Canaccord has adjusted its price target for Reynolds Consumer Products (REYN, Financial), reducing it to $26 from the previous $27, while maintaining a Hold rating on the shares. The adjustment follows the company's first-quarter performance, which did not meet anticipated sales and profitability benchmarks. Additionally, unexpected inventory reductions by retailers and the effects of tariffs have led to a more cautious outlook. As a result, Reynolds has revised its full-year guidance downwards, with projections for the second quarter also appearing weaker than expected.

Wall Street Analysts Forecast

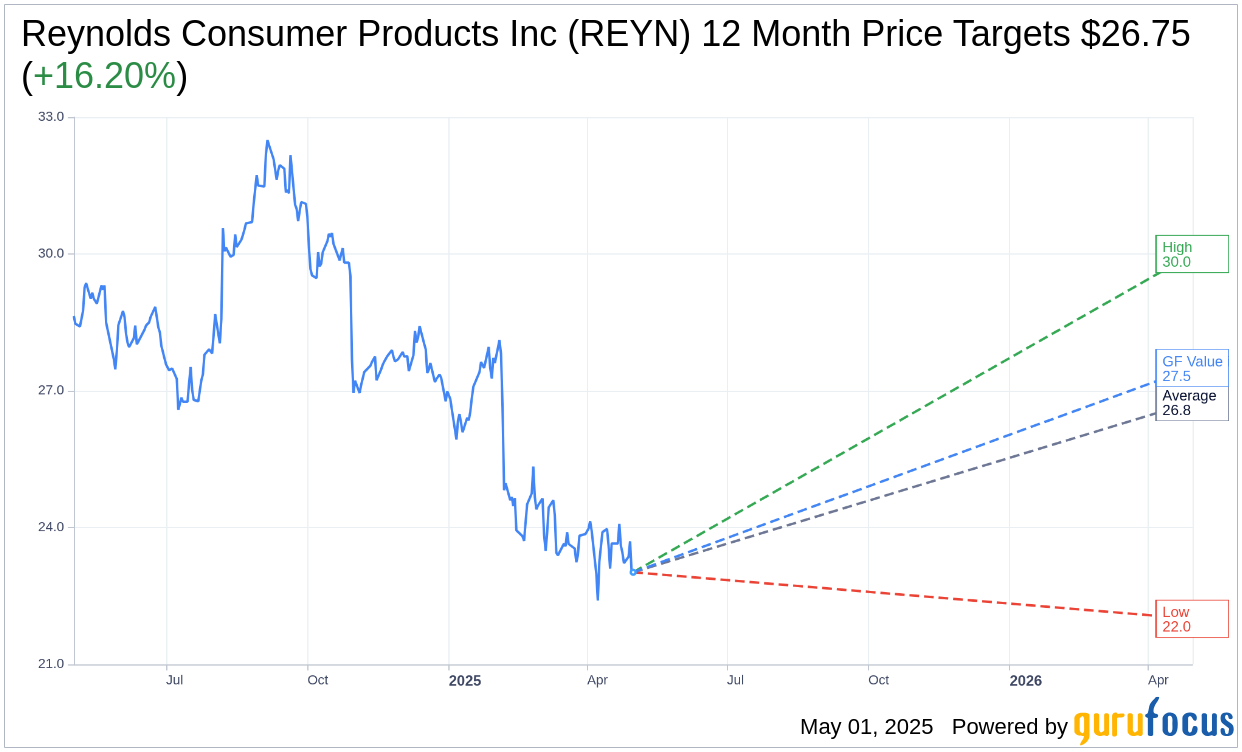

Based on the one-year price targets offered by 8 analysts, the average target price for Reynolds Consumer Products Inc (REYN, Financial) is $26.75 with a high estimate of $30.00 and a low estimate of $22.00. The average target implies an upside of 16.20% from the current price of $23.02. More detailed estimate data can be found on the Reynolds Consumer Products Inc (REYN) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Reynolds Consumer Products Inc's (REYN, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Reynolds Consumer Products Inc (REYN, Financial) in one year is $27.50, suggesting a upside of 19.46% from the current price of $23.02. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Reynolds Consumer Products Inc (REYN) Summary page.

REYN Key Business Developments

Release Date: April 30, 2025

- Net Revenue: $818 million for the first quarter.

- Retail Revenue: $767 million, $28 million below the first quarter of 2024.

- Non-Retail Revenue: Increased by $12 million.

- Adjusted EBITDA: $117 million, compared to $122 million in the previous year.

- Adjusted Earnings Per Share (EPS): Unchanged at $0.23 versus the first quarter of 2024.

- 2025 Net Revenue Guidance: Expected to be down low single digits compared to 2024.

- 2025 Adjusted EBITDA Guidance: $650 million to $670 million.

- 2025 Adjusted EPS Guidance: $1.54 to $1.61.

- Second Quarter Revenue Guidance: Expected to be down 2% to 5% compared to $930 million in Q2 2024.

- Second Quarter Adjusted EBITDA Guidance: $155 million to $165 million, compared to $172 million in Q2 2024.

- Second Quarter Adjusted EPS Guidance: $0.35 to $0.39, versus $0.46 in the previous year.

- Capital Spending Increase: Anticipated $20 million to $40 million increase in 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Reynolds Consumer Products Inc (REYN, Financial) outperformed its categories by 2 points at retail, capturing share in household foil, waste bags, food bags, and nonfoam disposable tableware.

- The company successfully introduced new products such as Hefty Press to Close food bags, Hefty Compostable cutlery, and Reynolds Kitchen air fryer cups, demonstrating strong innovation.

- Despite retailer destocking, Reynolds Consumer Products Inc (REYN) delivered its earnings guide, showcasing resilience in a dynamic macro environment.

- The company is implementing spring resets and price increases according to plan, gaining shelf space and points of distribution.

- Reynolds Consumer Products Inc (REYN) has a strong balance sheet, allowing it to invest in high-return growth and margin expansion programs.

Negative Points

- Retail revenues were $28 million below the first quarter of 2024, impacted by later Easter timing, retailer destocking, and declines in the foam category.

- Adjusted EBITDA decreased from $122 million in the previous year to $117 million, primarily due to lower retail sales.

- The company expects 2025 net revenues to be down low single digits compared to 2024, with adjusted EBITDA also projected to be lower.

- Reynolds Consumer Products Inc (REYN) faces $100 million to $200 million in cost headwinds on an annualized basis due to tariffs, impacting profitability.

- Retailer destocking is assumed to be a permanent adjustment, affecting the company's volume expectations for the full year.