Transaction Overview

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction involving Tredegar Corp (TG, Financial), reducing its holdings by 825,579 shares. The transaction was completed at a trade price of $7.70 per share. Following this reduction, BlackRock's current holding in Tredegar Corp stands at 1,860,803 shares, representing 5.40% of the firm's portfolio. This move reflects a strategic adjustment in BlackRock's investment approach towards Tredegar Corp, a company known for its manufacturing of polyethylene plastic films, polyester films, and aluminum extrusions.

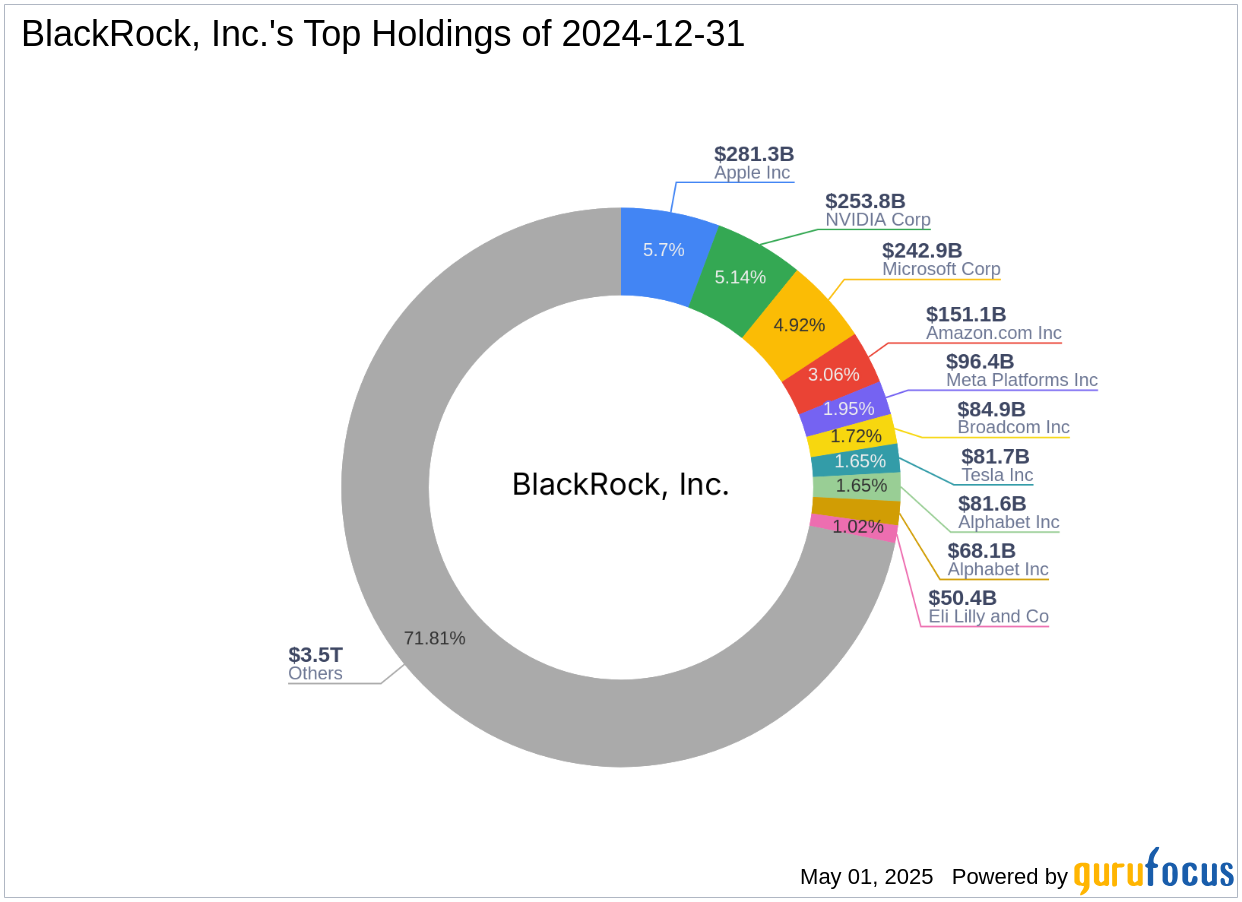

Profile of BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, NY, is a leading global investment firm renowned for its comprehensive investment strategies and substantial equity of $4,939.25 trillion. The firm's investment philosophy emphasizes diversification and long-term growth, with top holdings in major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These holdings underscore BlackRock's focus on sectors with robust growth potential.

Overview of Tredegar Corp

Tredegar Corp, a USA-based company, operates in the industrial products sector, specializing in the manufacture of polyethylene plastic films, polyester films, and aluminum extrusions. The company generates revenue through its business segments, including PE films, flexible packaging films, and aluminum extrusions, with a significant portion of its revenue derived from the United States, Asia, and Brazil. Tredegar's aluminum extrusions segment is particularly noteworthy, providing high-quality, soft-alloy, medium-strength aluminum for various markets, including construction and automotive.

Impact of the Transaction

The reduction in BlackRock's stake in Tredegar Corp suggests a reevaluation of the company's position within the firm's portfolio. Despite the reduction, Tredegar Corp still accounts for a notable 5.40% of BlackRock's holdings. This adjustment may reflect BlackRock's response to Tredegar's current market conditions and financial performance, as well as its strategic priorities in other sectors.

