BlackRock's Strategic Move in Trip.com

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a notable transaction by acquiring an additional 30,280,781 shares of Trip.com Group Ltd. This acquisition increased BlackRock's total holdings in Trip.com to 31,801,092 shares. The transaction was carried out at a price of $63.58 per share, marking a strategic move by the firm to bolster its position in the online travel sector. This acquisition reflects a 0.04% impact on BlackRock's extensive portfolio, with Trip.com now constituting 4.70% of the firm's holdings.

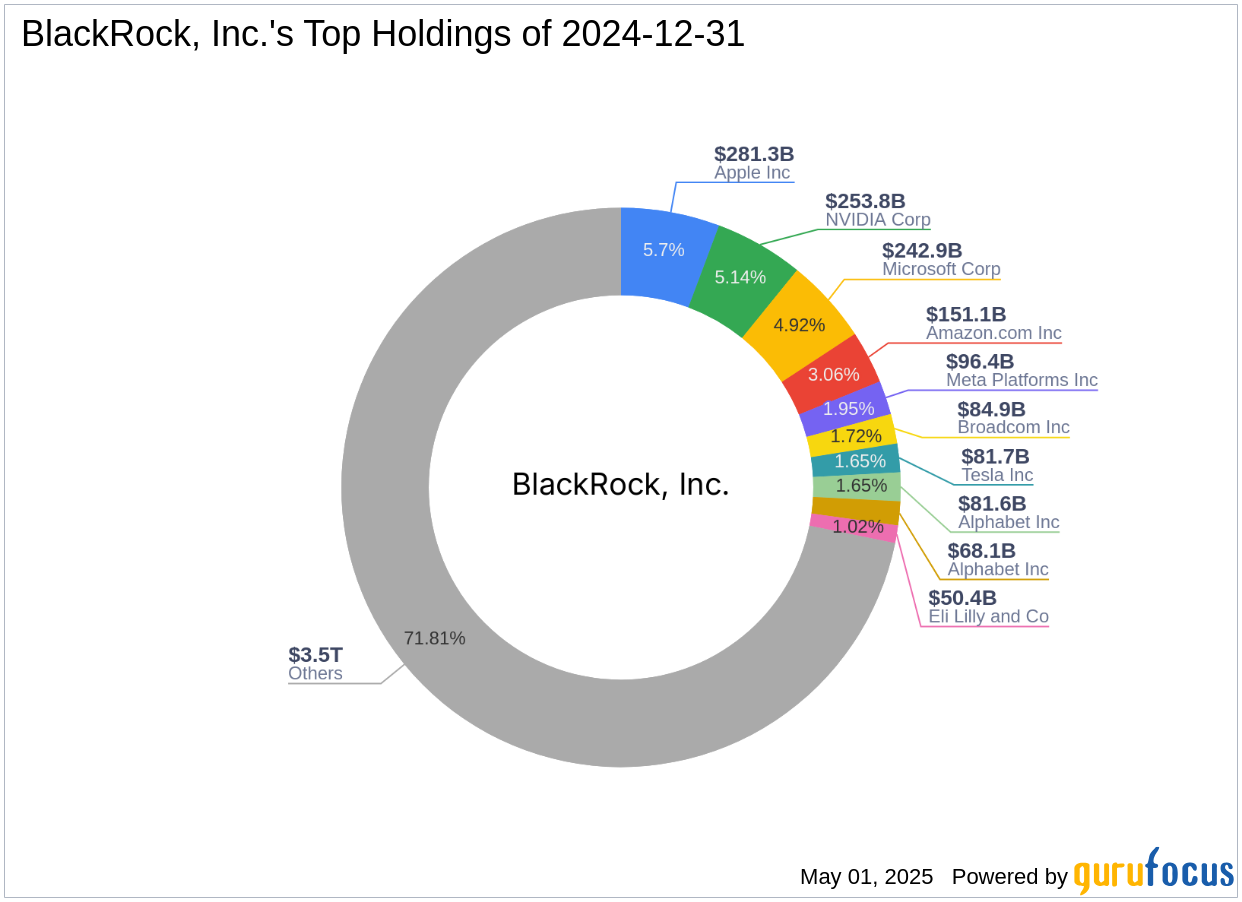

Overview of BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, is a leading investment firm renowned for its diverse portfolio and strategic investments in top sectors such as Technology and Financial Services. The firm holds significant positions in major companies like Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), and Microsoft Corp. (MSFT, Financial). With an equity value of $4,939.25 trillion, BlackRock's investment philosophy focuses on long-term growth and value creation. The firm's top sector investments highlight its commitment to leveraging technological advancements and financial innovations.

Details of the Trip.com Group Ltd Transaction

The recent transaction involving Trip.com Group Ltd was executed at a price of $63.58 per share. This strategic acquisition by BlackRock has resulted in Trip.com holding a 4.70% position in the firm's portfolio. Despite a recent decline in Trip.com's stock price by 7.16% since the transaction, BlackRock's decision to increase its stake indicates confidence in the company's long-term potential and market position.

Trip.com Group Ltd: Company Profile

Founded in 1999, Trip.com is a leading online travel agent in China, listed on Nasdaq since December 2003. The company operates across various segments, including accommodation reservation and transportation ticketing, with a market capitalization of $38.58 billion. Trip.com is strategically positioned to benefit from China's growing demand for outbound travel, with a significant portion of its revenue generated from accommodation and ticketing services. The company's international business, which accounted for 25% of revenue before the pandemic, remains crucial for margin expansion.

