Barclays has revised its price target for Illinois Tool Works (ITW, Financial), reducing it from $240 to $237 while maintaining an Equal Weight rating on the stock. The adjustment comes as the company's earnings forecast for 2025 now includes provisions for potential tax and currency fluctuations, according to a note shared by the analyst with investors.

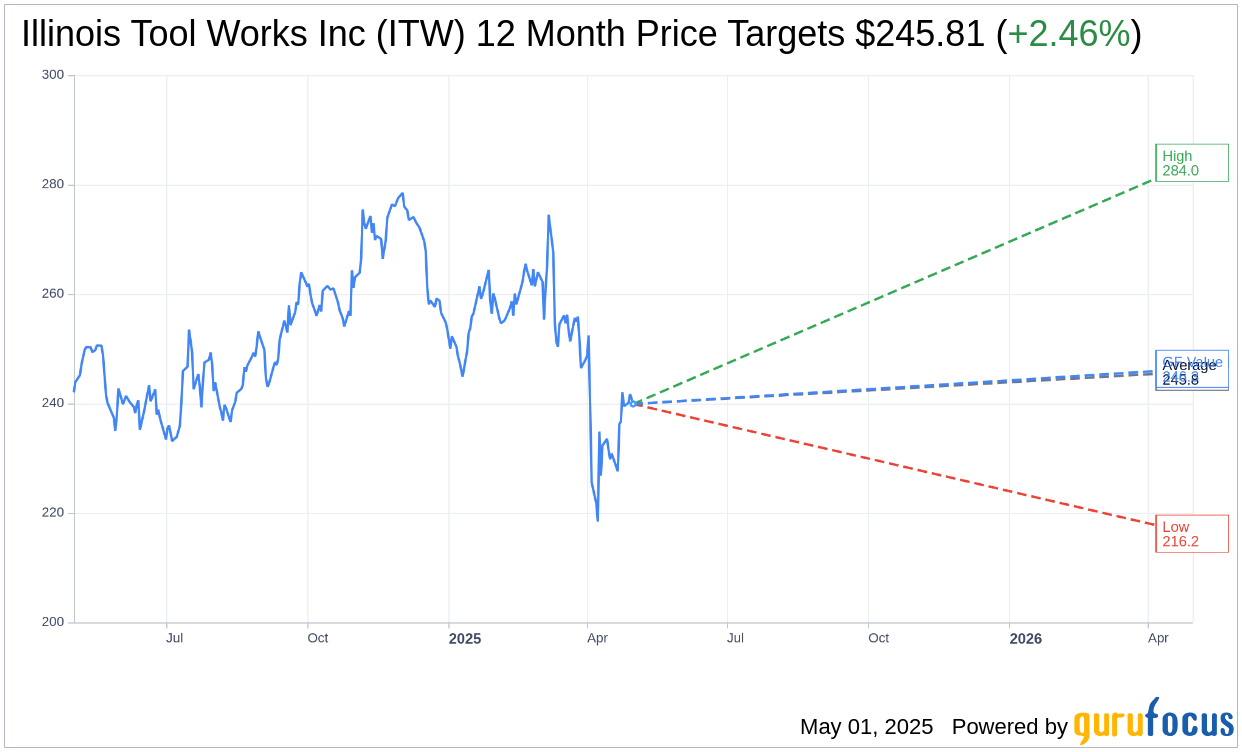

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Illinois Tool Works Inc (ITW, Financial) is $245.81 with a high estimate of $284.00 and a low estimate of $216.22. The average target implies an upside of 2.46% from the current price of $239.91. More detailed estimate data can be found on the Illinois Tool Works Inc (ITW) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Illinois Tool Works Inc's (ITW, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Illinois Tool Works Inc (ITW, Financial) in one year is $246.34, suggesting a upside of 2.68% from the current price of $239.91. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Illinois Tool Works Inc (ITW) Summary page.

ITW Key Business Developments

Release Date: April 30, 2025

- Operating Margin: 24.8%, with enterprise initiatives contributing 120 basis points.

- GAAP EPS: $2.38, ahead of planned expectations.

- Organic Growth: Down 1.6%; flat on an equal days basis.

- Total Revenue: Down 3.4%, impacted by foreign currency translation and product line simplification.

- Free Cash Flow: $496 million with a conversion rate of 71%.

- Automotive OEM Operating Margin: 19.3%, or 20.1% excluding restructuring.

- Food Equipment Organic Growth: Up 1%, or 3% on an equal days basis.

- Test and Measurement and Electronics Organic Revenue: Down 5%, with MTS business down 19%.

- Welding Organic Growth: Flat, up 2% on an equal days basis.

- Polymers and Fluids Organic Revenue: Up 2%, with operating margin improving 70 basis points to 26.5%.

- Construction Products Organic Growth: Down 7% in tough end markets.

- Specialty Products Organic Revenue: Up 1%, with operating margin improving 120 basis points to 30.9%.

- Full Year 2025 GAAP EPS Guidance: $10.15 to $10.55.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Illinois Tool Works Inc (ITW, Financial) delivered a solid start to the year with GAAP EPS of $2.38, ahead of planned expectations.

- Operating margins improved by 120 basis points due to enterprise initiatives, reaching 24.8%.

- The company is well-positioned to mitigate tariff impacts through its 'produce where we sell' strategy, which covers over 90% of its operations.

- ITW's diversified portfolio and decentralized structure allow it to outperform in uncertain environments.

- Strong performance in the Automotive OEM segment in China, with 14% growth driven by the EV market.

Negative Points

- Organic growth was down 1.6% as expected, with total revenue declining by 3.4% due to foreign currency translation and product line simplification.

- The Test and Measurement and Electronics segment saw a 5% decline in organic revenue, impacted by a 19% drop in the MTS business.

- Construction Products experienced a 7% decline in organic growth due to tough end markets and a decrease in new housing starts.

- The company faces uncertainties related to tariffs and customer demand, which could impact future performance.

- Operating margin decline year-over-year was primarily due to the nonrepeat of a 300 basis points LIFO inventory accounting benefit from the previous year.