- Seaport Global initiates coverage on AMD with a Buy rating and a $110 target.

- Wall Street analysts forecast a potential average price increase to $135.46 for AMD.

- GuruFocus estimates an impressive 65.63% upside for AMD over the next year.

Seaport Global has initiated coverage on Advanced Micro Devices (AMD, Financial) with a promising Buy rating and a target price of $110. This coverage underscores AMD’s robust potential to bolster its market share and intensify competition with industry giants such as Intel (INTC) and Nvidia (NVDA). Although AMD's AI chips have gained a competitive edge, the company is encouraged to enhance its software offerings to realize its full potential. Despite recent market challenges, with the stock dipping 7.4% in the past month and 19% over the last three months, optimism remains strong about its future performance.

Wall Street Analysts Forecast

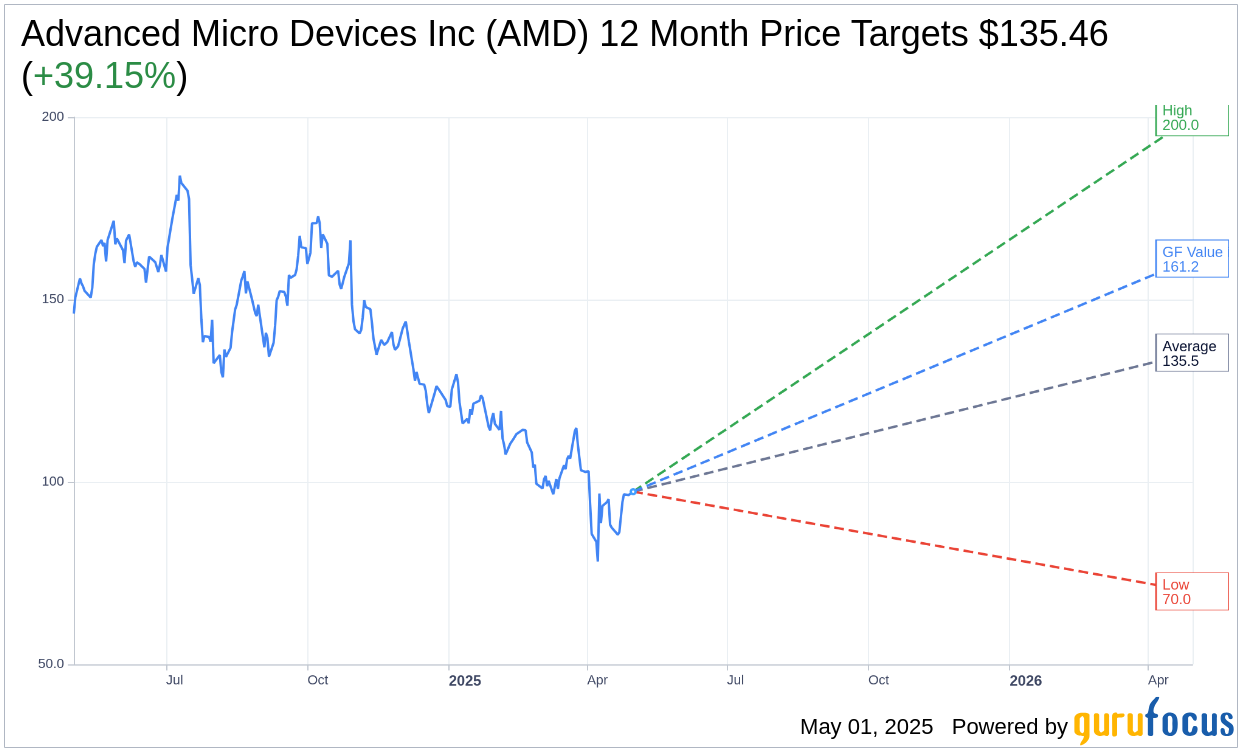

According to the one-year price projections from 41 analysts, Advanced Micro Devices Inc (AMD, Financial) is expected to reach an average target price of $135.46, with predictions ranging between a high of $200.00 and a low of $70.00. This average target price indicates a potential 39.15% upside from the current AMD stock price of $97.35. Investors seeking more in-depth estimate data are encouraged to explore the Advanced Micro Devices Inc (AMD) Forecast page.

Analyst Recommendations and Ratings

The consensus recommendation from 51 brokerage firms positions Advanced Micro Devices Inc (AMD, Financial) at an average recommendation score of 2.3, suggesting an "Outperform" status. This rating scale spans from 1 to 5, where 1 indicates a Strong Buy and 5 signals a Sell recommendation, reflecting a cautiously optimistic outlook for AMD.

GuruFocus GF Value Assessment

Utilizing GuruFocus estimates, the projected GF Value for Advanced Micro Devices Inc (AMD, Financial) in one year is an impressive $161.24. This valuation suggests a substantial 65.63% upside from the current trading price of $97.35. The GF Value represents GuruFocus' fair value assessment, based on historical trading multiples, past business growth, and future business performance estimates. Investors looking for more comprehensive insights can visit the Advanced Micro Devices Inc (AMD) Summary page.