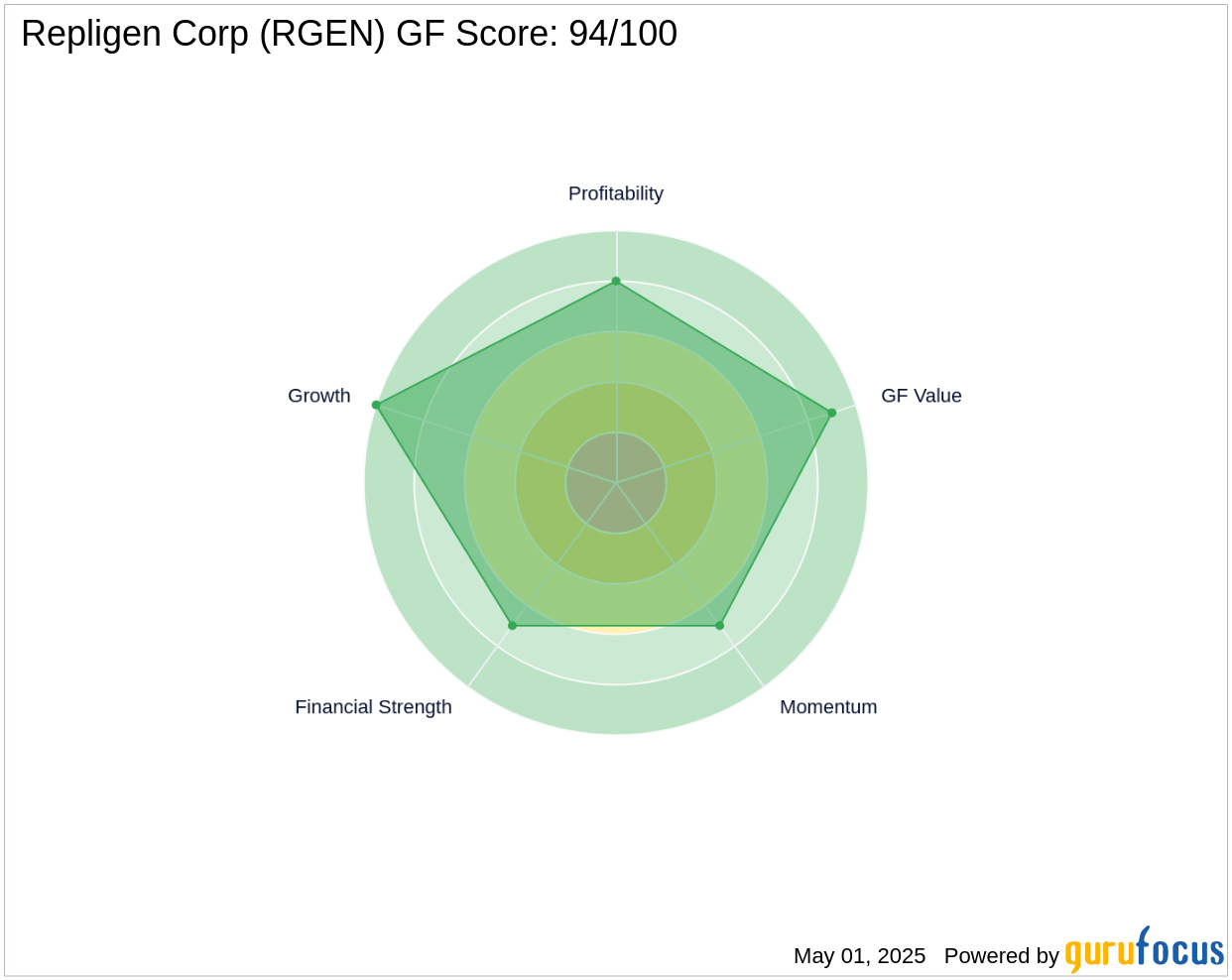

Financial Metrics and Valuation of Repligen Corp

Repligen Corp currently boasts a market capitalization of $7.75 billion, with a stock price of $137.99. The company's valuation metrics indicate a [GF Value](https://www.gurufocus.com/term/gf-value/RGEN) of $155.14, suggesting that the stock is modestly undervalued with a Price to GF Value ratio of 0.89. Repligen's [GF Score](https://www.gurufocus.com/term/gf-score/RGEN) of 94/100 signifies a high potential for outperformance, making it an attractive consideration for value investors.

Performance and Growth Indicators

Repligen's financial health is robust, with a [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/RGEN) of 7/10 and a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/RGEN) of 8/10. The company's [Growth Rank](https://www.gurufocus.com/term/rank-growth/RGEN) is an impressive 10/10, although recent metrics indicate declines in revenue and EBITDA growth. These indicators suggest that while Repligen faces some growth challenges, its overall financial strength remains solid.

Other Notable Investors in Repligen Corp

In addition to BlackRock, other prominent investors hold positions in Repligen. Notably, Joel Greenblatt (Trades, Portfolio) is among the investors with stakes in the company. Baron Funds is identified as the largest guru holding the most shares of Repligen, highlighting the stock's appeal among seasoned investors.

Conclusion: Implications for Repligen's Future

BlackRock's recent transaction involving Repligen Corp underscores the dynamic nature of investment strategies among major firms. While the reduction in shares may suggest a reevaluation of Repligen's role in BlackRock's portfolio, the stock's subsequent price gain indicates continued market confidence. For value investors, Repligen presents both opportunities and risks, with its strong financial metrics and growth potential balanced against recent performance challenges. As the life sciences sector continues to evolve, Repligen's strategic positioning and innovative offerings may drive future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: