On May 1, 2025, Janus Henderson Group PLC (JHG, Financial) released its 8-K filing for the first quarter of 2025, showcasing a solid financial performance that exceeded analyst expectations. The company reported a diluted earnings per share (EPS) of $0.77, surpassing the estimated EPS of $0.69. This performance is indicative of the company's robust investment strategies and effective management.

Company Overview

Janus Henderson Group provides investment management services to a diverse clientele, including retail intermediary (56% of managed assets), self-directed (23%), and institutional (21%) clients. As of September 2024, the company managed $382.3 billion in assets, with a focus on active equities (63%), fixed-income (21%), multi-asset (14%), and alternative (2%) investment platforms. The majority of its assets are sourced from North America (61%), with the remainder from Europe, the Middle East, Africa, Latin America (29%), and the Asia-Pacific region (10%).

Financial Performance and Strategic Developments

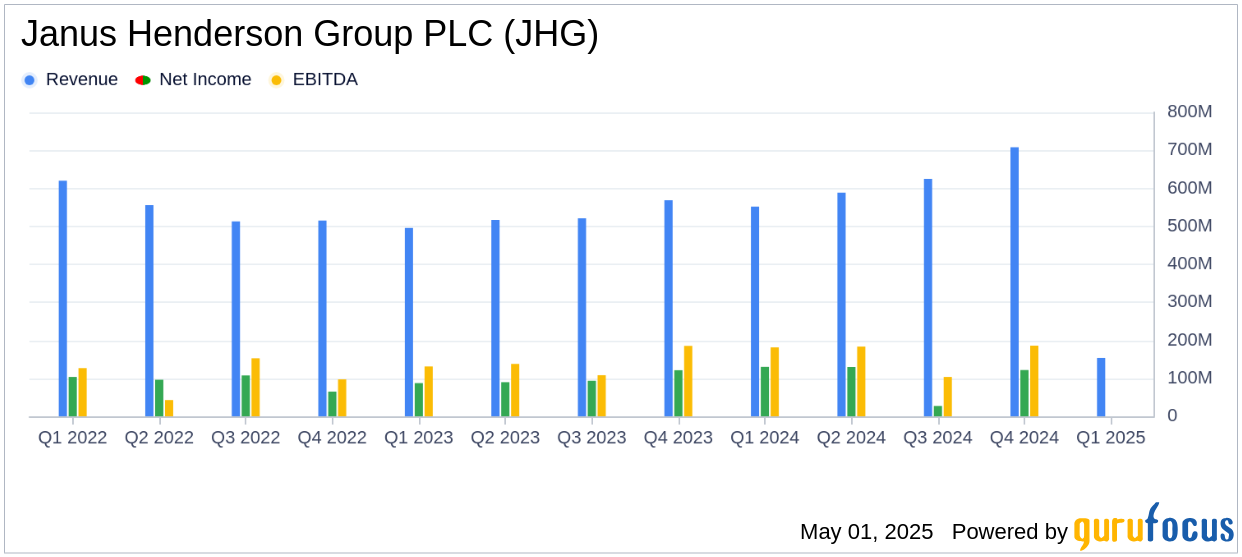

Janus Henderson reported a first-quarter 2025 operating income of $153.6 million, a decrease from $197.5 million in the fourth quarter of 2024 but an increase from $119.2 million in the first quarter of 2024. The adjusted operating income was $156.6 million, reflecting a year-over-year improvement. The company's net inflows of $2.0 billion in the first quarter highlight its ability to attract new investments, particularly in the Intermediary and Institutional segments.

Strategic Partnerships and Shareholder Returns

In April 2025, Janus Henderson announced a strategic partnership with The Guardian Life Insurance Company of America, which includes managing a $45 billion investment-grade public fixed income asset portfolio. This partnership is expected to enhance the company's capabilities and market reach. Additionally, the Board of Directors declared a 3% increase in the quarterly dividend to $0.40 per share and authorized $200 million in share buybacks through April 2026, reflecting the company's strong cash flow and commitment to returning capital to shareholders.

Investment Performance and Asset Management

Janus Henderson's investment performance remains robust, with 77%, 65%, and 73% of assets under management (AUM) outperforming relevant benchmarks over three-, five-, and ten-year periods, respectively, as of March 31, 2025. The company's AUM increased by 6% year-over-year to $373 billion, demonstrating its effective asset management strategies.

Financial Statements and Key Metrics

The company's financial statements reveal a strong balance sheet, with significant cash flow supporting its strategic initiatives and shareholder returns. The share repurchase program and dividend increase are indicative of Janus Henderson's financial health and strategic focus on enhancing shareholder value.

Ali Dibadj, Chief Executive Officer, stated: "Our first quarter results are solid, with year-over-year improvements in net flows, operating revenues, operating income, and EPS. The new buyback authorization and increase to our dividend reflect our excellent cash flow and our continued commitment to capital return."

Conclusion

Janus Henderson Group PLC's first-quarter 2025 results underscore its strong financial performance and strategic positioning in the asset management industry. The company's ability to exceed EPS estimates, coupled with strategic partnerships and shareholder-friendly initiatives, positions it well for future growth and value creation. Investors and stakeholders will likely view these developments as positive indicators of the company's ongoing success and resilience in a competitive market.

Explore the complete 8-K earnings release (here) from Janus Henderson Group PLC for further details.