Transaction Overview

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction involving Unitil Corp (UTL, Financial), reducing its holdings by 254,323 shares. The shares were traded at a price of $57.69, resulting in a total holding of 2,782,361 shares in Unitil. This transaction reflects a strategic decision by BlackRock, which holds a 17.10% position in Unitil's stock. The reduction in shares may indicate a shift in BlackRock's investment strategy or a response to market conditions affecting Unitil.

Profile of BlackRock, Inc. (Trades, Portfolio)

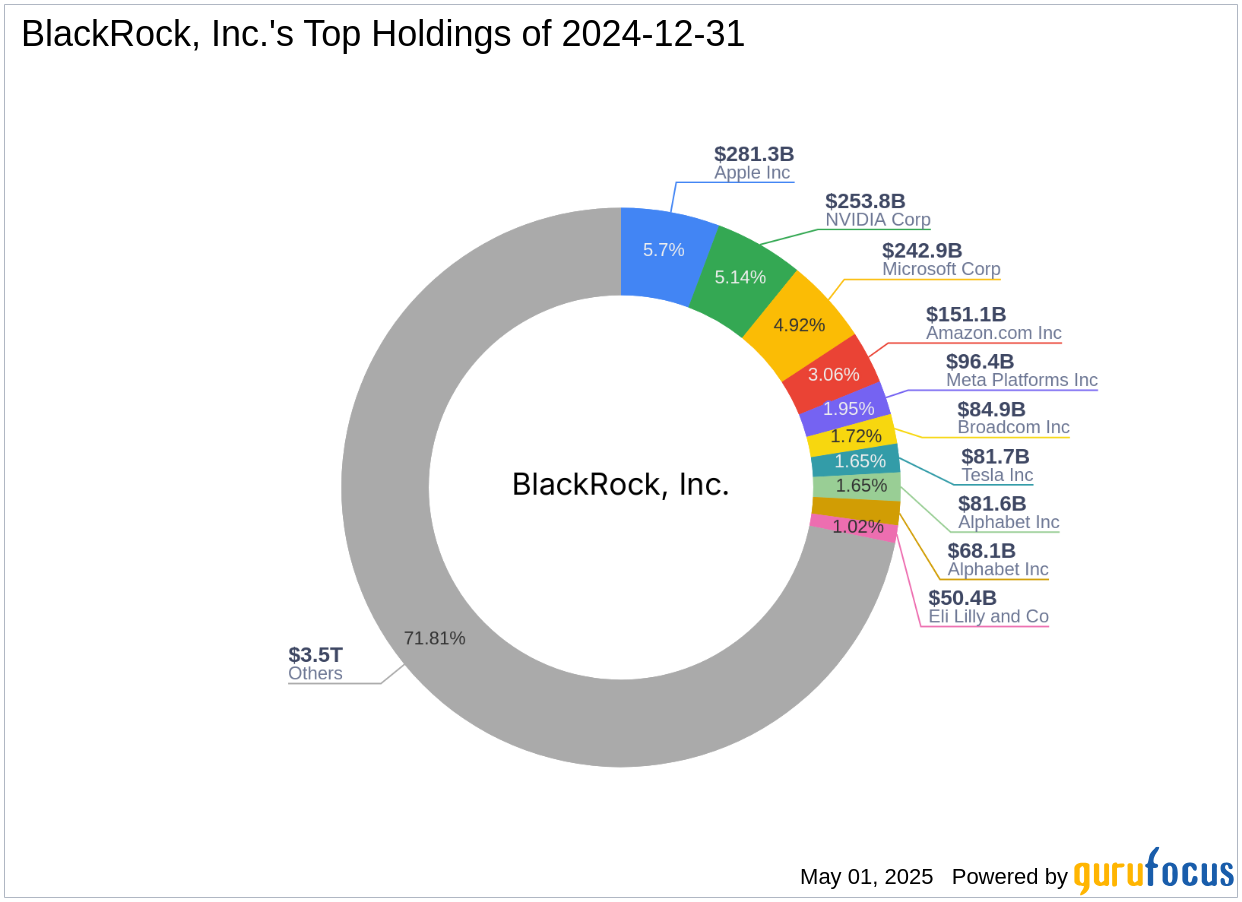

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a leading global investment firm known for its extensive portfolio and strategic investment philosophy. With equity holdings amounting to $4,939.25 trillion, BlackRock is a dominant player in the financial sector. The firm's investment approach focuses on long-term value creation, with significant stakes in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and others. BlackRock's portfolio is heavily weighted towards the technology and financial services sectors, reflecting its confidence in these industries' growth potential.

BlackRock's Portfolio and Investment Strategy

BlackRock's investment strategy is characterized by a focus on high-growth sectors, particularly technology and financial services. The firm's top holdings include industry giants like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). This strategic allocation underscores BlackRock's commitment to investing in companies with robust growth prospects and strong market positions. By concentrating on these sectors, BlackRock aims to capitalize on technological advancements and financial innovations that drive long-term value.

Overview of Unitil Corp

Unitil Corp is a utility company based in the USA, primarily engaged in the distribution of electricity and natural gas. Operating in New Hampshire, Massachusetts, and Maine, Unitil serves a diverse customer base through its Electric and Gas segments. The company has a market capitalization of $952.998 million, reflecting its stable position in the regulated utilities industry. Unitil's business model focuses on providing reliable energy services, with the majority of its revenue generated from its Electric segment.

