Key Highlights:

- Shift4 Payments (FOUR, Financial) expands its public offering to 8.75 million shares at $100 each.

- Analysts predict a potential 38.31% price increase over the next year.

- The company's GF Value suggests a 12.71% upside from the current stock price.

Shift4 Payments (NYSE: FOUR) has recently expanded its previously announced underwritten public offering to include 8.75 million shares of Series A Mandatory Convertible Preferred Stock, each priced at $100. The proceeds from this offering are earmarked to fund the $1.74 billion debt for the acquisition of Global Blue Group.

Wall Street Analysts: Price Target Expectations

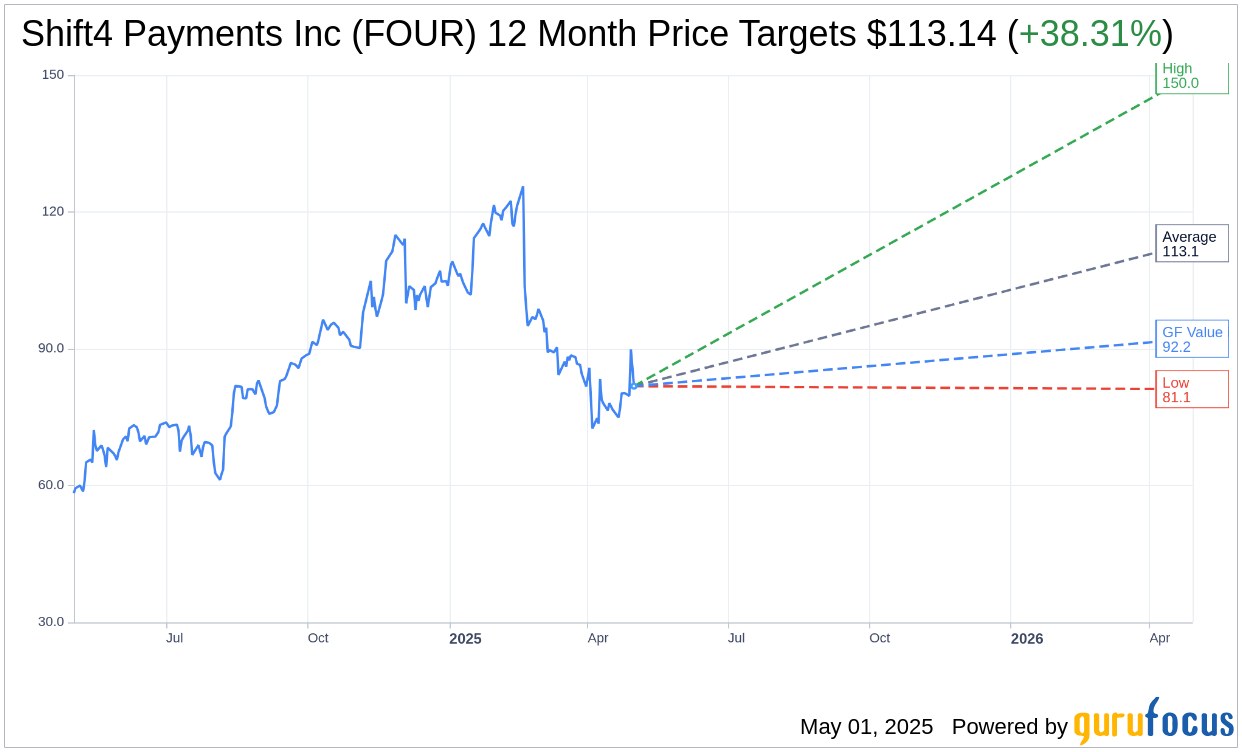

Analysts have set one-year price targets for Shift4 Payments Inc (FOUR, Financial), with an average target price of $113.14, an optimistic high of $150.00, and a conservative low of $81.14. This implies a promising potential upside of 38.31% from the current trading price of $81.80. Investors seeking more comprehensive estimates can explore the Shift4 Payments Inc (FOUR) Forecast page on GuruFocus.

Brokerage Firm Recommendations

With input from 23 brokerage firms, Shift4 Payments Inc (FOUR, Financial) receives an average recommendation rating of 2.0, aligning with the "Outperform" category. Ratings are scaled from 1 (Strong Buy) to 5 (Sell), indicating positive sentiment towards the stock's performance.

GuruFocus Valuation Insights

According to GuruFocus, the estimated GF Value for Shift4 Payments Inc (FOUR, Financial) in the coming year is projected at $92.20. This signifies an additional upside potential of 12.71% from the current price of $81.80. The GF Value reflects GuruFocus' fair value estimation, derived from historical stock multiples, past business growth, and future performance projections. For further details, visit the Shift4 Payments Inc (FOUR) Summary page on GuruFocus.