Needham has reaffirmed its Buy rating for Everspin Technologies (MRAM, Financial), setting a price target of $8. The decision comes after a shift in coverage and reflects optimism about the company's revenue growth in its Spin-transfer Torque and Toggle products. According to analysts, Everspin's collaboration with various licensing partners is progressing through different development phases, which is expected to produce high-margin revenue streams and potential royalty or foundry opportunities in the future.

Needham identifies the satellite sector as a promising area for Everspin's technology applications. The firm anticipates that the company's recent product introductions could unlock additional growth prospects by 2026.

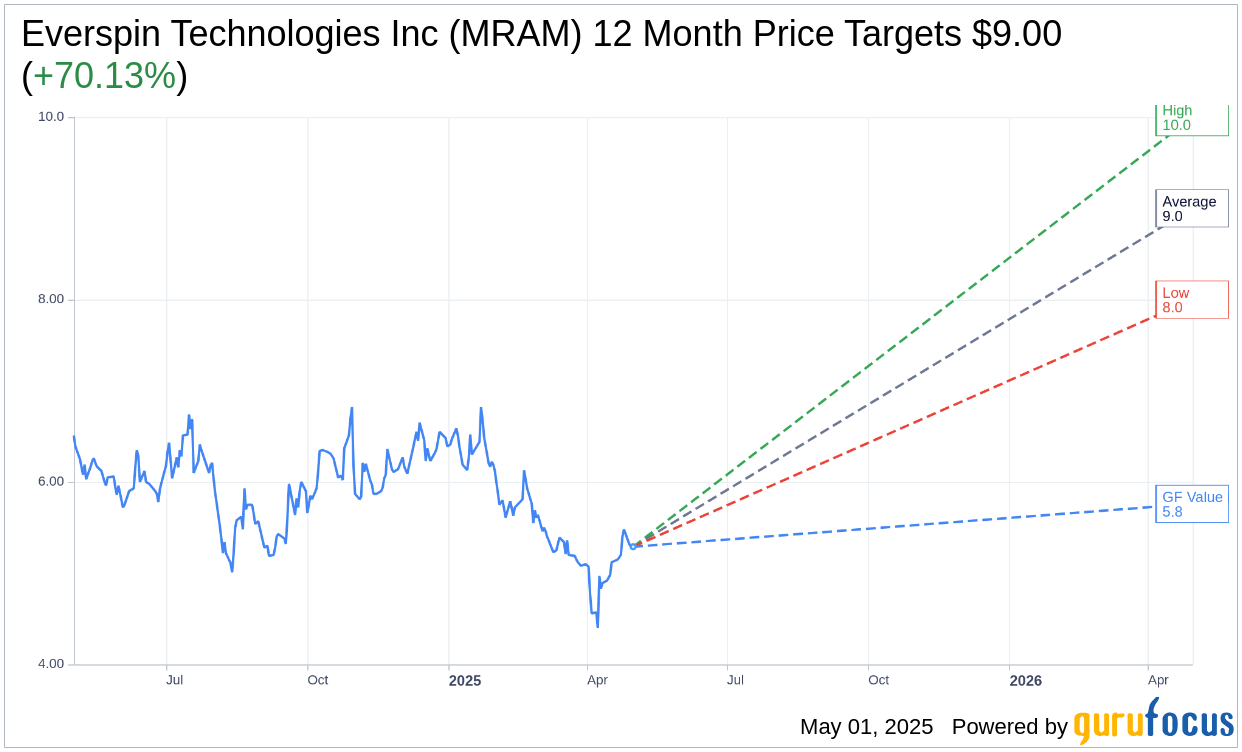

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Everspin Technologies Inc (MRAM, Financial) is $9.00 with a high estimate of $10.00 and a low estimate of $8.00. The average target implies an upside of 70.13% from the current price of $5.29. More detailed estimate data can be found on the Everspin Technologies Inc (MRAM) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Everspin Technologies Inc's (MRAM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Everspin Technologies Inc (MRAM, Financial) in one year is $5.76, suggesting a upside of 8.88% from the current price of $5.29. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Everspin Technologies Inc (MRAM) Summary page.

MRAM Key Business Developments

Release Date: April 30, 2025

- Revenue: $13.1 million, above guidance range of $12 million to $13 million.

- Non-GAAP EPS: $0.02 per diluted share.

- MRAM Product Sales: $11.0 million.

- Licensing, Royalty, Patent, and Other Revenue: $2.1 million, down from $3.6 million in Q1 2024.

- GAAP Gross Margin: 51.4%, down from 56.5% in Q1 2024.

- GAAP Operating Expenses: $8.7 million.

- Non-GAAP Net Income: $0.4 million.

- Cash and Cash Equivalents: $42.2 million.

- Cash Flow from Operations: $1.4 million.

- Q2 2025 Revenue Guidance: $12.5 million to $13.5 million.

- Q2 2025 GAAP Net Loss Guidance: Between $0.05 loss and breakeven per basic share.

- Q2 2025 Non-GAAP Net Income Guidance: Between breakeven and $0.05 per basic share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Everspin Technologies Inc (MRAM, Financial) reported first-quarter revenue of $13.1 million, exceeding their guidance range.

- The company achieved a non-GAAP EPS of $0.02, surpassing expectations.

- Everspin continues to see strong product revenue, particularly from the PERSYST 1-gigabit STT-MRAM used in data center applications.

- The company is involved in significant projects with major automotive and aerospace clients, including Lucid Motors and Blue Origin.

- Everspin's balance sheet remains strong and debt-free, with cash and cash equivalents of $42.2 million.

Negative Points

- Licensing, royalty, patent, and other revenue decreased to $2.1 million from $3.6 million in Q1 2024.

- Gross margin decreased to 51.4% from 56.5% in Q1 2024 due to a lower mix of high-margin licensing revenue.

- The company anticipates a non-GAAP net loss per basic share between $0.05 and breakeven for Q2 2025.

- Everspin's revenue is expected to be more heavily weighted towards the second half of 2025, indicating potential short-term challenges.

- There is uncertainty regarding potential tariff impacts, particularly concerning products manufactured in the US and shipped to China.