Lucid Capital has begun coverage on Aligos Therapeutics, identified by the ticker (ALGS, Financial), with a "Buy" recommendation and a price target of $36. The company's leading product, ALG-000184, is an advanced small-molecule designed to modulate core assembly, currently being developed to treat chronic hepatitis B. In Phase 1 trials, ALG-000184 showcased promising antiviral effectiveness that could position it as a top contender in its class. Lucid Capital views Aligos as an enticing investment opportunity, particularly appealing at its current valuation.

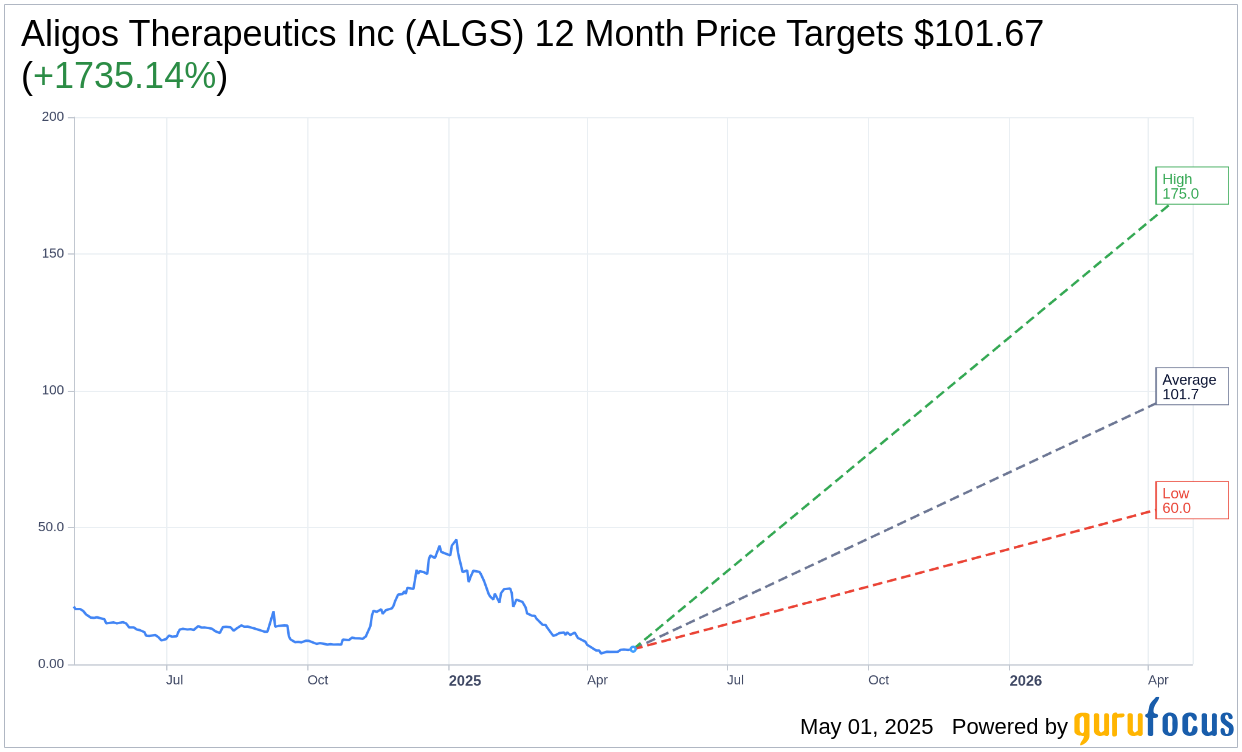

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Aligos Therapeutics Inc (ALGS, Financial) is $101.67 with a high estimate of $175.00 and a low estimate of $60.00. The average target implies an upside of 1,735.14% from the current price of $5.54. More detailed estimate data can be found on the Aligos Therapeutics Inc (ALGS) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Aligos Therapeutics Inc's (ALGS, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Aligos Therapeutics Inc (ALGS, Financial) in one year is $1.75, suggesting a downside of 68.41% from the current price of $5.54. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Aligos Therapeutics Inc (ALGS) Summary page.