Piper Sandler's analyst Matt O’Brien has adjusted the price target for Tandem Diabetes (TNDM, Financial) from $36 to $30, while maintaining an Overweight rating on the stock. The adjustment comes after the company announced strong first-quarter results, outperforming expectations on both revenue and profit. Tandem Diabetes reaffirmed its financial projections for the year, with Piper Sandler expressing confidence that the revenue goals are attainable.

The company's domestic operations are currently thriving, and the international segment is expected to see significant growth by 2026, driven by a substantial renewal cycle. Several upcoming catalysts could potentially drive Tandem Diabetes stock upward from its current undervalued state, reinforcing Piper Sandler's positive outlook on the stock.

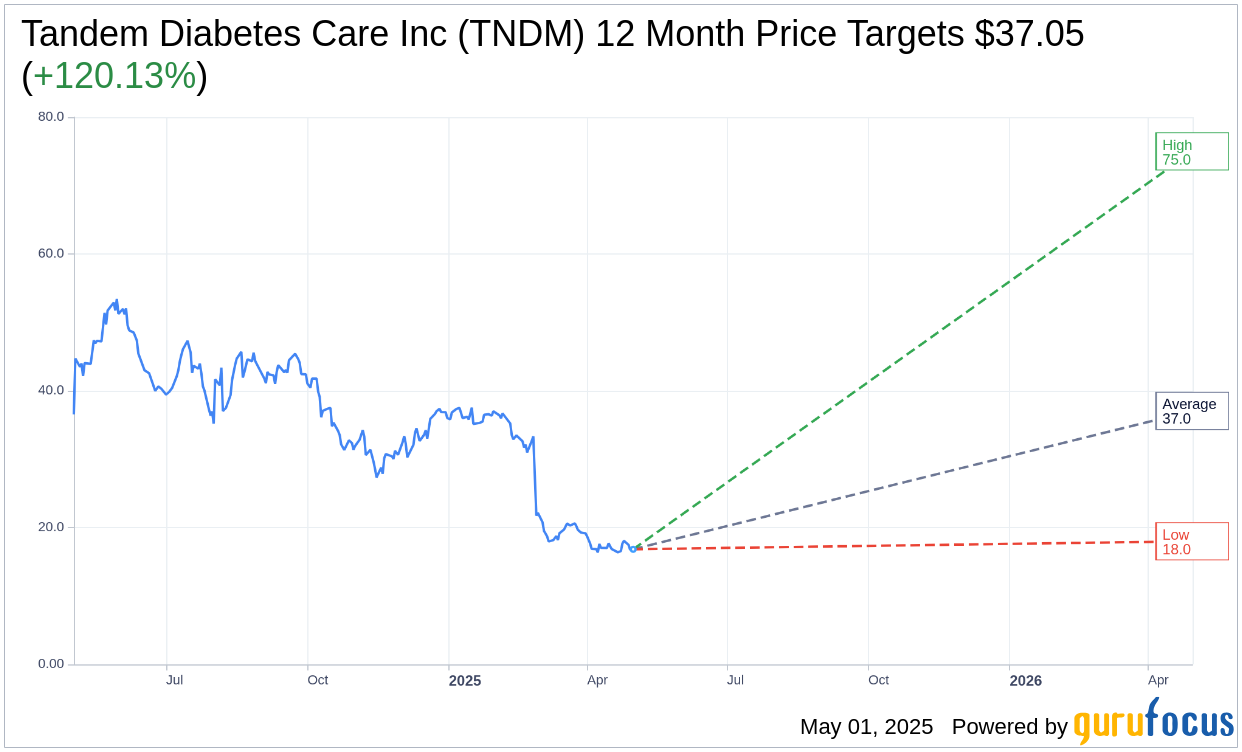

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Tandem Diabetes Care Inc (TNDM, Financial) is $37.05 with a high estimate of $75.00 and a low estimate of $18.00. The average target implies an upside of 120.13% from the current price of $16.83. More detailed estimate data can be found on the Tandem Diabetes Care Inc (TNDM) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Tandem Diabetes Care Inc's (TNDM, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tandem Diabetes Care Inc (TNDM, Financial) in one year is $50.45, suggesting a upside of 199.76% from the current price of $16.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tandem Diabetes Care Inc (TNDM) Summary page.

TNDM Key Business Developments

Release Date: April 30, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Tandem Diabetes Care Inc (TNDM, Financial) achieved more than 20% growth for the third consecutive quarter, with record first-quarter sales in the U.S. and internationally.

- The FDA cleared Control-IQ plus for people with type two diabetes, expanding Tandem's addressable market significantly.

- The company reported a meaningful improvement in adjusted EBITDA year over year, demonstrating increased profitability.

- Tandem's pharmacy channel initiative is progressing well, with approximately 30% of U.S. lives now covered under the pharmacy benefit.

- International sales reached an all-time high, driven by demand for the t:slim X2 platform and strong supply sales.

Negative Points

- There are potential headwinds anticipated in the back half of the year due to the transition to direct sales in select international markets.

- The company faces challenges in scaling its sales force productivity, which is expected to take nine to 12 months to fully realize.

- Despite progress, the reimbursement process for type two diabetes under Medicare remains onerous, posing a barrier to wider adoption.

- Competitive pressures remain strong in both U.S. and international markets, with new entrants expected.

- SG&A expenses increased due to sales force expansion and investments in international infrastructure, impacting short-term profitability.