Altisource Portfolio Solutions (ASPS, Financial) reported a notable increase in its first-quarter revenue, reaching $43.439 million compared to $39.469 million in the same period last year. This growth highlights an 11% rise in total service revenue, which climbed to $40.9 million. Furthermore, the company's Adjusted EBITDA witnessed a 14% improvement, totaling $5.3 million. These gains were attributed to the expansion of their Renovation Business, a surge in foreclosure initiations, and successful sales efforts.

ASPS also benefitted from scale advantages and a favorable revenue mix, contributing to its Adjusted EBITDA growth outpacing that of service revenue. Additionally, in February 2025, the company completed an exchange and maturity extension transaction with its lenders. This strategic move has significantly bolstered the company's balance sheet while also reducing its interest expenses, paving the way for further financial stability and growth.

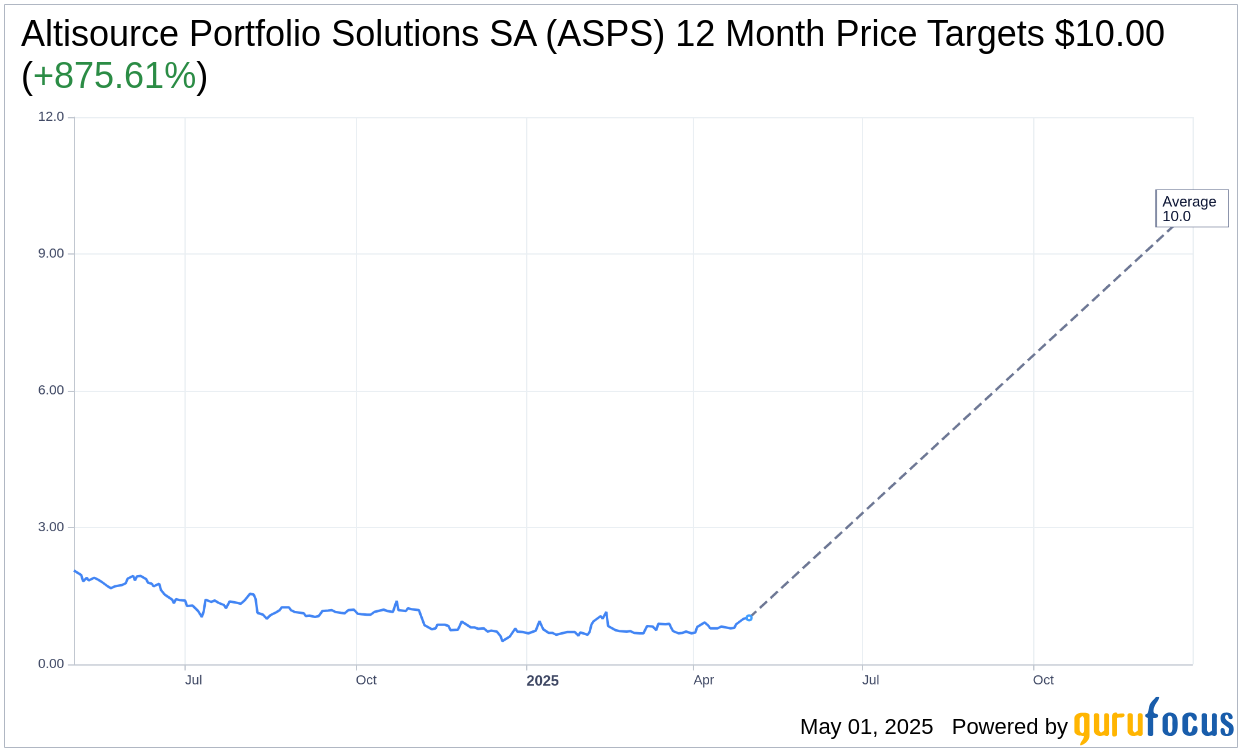

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Altisource Portfolio Solutions SA (ASPS, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an upside of 875.61% from the current price of $1.03. More detailed estimate data can be found on the Altisource Portfolio Solutions SA (ASPS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Altisource Portfolio Solutions SA's (ASPS, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.