Overview of BlackRock's Recent Transaction

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio), a leading investment firm, executed a significant transaction involving Unisys Corp. The firm reduced its holdings by 592,680 shares at a price of $4.59 per share. This adjustment brought BlackRock's total shares in Unisys Corp to 5,245,723. The transaction reflects a strategic decision by BlackRock, which holds a 7.40% position in Unisys Corp. This move is noteworthy given the current market conditions and the performance of Unisys Corp's stock.

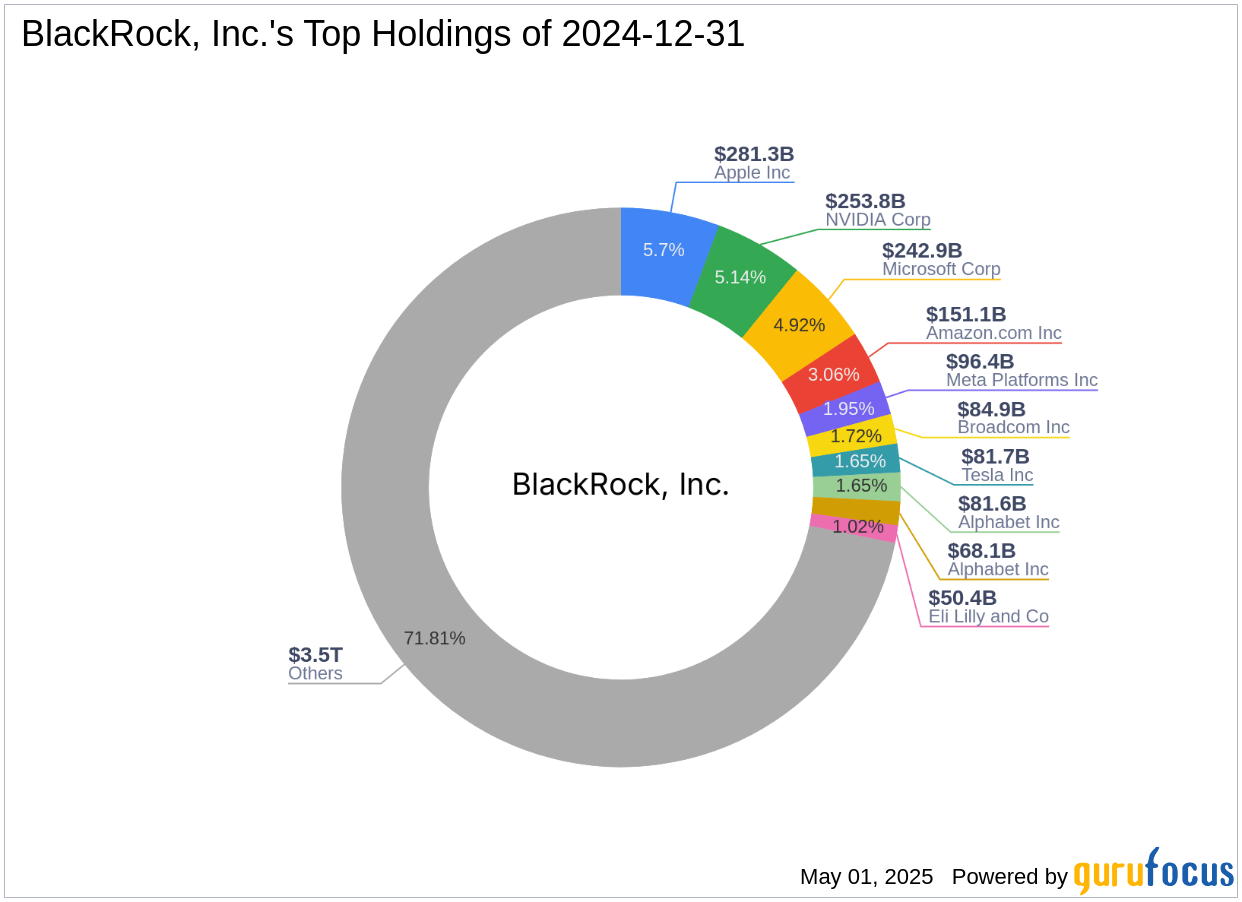

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a prominent player in the investment management industry. Known for its robust investment philosophy, BlackRock focuses on technology and financial services sectors, aligning with its top holdings in companies like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With an equity value of $4,939.25 trillion, BlackRock's strategic decisions are closely watched by market participants. The firm's investment strategies often emphasize long-term growth and value creation.

Unisys Corp: A Technology Solutions Provider

Unisys Corp, a technology solutions provider based in the USA, operates through three primary business segments: Digital Workplace Solutions (DWS), Cloud, Applications & Infrastructure Solutions (CA&I), and Enterprise Computing Solutions (ECS). The company is engaged in delivering technology solutions across government, financial services, and commercial markets. Unisys Corp's ECS segment, which provides secure, high-intensity enterprise computing solutions, generates the majority of its revenue. Despite its diverse offerings, the company faces challenges in maintaining growth and profitability.

