Summary:

- Advanced Energy Industries, Inc. (AEIS, Financial) reports notable revenue growth in Q1 2025 driven by strong market demand.

- Wall Street analysts forecast potential upside, with price targets pointing towards a promising future for AEIS investors.

- GuruFocus estimates suggest a slight downside relative to AEIS's current trading value, highlighting cautious valuation.

Advanced Energy Industries, Inc. (AEIS) has announced an impressive 24% year-over-year increase in its Q1 2025 revenue, amounting to $405 million. This growth is primarily attributed to robust performance in the data center computing and semiconductor sectors. Looking ahead, the company anticipates Q2 revenue to reach approximately $420 million, accompanied by a non-GAAP EPS of $1.30, underlining the ongoing strong demand and effectiveness of its strategic investments.

Wall Street Analysts' Forecast

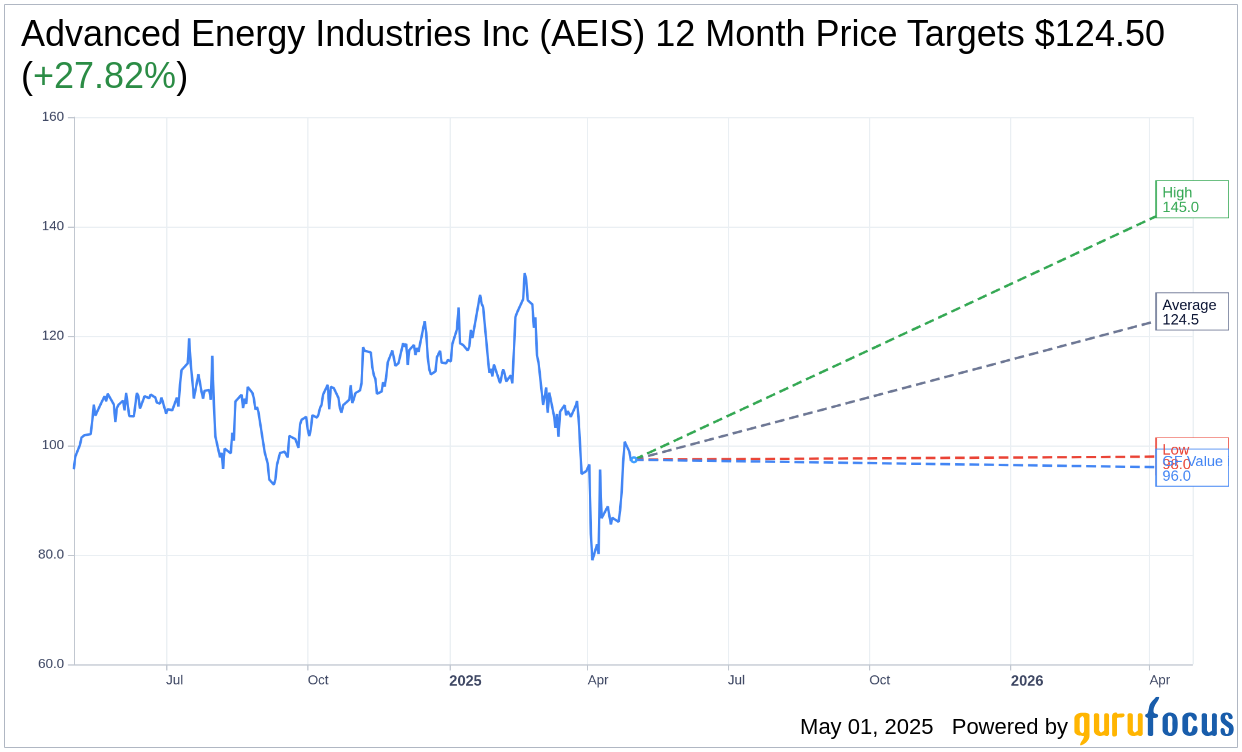

According to insights from 10 analysts, the one-year price target average for Advanced Energy Industries, Inc. (AEIS, Financial) stands at $124.50. Price estimates range from a high of $145.00 to a low of $98.00, with the average target suggesting a potential upside of 27.82% from the current price of $97.40. For deeper insights, visit the Advanced Energy Industries Inc (AEIS) Forecast page.

The consensus from 12 brokerage firms positions Advanced Energy Industries, Inc.'s (AEIS, Financial) average recommendation at 2.0, signifying an "Outperform" rating. This recommendation is assessed on a scale from 1 to 5, where 1 reflects a Strong Buy and 5 indicates a Sell.

Valuation Insights from GuruFocus

Using GuruFocus estimates, the projected GF Value for Advanced Energy Industries, Inc. (AEIS, Financial) in a year's time is $95.95. This suggests a potential downside of 1.49% from the current trading price of $97.40. The GF Value is derived from historical trading multiples, past business growth, and future business performance estimates. For more comprehensive data, refer to the Advanced Energy Industries Inc (AEIS) Summary page.

This analysis underscores the potential in AEIS, with Wall Street viewing it favorably despite the GuruFocus fair value highlighting caution. Investors should consider these mixed signals when making informed decisions about AEIS's investment opportunities.