Quick Summary:

- First Foundation Inc. (FFWM, Financial) reports a successful return to profitability in Q1 2025.

- Net interest margin improved, with financial projections indicating further enhancements by Q4 2025.

- Analyst price targets suggest significant upside, though potential risks remain based on GF Value estimates.

First Foundation Inc. (FFWM) has demonstrated a marked return to profitability in the first quarter of 2025. The company announced a net income of $6.9 million or $0.08 per share, a significant turnaround from the previous quarter's losses. This positive shift is largely attributed to strategic improvements, including a 9 basis point enhancement in the net interest margin, now at 1.67%, alongside a $5 million reduction in non-interest expenses.

With a focus on sustainable growth, First Foundation funded $180 million in new commercial and industrial loans. Additionally, the company aims to streamline its operations by eliminating multifamily loans held for sale by the end of the year. CFO Jamie Britton forecasts the net interest margin to further increase to between 1.8% and 1.9% by Q4 2025, signaling continued financial health.

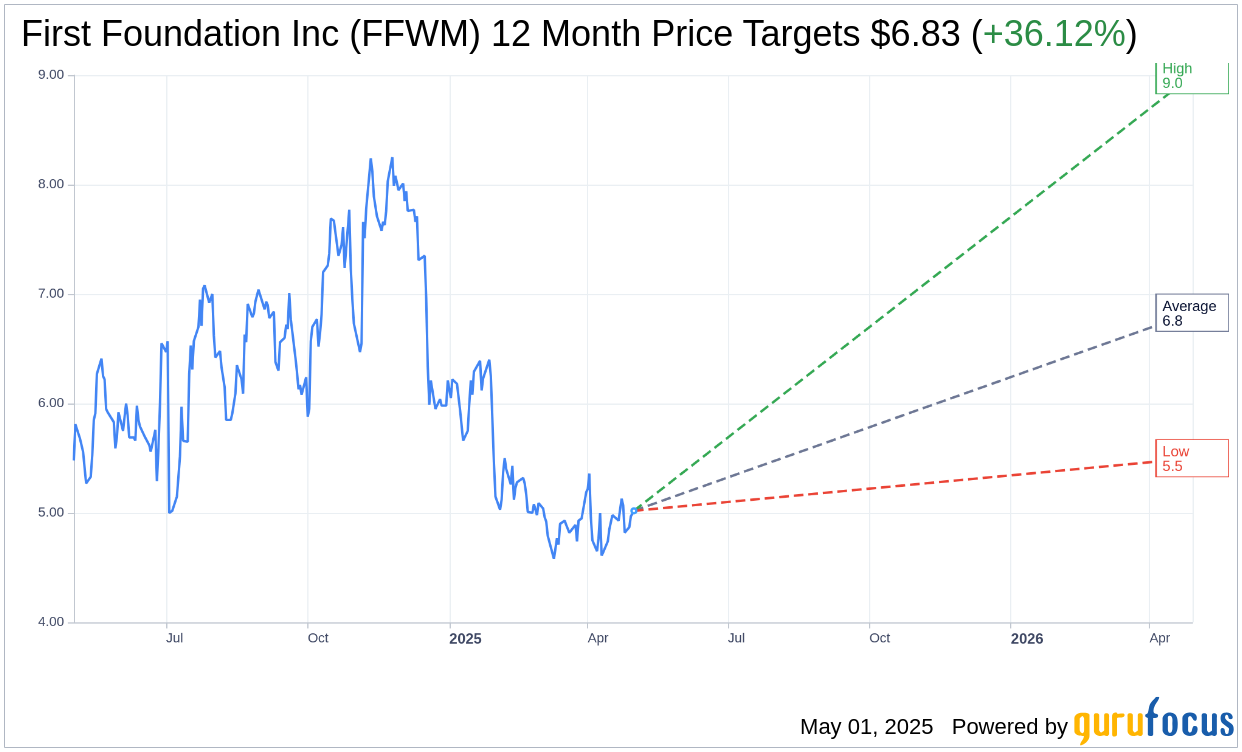

Wall Street Analysts Forecast

Analysts have provided their one-year price target forecasts for First Foundation Inc. (FFWM, Financial), with an average target price of $6.83. This suggests a compelling upside potential of 36.12% from the current share price of $5.02. The target prices range from a high of $9.00 to a low of $5.50, reflecting a variety of expectations. Investors can explore more detailed projections on the First Foundation Inc (FFWM) Forecast page.

Furthermore, the average recommendation from 4 brokerage firms sits at 2.8, indicating a "Hold" status for FFWM. The recommendation scale interprets 1 as a Strong Buy and 5 as Sell, positioning First Foundation in a middle-ground investment status among analysts.

Looking through the lens of GuruFocus estimates, the GF Value for First Foundation Inc. (FFWM, Financial) is projected at $1.69 in one year. This calculation suggests a potential downside of 66.33% from the current price of $5.02. The GF Value is a metric provided by GuruFocus to represent the fair trading value of a stock, determined by historical trading multiples, past business growth, and future performance estimates. For more insights, visit the First Foundation Inc (FFWM) Summary page.