Key Highlights:

- HF Sinclair (DINO, Financial) exceeded earnings expectations but reported lower-than-expected revenue.

- Analysts predict an average upside potential of 38.30% for HF Sinclair's stock.

- GuruFocus estimates suggest a significant upside of 53.74% over the next year.

HF Sinclair (DINO) recently reported its first-quarter financial results, highlighting a mixed bag of earnings and revenue figures. The company's non-GAAP earnings per share were -$0.27, beating market expectations by $0.14. However, HF Sinclair faced challenges on the revenue front, generating $6.37 billion—a decline of 9.4% compared to the previous year, and $420 million below analyst estimates. The company reported EBITDA of $262 million, with adjusted EBITDA coming in at $201 million.

Wall Street Analysts Forecast

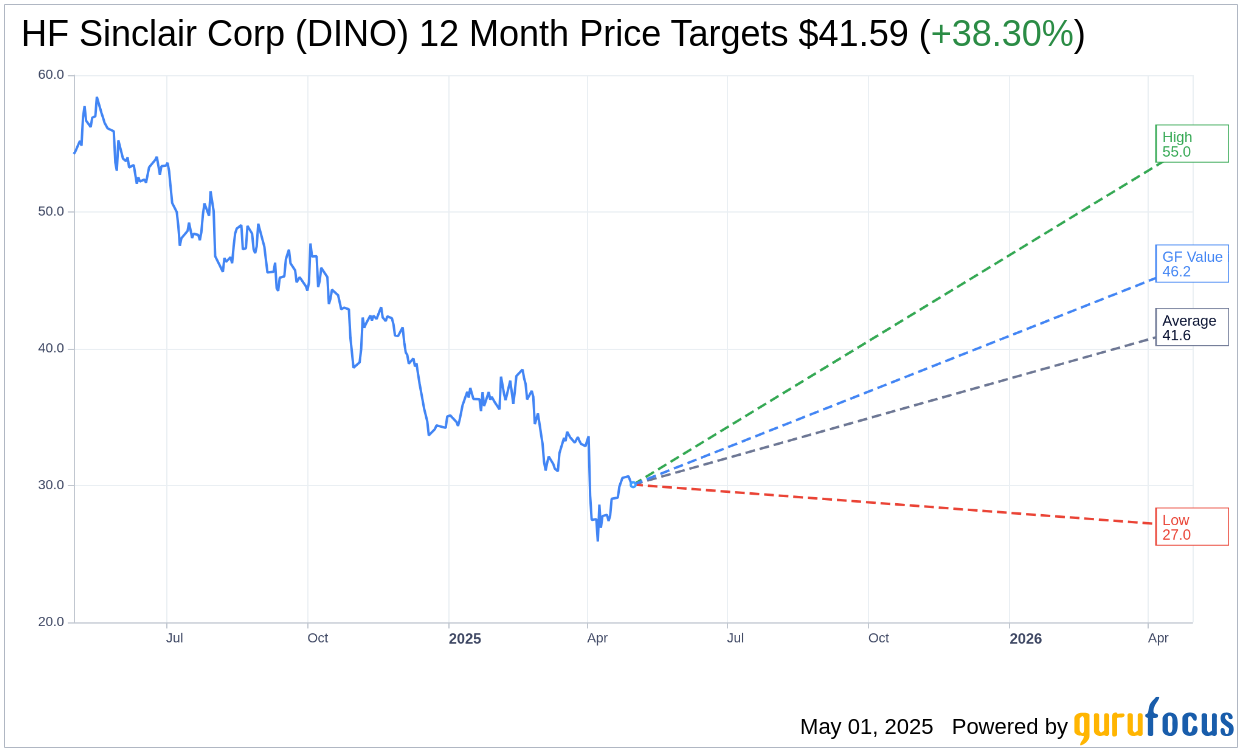

Analysts have provided their one-year price targets for HF Sinclair Corp (DINO, Financial), offering insights into potential stock performance. The average target sits at $41.59, with projections ranging from a high of $55.00 to a low of $27.00. This average target suggests an upside of 38.30% from the current trading price of $30.07. Investors can explore more detailed projections on the HF Sinclair Corp (DINO) Forecast page.

The consensus among 17 brokerage firms indicates an average recommendation of 2.5 for HF Sinclair Corp (DINO, Financial), reflecting an "Outperform" status. This rating is on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell.

GuruFocus GF Value Estimate

According to GuruFocus' estimates, the GF Value for HF Sinclair Corp (DINO, Financial) is projected to be $46.23 within the next year. This valuation suggests a substantial upside of 53.74% from the current price of $30.07. The GF Value metric represents GuruFocus' evaluation of a stock's fair market value, considering historical trading multiples, past business growth, and future performance forecasts. More comprehensive information can be accessed on the HF Sinclair Corp (DINO) Summary page.