BlackRock, Inc. (Trades, Portfolio)'s Recent Acquisition

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) made a significant move by acquiring an additional 21,515 shares of Palladyne AI Corp at a price of $5.88 per share. This transaction increased BlackRock's total holdings in Palladyne AI Corp to 471,128 shares. The acquisition reflects BlackRock's ongoing interest in expanding its portfolio within the technology sector, particularly in companies that are at the forefront of artificial intelligence and machine learning innovations.

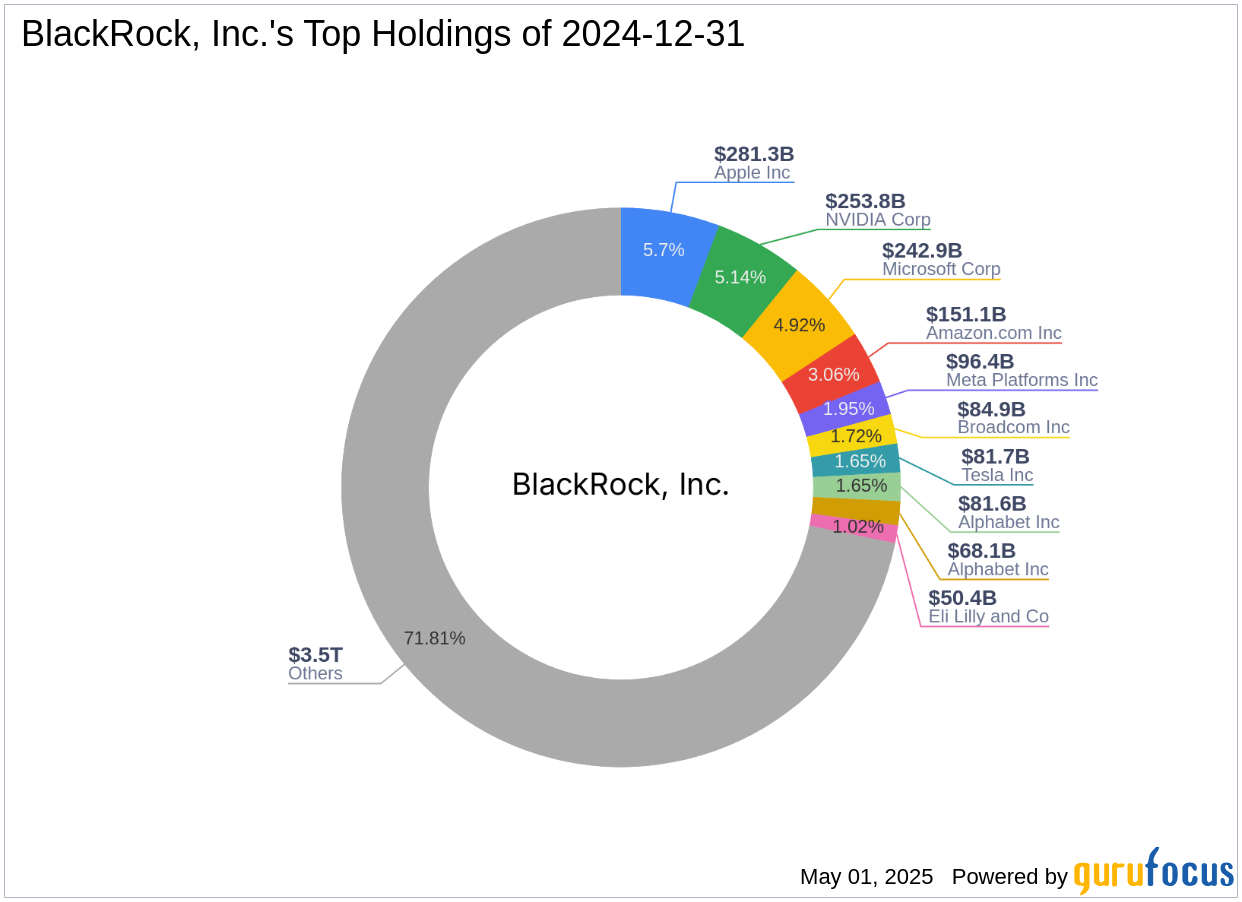

About BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, NY, is a leading global investment firm known for its extensive portfolio and strategic investments. The firm is renowned for its investment philosophy that emphasizes diversification and long-term growth, with significant equity holdings in the technology and financial services sectors. Some of BlackRock's top holdings include major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With an equity value of $4,939.25 trillion, BlackRock continues to be a dominant force in the investment landscape.

Introducing Palladyne AI Corp

Palladyne AI Corp is a software company based in the USA, specializing in artificial intelligence and machine learning solutions for robotic systems. The company's innovative software enables robots to observe, learn, reason, and act autonomously in both structured and unstructured environments. Palladyne AI's technology has diverse applications across industries such as automotive, aviation, construction, defense, and logistics, making it a pivotal player in the AI sector.

