Key Takeaways:

- Vertiv Holdings (VRT, Financial) recently formed an alliance with NVIDIA and iGenius to create a sovereign AI data center in Italy.

- Following strong Q1 2025 earnings and revised full-year sales guidance, shares surged by 20% last week, with expectations of a 36% upside.

- Wall Street analysts offer positive forecasts, with average price targets indicating significant growth potential.

Strategic Partnerships and Financial Performance Boost Vertiv Holdings

Vertiv Holdings (VRT) has made headlines with its recent partnership with NVIDIA and iGenius to develop a sovereign AI data center in Italy. This strategic move has propelled the company's shares up by 20% last week. Additionally, the company reported robust Q1 2025 earnings and updated its full-year sales guidance, suggesting a promising 36% upside. These developments underscore Vertiv's optimistic outlook for future revenue growth and its strengthened market positioning.

Wall Street Analysts' Projections

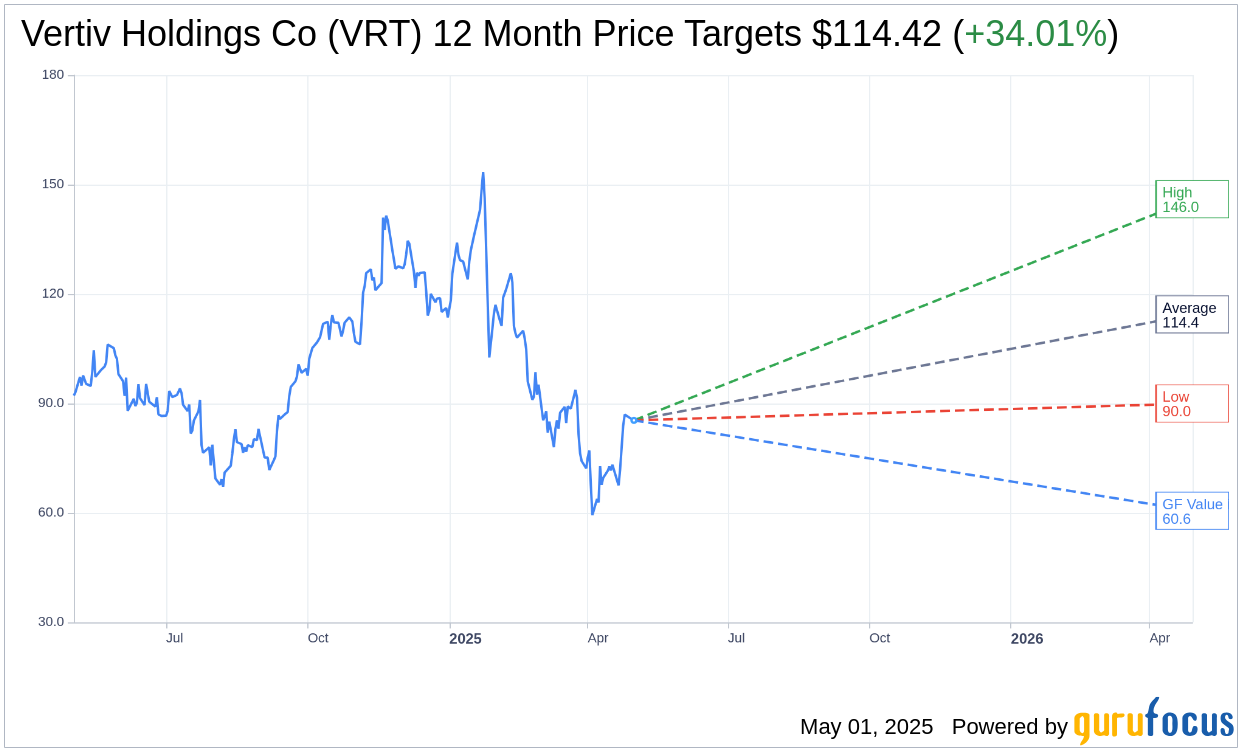

Wall Street analysts provide a positive outlook for Vertiv Holdings Co (VRT, Financial), with one-year price targets from 20 analysts averaging at $114.42. The highest estimate reaches $146.00, while the lowest is $90.00, reflecting an anticipated upside of 34.01% from the current price of $85.38. Investors can explore more in-depth estimate data on the Vertiv Holdings Co (VRT) Forecast page.

Brokerage Recommendations and GF Value

According to consensus from 24 brokerage firms, Vertiv Holdings Co (VRT, Financial) has an average recommendation of 1.9, indicating an "Outperform" status. The rating system spans from 1, indicating a Strong Buy, to 5, suggesting a Sell.

However, based on GuruFocus estimates, the GF Value for Vertiv Holdings Co (VRT, Financial) over the next year is projected at $60.60. This figure suggests a potential downside of 29.02% from the current price of $85.38. The GF Value is determined by historical trading multiples and considers past business growth alongside future performance estimates. Further comprehensive data is available on the Vertiv Holdings Co (VRT) Summary page.