Financial Performance and Valuation of Unisys Corp

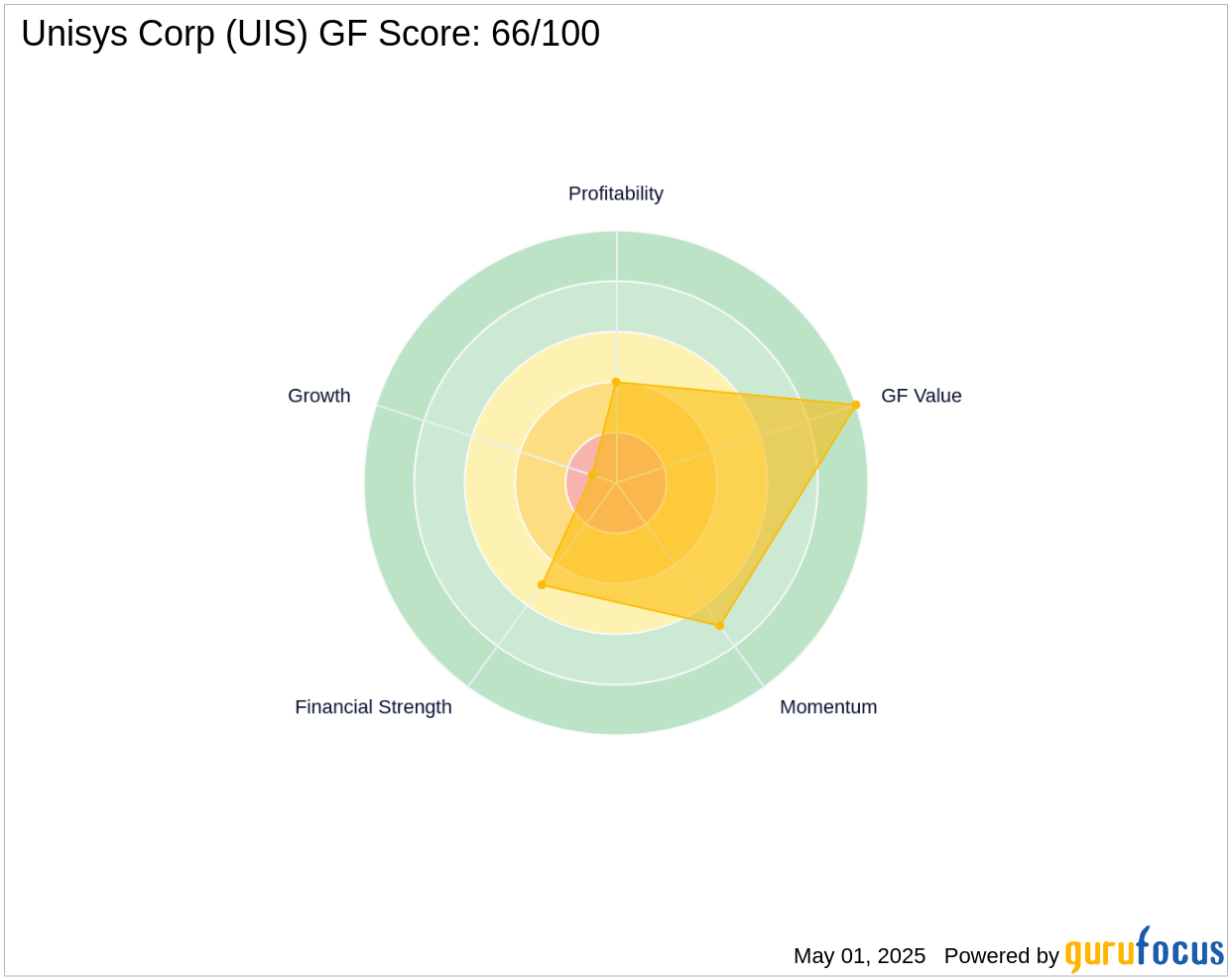

As of May 1, 2025, Unisys Corp has a market capitalization of $282.14 million, with a stock price of $3.97. The stock is considered modestly undervalued, with a GF Value of $5.34 and a Price to GF Value ratio of 0.74. This suggests a potential upside for investors seeking value opportunities. However, the company's financial metrics, such as a Financial Strength rank of 5/10 and a Profitability Rank of 4/10, indicate areas of concern that investors should consider.

Recent Performance Metrics of Unisys Corp

Unisys Corp's stock has experienced a year-to-date decline of 38.64%, reflecting challenges in the current market environment. The stock's GF Score of 66/100 suggests poor future performance potential. Additionally, the company's Growth Rank of 1/10 and Altman Z score of -0.30 highlight financial vulnerabilities that may impact its long-term prospects.

Implications of BlackRock's Transaction

BlackRock's decision to reduce its stake in Unisys Corp may have several implications. The reduction could be a strategic move to reallocate resources towards more promising opportunities within its portfolio. Given Unisys Corp's recent performance metrics and financial challenges, BlackRock might be seeking to optimize its investment returns by adjusting its holdings. This transaction could also signal BlackRock's cautious outlook on Unisys Corp's future performance.

Conclusion

In summary, BlackRock's recent reduction in Unisys Corp shares reflects a strategic portfolio adjustment amid challenging market conditions. While Unisys Corp presents a modestly undervalued opportunity, its financial metrics and recent performance suggest potential risks. Investors should consider these factors when evaluating the company's future outlook. As market dynamics continue to evolve, the implications of BlackRock's transaction will be closely monitored by market participants and value investors alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.