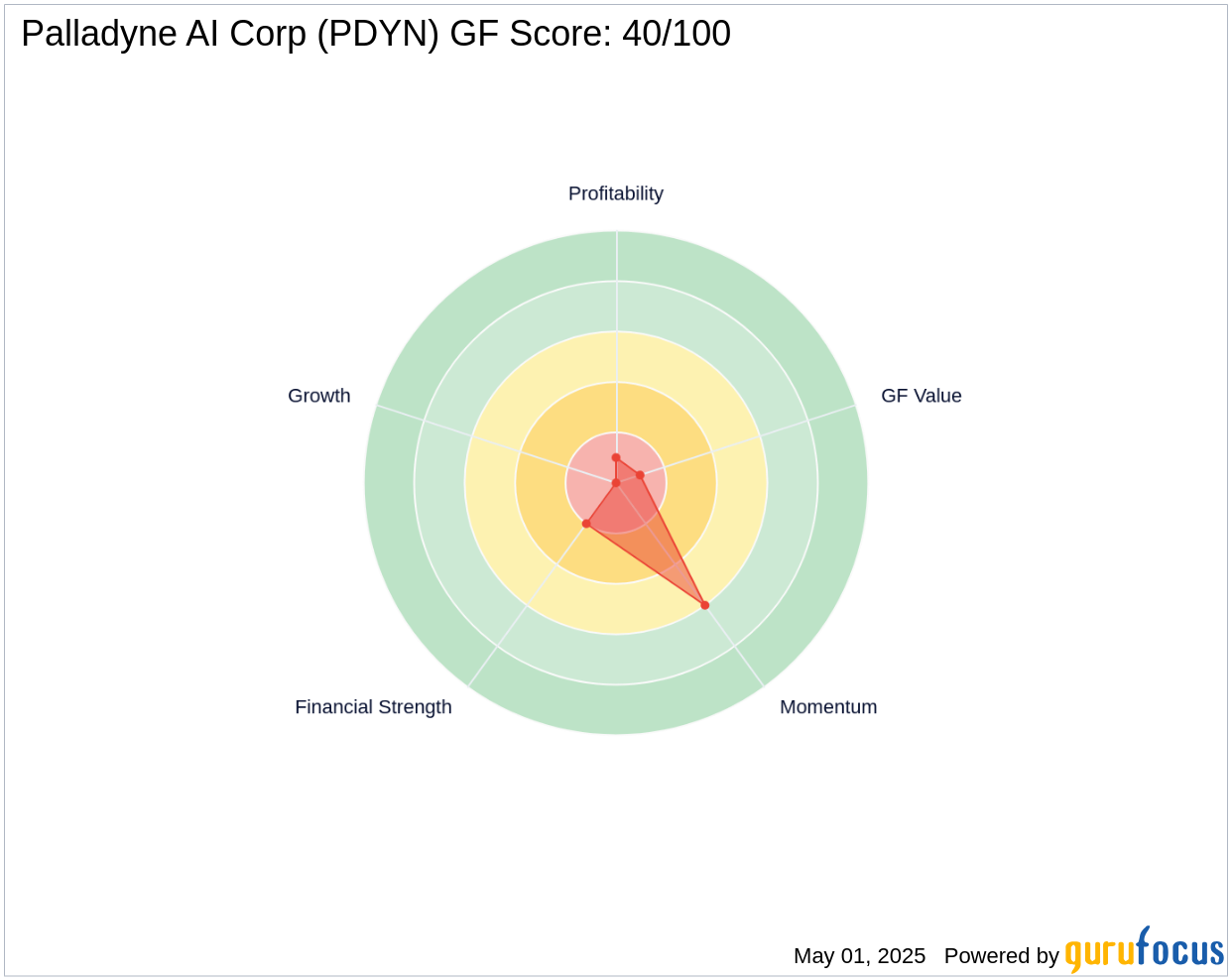

Financial Metrics and Valuation

As of May 1, 2025, Palladyne AI Corp has a market capitalization of $217.138 million, with a current stock price of $6.08. Despite its innovative offerings, the stock is considered significantly overvalued, with a GF Value Rank of 1/10 and a GF Value of 1.94. The stock's price to GF Value ratio stands at 3.13, indicating a premium over its intrinsic value. The company's financial performance is challenged by negative returns on equity (ROE) and assets (ROA), with a Profitability Rank of 1/10.

Performance and Growth Indicators

Palladyne AI Corp's financial performance reveals a mixed picture. The company has experienced revenue growth of 2.7% over the past three years, with an EBITDA growth of 38.7% and earnings growth of 19.7%. However, its Growth Rank is 0/10, reflecting low profitability and growth potential. The company's GF-Score is 40/100, indicating a poor future performance potential.

Implications of BlackRock's Investment

BlackRock's increased stake in Palladyne AI Corp suggests a strategic interest in the AI sector, despite the company's current valuation and performance challenges. This investment could be driven by the potential for long-term growth and innovation in AI technology. BlackRock's decision to invest in Palladyne AI may also reflect confidence in the company's ability to leverage its technology across various industries, potentially leading to improved financial performance in the future.

Conclusion

In summary, BlackRock, Inc. (Trades, Portfolio)'s acquisition of additional shares in Palladyne AI Corp highlights the firm's commitment to investing in cutting-edge technology companies. While Palladyne AI faces challenges in terms of valuation and profitability, the investment by a major firm like BlackRock underscores the potential for future growth and innovation. As the AI sector continues to evolve, Palladyne AI's strategic position could lead to significant advancements and opportunities in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.