Empery Asset Management, LP (Trades, Portfolio), a prominent investment firm, recently made a significant adjustment to its holdings in Knightscope Inc. On March 31, 2025, the firm reduced its position in the security technology company by 351,477 shares, marking a substantial decrease of 84.02%. This transaction reflects a strategic decision by the firm, which now holds 66,826 shares of Knightscope Inc. The shares were traded at a price of $2.82 each, and the stock now constitutes 1.02% of Empery Asset Management's portfolio.

About Empery Asset Management, LP (Trades, Portfolio)

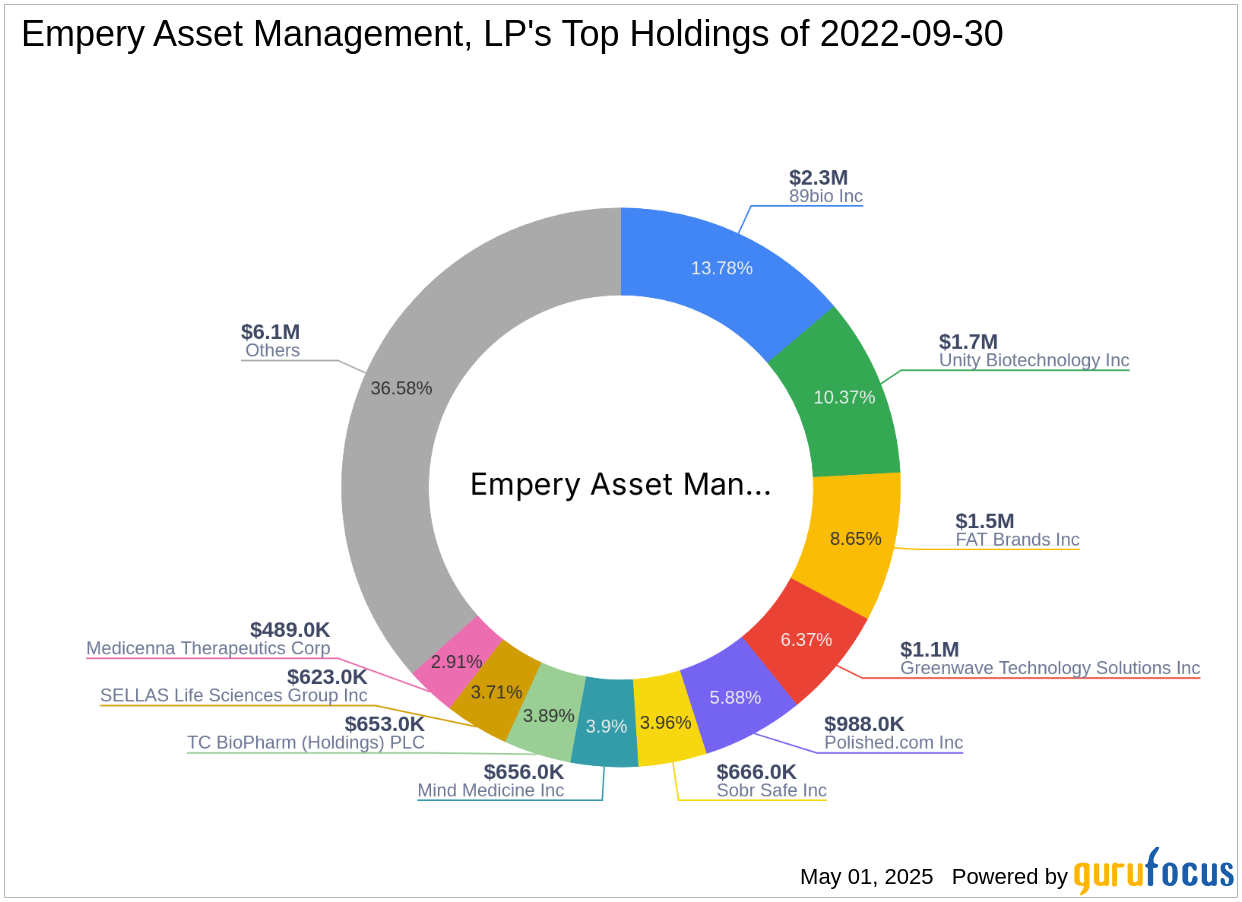

Empery Asset Management, LP (Trades, Portfolio) is headquartered at 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. The firm is recognized for its diversified investment approach, managing a portfolio of 88 stocks with a strong focus on the healthcare and consumer cyclical sectors. Empery Asset Management's top holdings include Unity Biotechnology Inc (FRA:9U90, Financial), Greenwave Technology Solutions Inc (GWAV, Financial), 89bio Inc (ETNB, Financial), FAT Brands Inc (FATBW, Financial), and Polished.com Inc (POLWQ, Financial). The firm's investment philosophy emphasizes strategic diversification and sector-specific expertise.