Financial Analysis of Unitil Corp

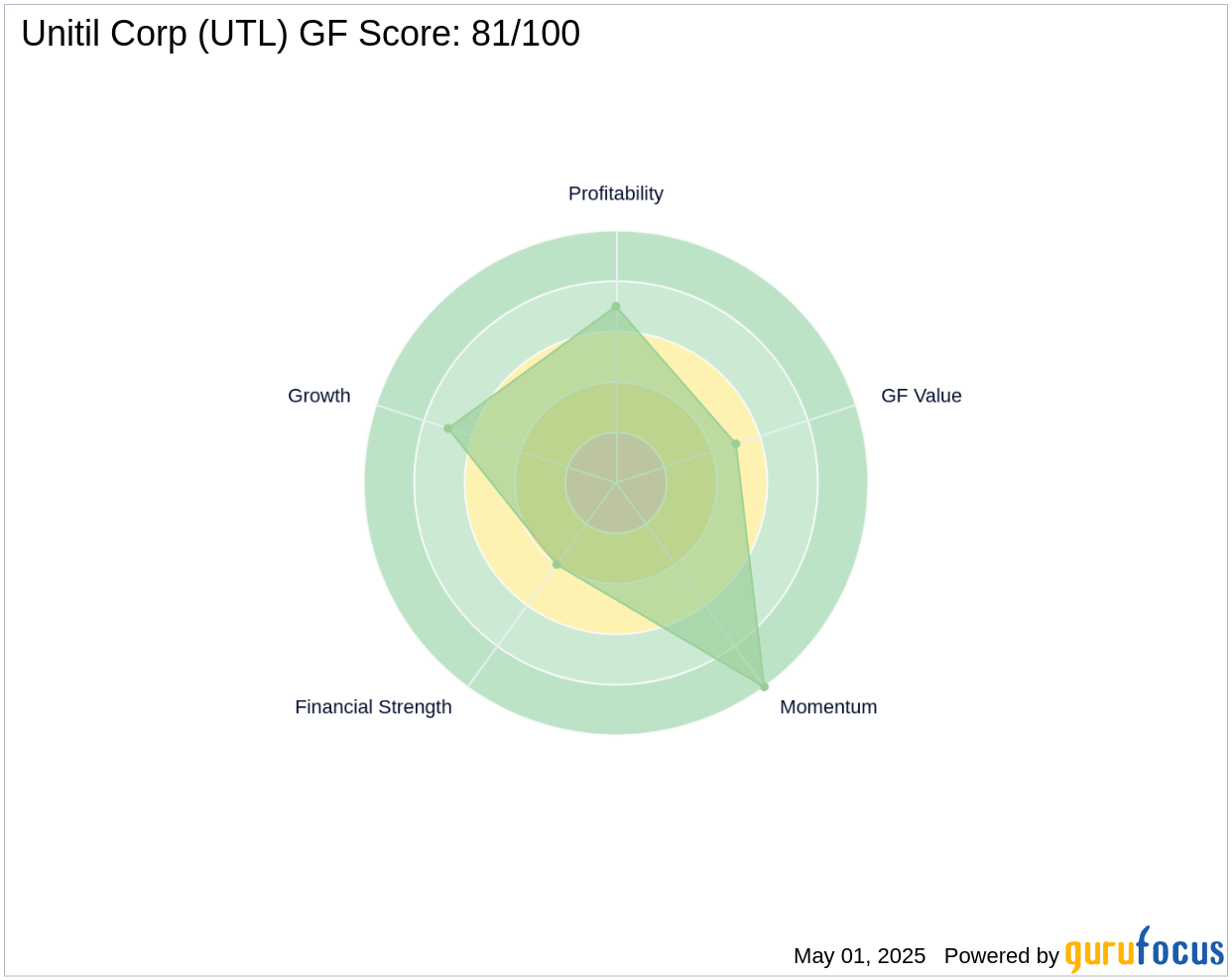

Unitil Corp's current stock price stands at $58.66, slightly above its trade price, indicating a modest overvaluation according to the GF-Score. The company has a price-to-earnings (PE) ratio of 20.06 and a GF Score of 81/100, suggesting good outperformance potential. Despite its modest overvaluation, Unitil's financial metrics, including a Profitability Rank of 7/10 and a Growth Rank of 7/10, indicate a stable financial position. However, its Altman Z score of 1.01 and interest coverage of 2.40 highlight potential financial vulnerabilities.

Implications of the Transaction

The reduction in Unitil shares by BlackRock may have several implications for both the firm and Unitil. For BlackRock, this transaction could be part of a broader strategy to rebalance its portfolio or to capitalize on other investment opportunities. For Unitil, the reduction might reflect BlackRock's assessment of the company's current valuation and market conditions. Despite the reduction, BlackRock's substantial remaining stake indicates continued confidence in Unitil's long-term prospects.

Market Context and Future Outlook

Unitil's stock has experienced a year-to-date price change of 9.26%, reflecting positive market sentiment. The company's future outlook is supported by its stable growth and profitability ranks, each at 7/10. As a regulated utility, Unitil benefits from predictable revenue streams, although its modest overvaluation suggests limited upside potential in the short term. Investors will likely monitor Unitil's ability to maintain its growth trajectory and financial stability in the face of evolving market dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.