Financial Metrics and Valuation

Tredegar Corp's market capitalization stands at $269.298 million, with a current stock price of $7.77. The stock is considered modestly overvalued, with a GF Value of $6.32 and a Price to GF Value ratio of 1.23. These metrics indicate that the stock is trading above its intrinsic value, suggesting limited margin of safety for potential investors.

Performance and Growth Indicators

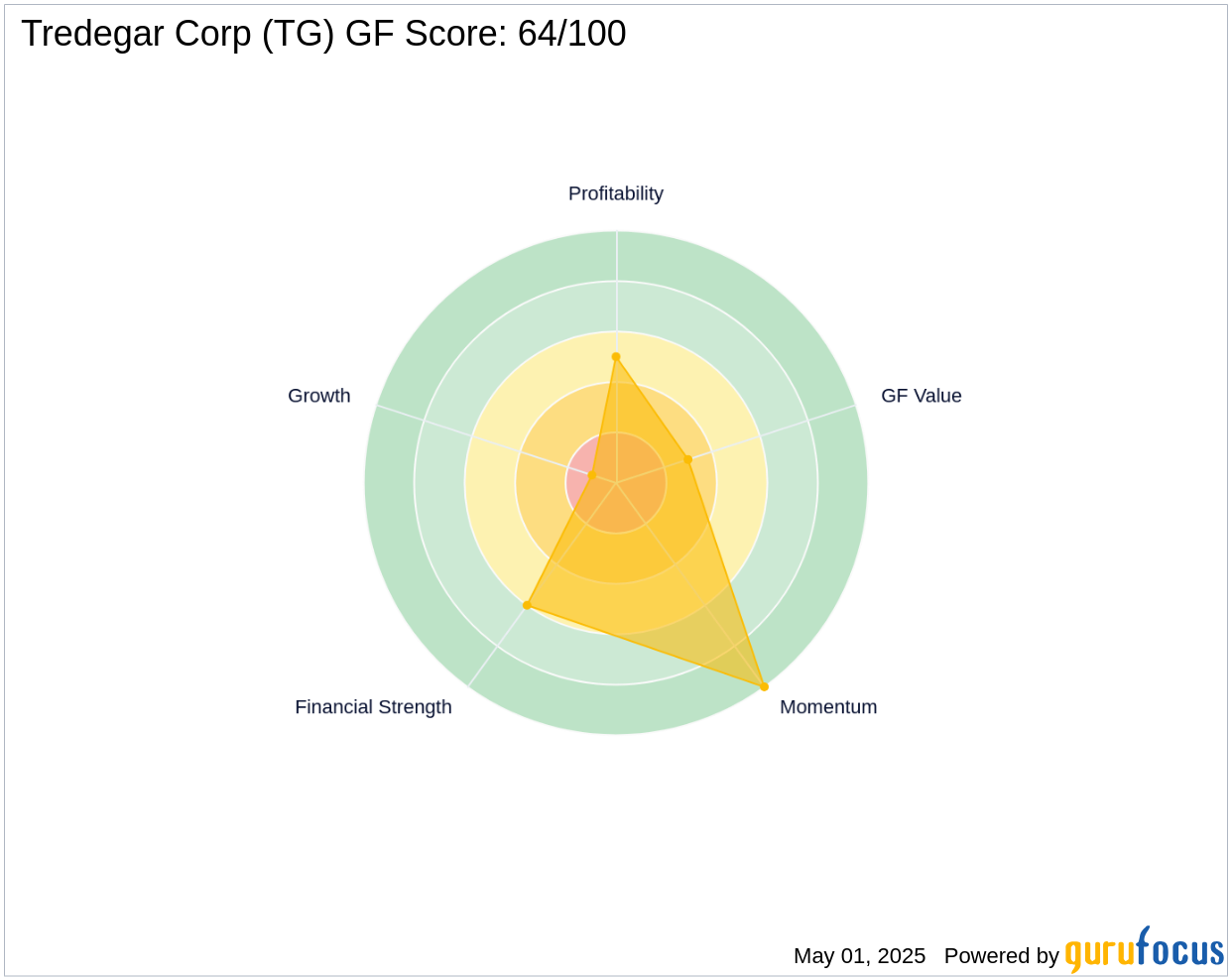

Tredegar Corp's financial performance presents several challenges, as reflected in its GF Score of 64/100 and a Balance Sheet Rank of 6/10. The company has faced negative growth rates in revenue (-10.80%), EBITDA (-31.40%), and earnings (-24.90%) over the past three years, highlighting significant profitability and growth challenges.

Market and Industry Context

Within the industrial products industry, Tredegar Corp faces competitive pressures and operational challenges, as evidenced by its low Profitability Rank of 5/10 and Growth Rank of 1/10. The company's Altman Z score of 3.28 suggests moderate financial distress risk, while its interest coverage ratio of 4.37 indicates limited ability to meet interest obligations.

Conclusion

BlackRock's recent transaction involving Tredegar Corp provides valuable insights into the firm's strategic portfolio management. While Tredegar Corp remains a part of BlackRock's holdings, the reduction reflects a cautious approach given the company's current financial standing and market conditions. For value investors, Tredegar Corp presents both opportunities and risks, necessitating careful consideration of its financial metrics and industry position before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.