Knightscope Inc: A Security Technology Innovator

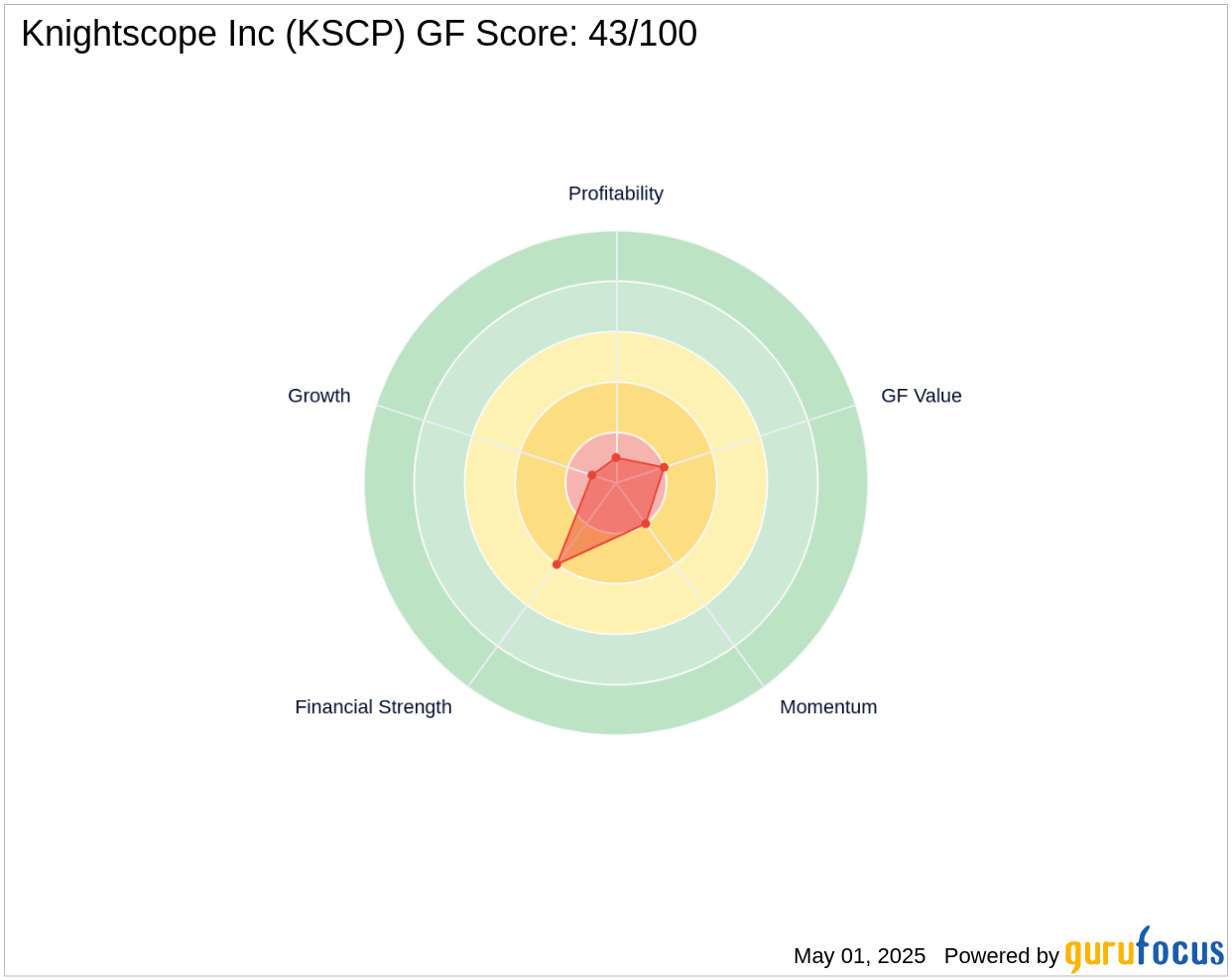

Knightscope Inc, trading under the symbol KSCP, is a Silicon Valley-based company specializing in security technology. The company designs and manufactures Autonomous Security Robots (ASRs) and Emergency Communication Devices (ECDs), providing innovative solutions for real-time on-site data collection and analysis. Knightscope's market capitalization stands at $34.437 million, reflecting its niche position in the business services industry. Despite its innovative offerings, the company faces challenges in financial performance, as indicated by its GF Score of 43/100, suggesting poor future performance potential.

Financial Insights and Market Performance

Knightscope Inc's financial metrics reveal a complex picture. The company has a GF Value of $13.66, with a Price to GF Value ratio of 0.37, indicating a possible value trap. The company's balance sheet ranks 4/10, while its profitability is notably low at 1/10. Since the transaction, Knightscope's stock price has surged by 76.95%, currently trading at $4.99. However, the stock has experienced a dramatic decline of 99.31% since its IPO on January 27, 2022, highlighting the volatility and risks associated with the investment.

Implications of the Transaction

The decision by Empery Asset Management, LP (Trades, Portfolio) to significantly reduce its stake in Knightscope Inc may suggest a strategic reassessment of the company's potential. This move could be driven by Knightscope's financial challenges and market performance, as reflected in its Altman Z score of -10.94 and Piotroski F-Score of 2. Value investors should carefully evaluate Knightscope's financial health and market position before making investment decisions. The firm's reduction in holdings could indicate a cautious approach, considering the company's current financial metrics and the broader market environment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.