Stephens has elevated its rating for Trane (TT, Financial) from Equal Weight to Overweight, increasing the price target to $475 from a previous $412. The decision comes from the firm's anticipation of Trane reaching a status as a leading compounder, deserving of a quality-growth premium similar to a select group of industrial companies. Trane's notable strengths, such as its company culture, efficient operating systems, direct commercial sales force, and substantial aftermarket/service contributions, are acknowledged by the firm. However, Stephens suggests that these factors are not fully considered in the current share price, which remains about 8% lower than its peak last fall.

Wall Street Analysts Forecast

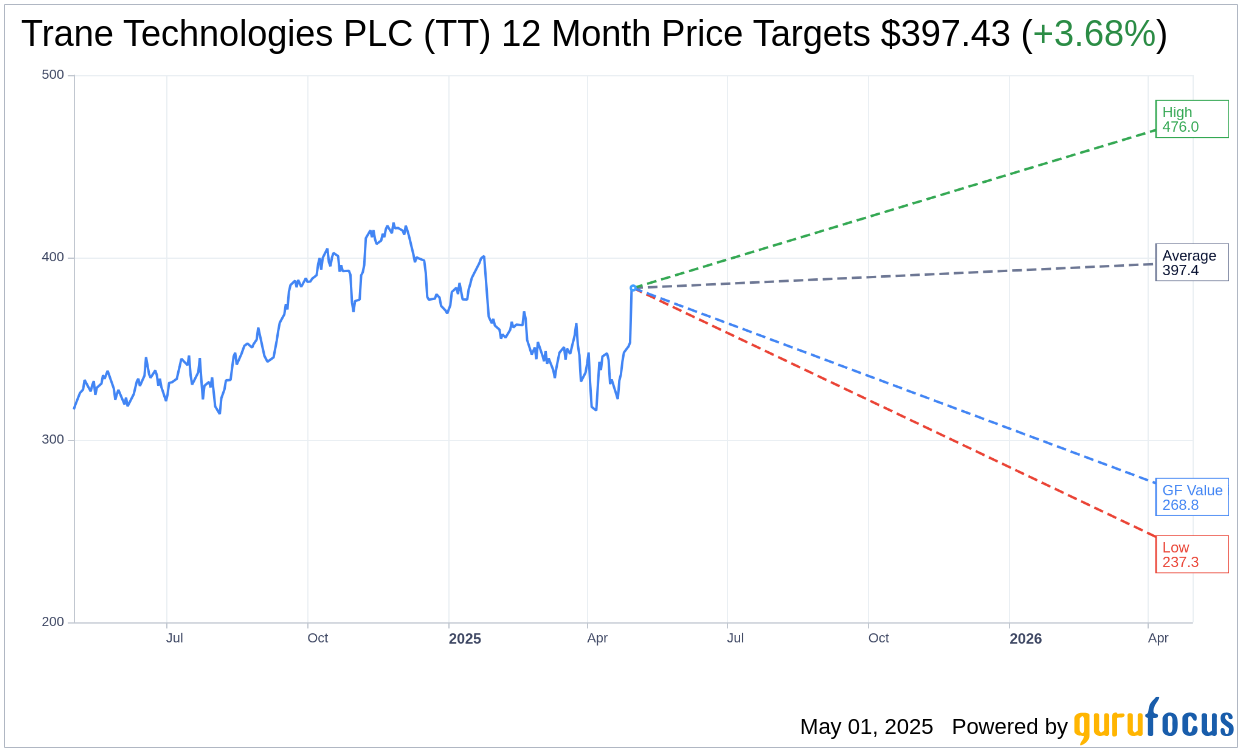

Based on the one-year price targets offered by 18 analysts, the average target price for Trane Technologies PLC (TT, Financial) is $397.43 with a high estimate of $476.00 and a low estimate of $237.34. The average target implies an upside of 3.68% from the current price of $383.31. More detailed estimate data can be found on the Trane Technologies PLC (TT) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Trane Technologies PLC's (TT, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Trane Technologies PLC (TT, Financial) in one year is $268.78, suggesting a downside of 29.88% from the current price of $383.31. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Trane Technologies PLC (TT) Summary page.

TT Key Business Developments

Release Date: April 30, 2025

- Organic Revenue Growth: 11% increase in Q1 2025.

- Adjusted EBITDA Margin Expansion: 130 basis points improvement.

- Adjusted EPS Growth: 26% increase.

- Bookings Growth: 4% increase with a book-to-bill ratio of 113%.

- Backlog Increase: $500 million added, including $400 million in Americas Commercial HVAC.

- Americas Commercial HVAC Revenue Growth: Mid-teens growth in equipment and low teens in services.

- Residential Revenue Growth: High teens increase.

- Transport Refrigeration Revenue Growth: Mid-single digits increase.

- EMEA Commercial HVAC Bookings Growth: Mid-teens increase.

- EMEA Revenue Growth: Mid-single digits increase.

- Asia Pacific Revenue Growth (excluding China): Low 20s increase.

- China Revenue Decline: High 20s decrease.

- Adjusted EBITDA Margin Expansion in Americas: 170 basis points.

- Adjusted EBITDA Margin Decline in EMEA: 190 basis points.

- Adjusted EBITDA Margin Expansion in Asia Pacific: 90 basis points.

- 2025 Guidance: 7% to 8% organic revenue growth and $12.70 to $12.90 adjusted EPS.

- Q2 2025 Guidance: Approximately 8% organic revenue growth and $3.75 adjusted EPS.

- Capital Deployment in Q1 2025: $775 million, including $210 million to dividends, $15 million to M&A, and $550 million to share repurchases.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Trane Technologies PLC (TT, Financial) reported strong financial results with 11% organic revenue growth and a 26% increase in adjusted EPS for Q1 2025.

- The company achieved a book-to-bill ratio of 113% for the enterprise, indicating strong demand and future revenue potential.

- Commercial HVAC bookings in the Americas set a new quarterly record, showcasing robust demand in this segment.

- The Service business, representing one-third of enterprise revenues, has shown a high single-digit compound annual growth rate since 2019.

- Trane Technologies PLC (TT) is confident in delivering results towards the higher end of their full-year revenue and EPS guidance ranges.

Negative Points

- Transport refrigeration bookings were down low single digits, reflecting challenges in this segment.

- In China, the market remains challenging with bookings and revenues down significantly against tough prior year comparisons.

- The EMEA segment experienced a decline in adjusted EBITDA margin by 190 basis points due to high business reinvestment.

- The company anticipates a mid-20s trailer market decline for 2025, which could impact the transport segment.

- Tariff impacts are expected to cost approximately $250 million to $275 million in 2025, posing a challenge to manage costs.