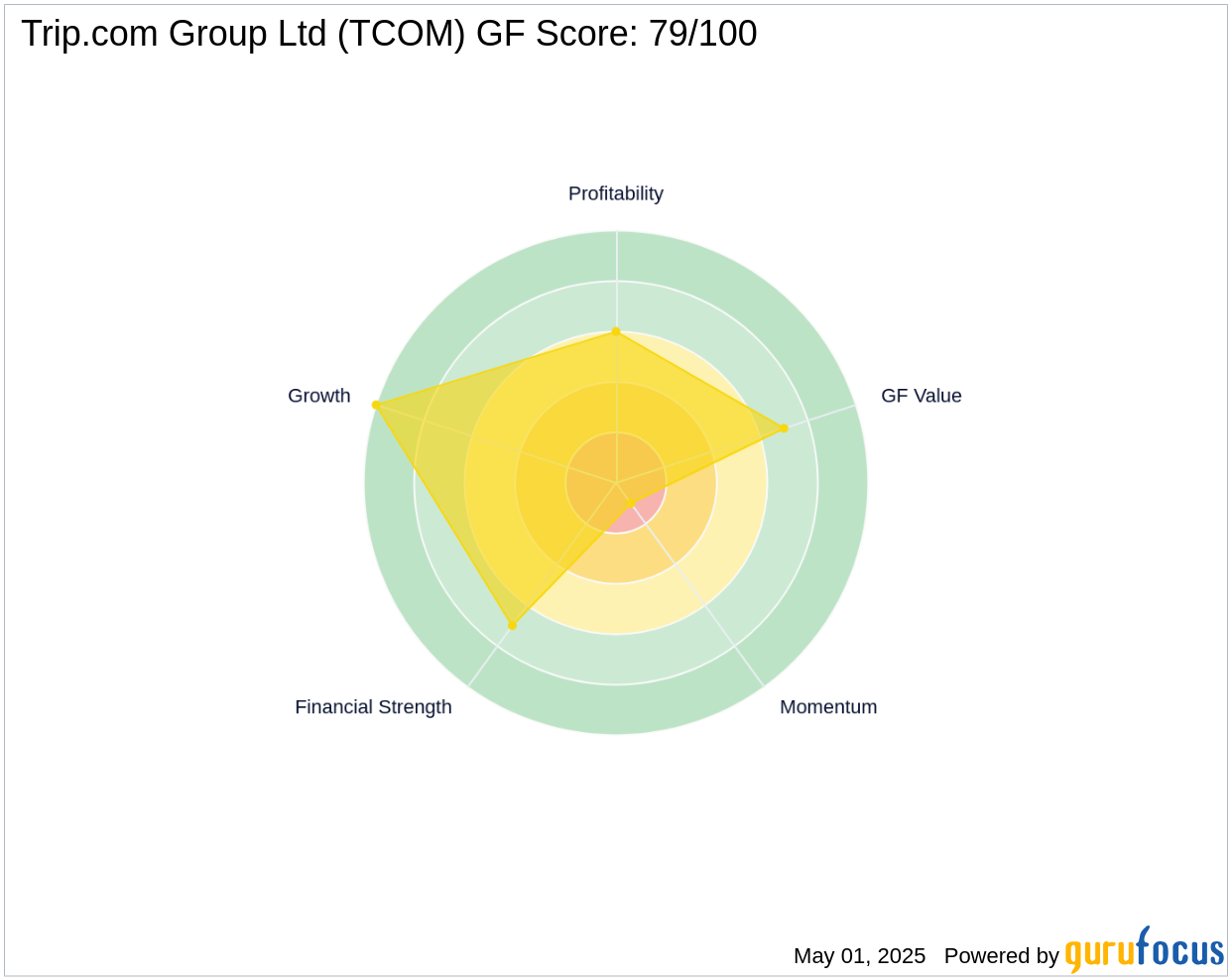

Financial Performance and Valuation of Trip.com

Trip.com is currently considered fairly valued with a GF Value of $61.41 and a price-to-GF Value ratio of 0.96. The company has demonstrated robust growth metrics, with a 3-year revenue growth of 28.90% and an EBITDA growth of 85.40%. Despite recent stock price fluctuations, Trip.com maintains a strong Growth Rank of 10/10, indicating its potential for sustained expansion in the competitive online travel industry.

Market Position and Competitive Landscape

Trip.com operates in a competitive Chinese OTA industry, facing competition from players like Meituan and Alibaba-backed Fliggy. Despite a recent stock price decline of 7.16% since the transaction, Trip.com maintains a solid growth rank of 10/10. The company's strategic focus on international expansion and technological innovation positions it well to capture market share and drive future growth.

Other Notable Investors in Trip.com

In addition to BlackRock, other significant investors in Trip.com include Ken Fisher (Trades, Portfolio) and Dodge & Cox. Davis Selected Advisers holds the largest share percentage among the gurus invested in Trip.com, highlighting the company's appeal to prominent investment firms. These investments underscore the confidence in Trip.com's growth prospects and market potential.

Transaction Analysis

The acquisition of additional shares in Trip.com by BlackRock signifies a strategic move to enhance its portfolio's exposure to the growing online travel sector. Despite the recent decline in Trip.com's stock price, the firm's decision to increase its stake reflects confidence in the company's long-term growth trajectory and market position. As Trip.com continues to expand its international presence and leverage technological advancements, it remains a key player in the competitive OTA industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: