Duolingo (DUOL, Financial) is significantly expanding its language offerings by introducing 148 new courses using generative AI technology. This ambitious move will double the platform's available courses for non-English speakers within a year, propelling the company toward a goal of attracting over one billion users.

The new additions mainly cater to beginner levels, although Duolingo plans to roll out more advanced lessons over time. According to the company's co-founder and CEO, the use of AI has greatly accelerated content creation, surpassing traditional methods in both speed and reach.

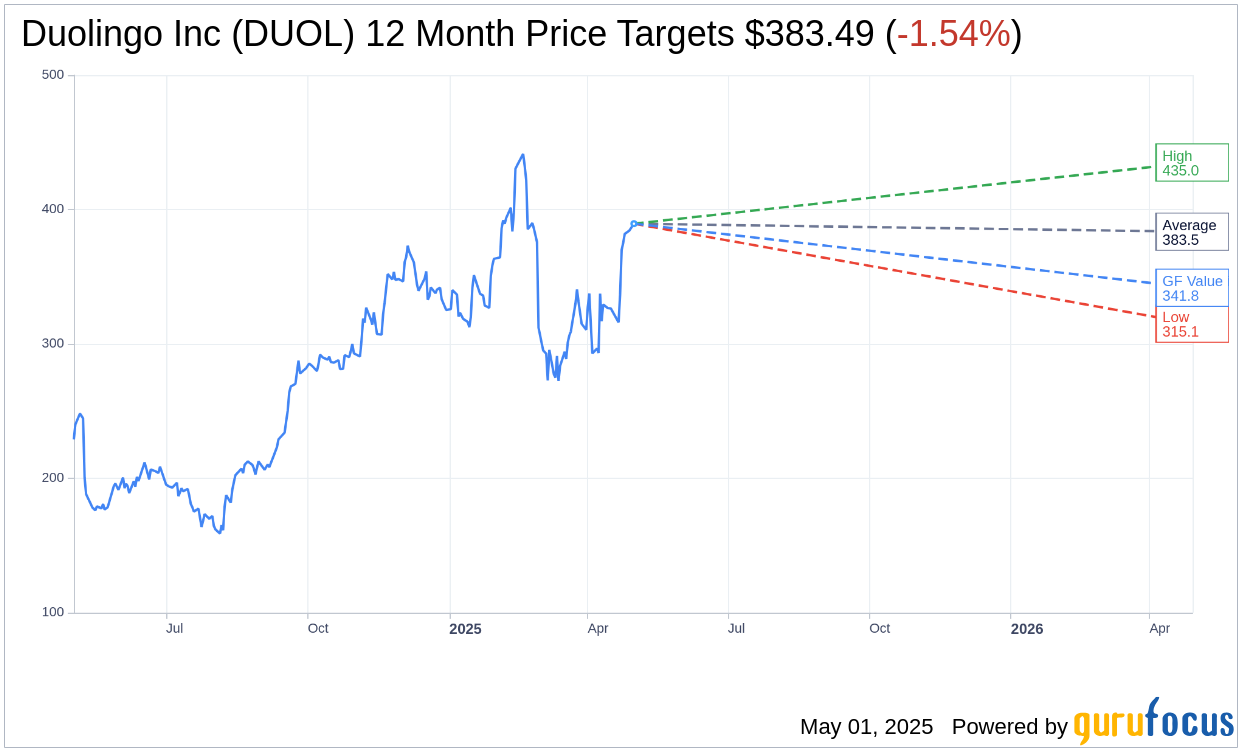

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Duolingo Inc (DUOL, Financial) is $383.49 with a high estimate of $435.00 and a low estimate of $315.12. The average target implies an downside of 1.54% from the current price of $389.48. More detailed estimate data can be found on the Duolingo Inc (DUOL) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Duolingo Inc's (DUOL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Duolingo Inc (DUOL, Financial) in one year is $341.81, suggesting a downside of 12.24% from the current price of $389.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Duolingo Inc (DUOL) Summary page.

DUOL Key Business Developments

Release Date: February 27, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Duolingo Inc (DUOL, Financial) reported a record quarter with a 51% year-over-year increase in daily active users, reaching 40 million.

- The company achieved its highest quarterly bookings, revenue, and adjusted EBITA, driven by strong Duolingo Max subscriptions and family plan momentum.

- Duolingo Max, featuring a Gen AI-powered conversation feature, has seen meaningful user engagement and represents about 5% of total subscribers.

- The family plan now accounts for 23% of total subscribers, showing higher retention and lifetime value than individual plans.

- Duolingo Inc (DUOL) plans to leverage generative AI to improve content across language, math, and music courses, aiming for faster scaling and global reach.

Negative Points

- Duolingo Inc (DUOL) anticipates a temporary 170 basis point year-over-year impact on gross margin in 2025 due to AI costs associated with Duolingo Max.

- The company expects a more moderate pace of profit growth compared to the exceptional levels of the past two years.

- AI costs are currently high, and while they are expected to decrease over time, they are not being optimized immediately.

- Duolingo Inc (DUOL) faces challenges in pricing Duolingo Max in poorer countries, such as India, where the current price is considered too high.

- Retention of resurrected users is not as strong as that of new users, indicating a need for improvement in user retention strategies.