Baird has elevated its price target for Advanced Energy (AEIS, Financial) to $132, up from the previous $124, while maintaining an Outperform rating. This adjustment comes in light of the company's impressive performance in the first quarter, during which its guidance for the second quarter surpassed market expectations.

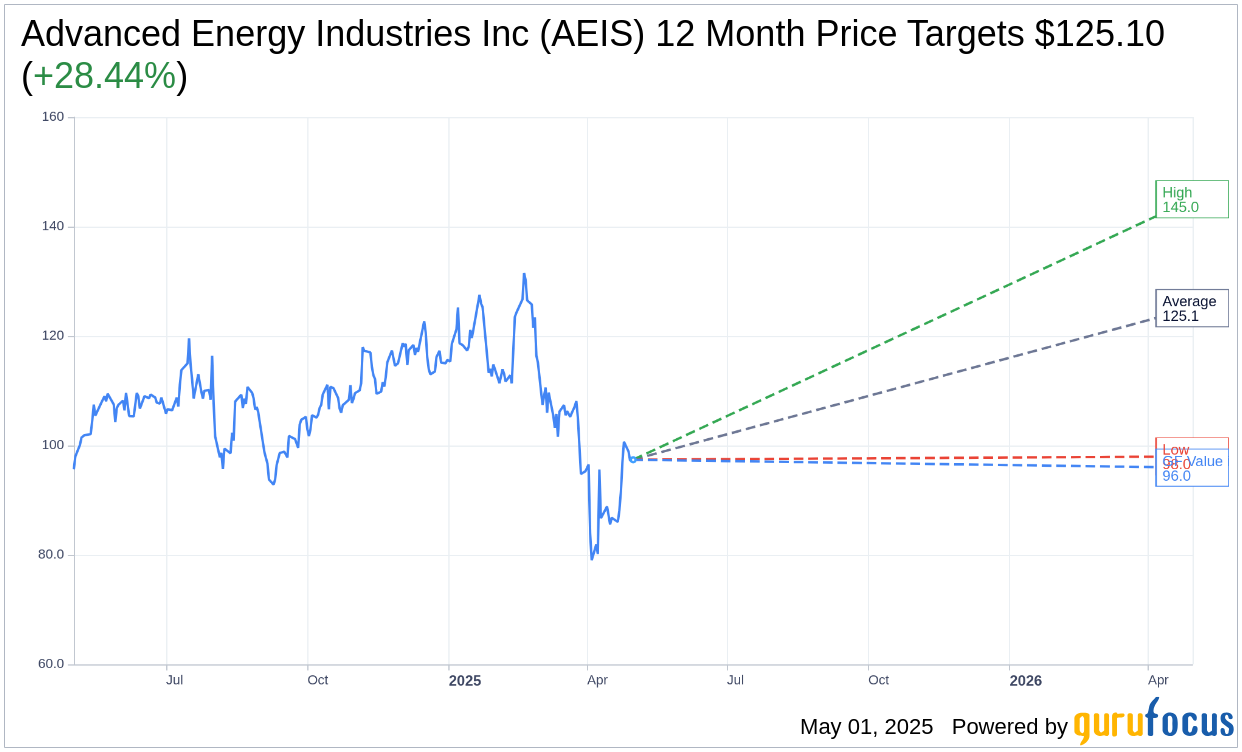

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Advanced Energy Industries Inc (AEIS, Financial) is $125.10 with a high estimate of $145.00 and a low estimate of $98.00. The average target implies an upside of 28.44% from the current price of $97.40. More detailed estimate data can be found on the Advanced Energy Industries Inc (AEIS) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Advanced Energy Industries Inc's (AEIS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advanced Energy Industries Inc (AEIS, Financial) in one year is $95.95, suggesting a downside of 1.49% from the current price of $97.4. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advanced Energy Industries Inc (AEIS) Summary page.

AEIS Key Business Developments

Release Date: February 12, 2025

- Revenue: $415 million, exceeded guidance, 11% sequential increase, 3% year-over-year growth.

- Gross Margin: 38%, best performance in 3 years, up 170 basis points sequentially.

- Net Income: Earnings of $1.30 per share, up from $0.98 in the previous quarter.

- Semiconductor Revenue: $227 million, up 15% sequentially and 19% year-over-year.

- Data Center Computing Revenue: $89 million, up 10% sequentially, 41% year-over-year.

- Industrial Medical Revenue: $77 million, flat sequentially, down year-over-year.

- Operating Expenses: $102 million, up 5% from last quarter.

- Cash Flow from Operations: $83 million, close to record levels.

- Total Cash: $722 million, net cash of $157 million.

- Inventory Days: Reduced to 126 days from 143 in Q3.

- Operating Margin: 13.5%, up 300 basis points from last quarter.

- 2024 Full Year Revenue: $1.48 billion, down 10% year-over-year.

- 2024 CapEx: $57 million, 3.8% of revenue.

- Q1 2025 Revenue Guidance: Approximately $392 million, plus or minus $20 million.

- Q1 2025 Gross Margin Guidance: 37% to 37.5%.

- Q1 2025 Non-GAAP Earnings Guidance: $1.03 per share, plus or minus $0.25.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Advanced Energy Industries Inc (AEIS, Financial) delivered strong financial results in the fourth quarter, with revenue of $415 million exceeding the high end of their guidance range.

- The company achieved a gross margin of 38%, marking their best performance in three years, driven by higher volume and improved factory efficiency.

- Data center computing revenue grew 10% sequentially, reaching a record quarter for data center computing product revenue.

- The company launched 35 new platform products in 2024, enhancing their product portfolio and customer engagement.

- AEIS made significant progress on their factory consolidation plan, aiming to move gross margin above 40%.

Negative Points

- The industrial and medical markets faced headwinds in 2024 due to lackluster demand and elevated inventory levels.

- Telecom and networking revenue reverted to more normal levels after a strong 2023, impacting overall revenue growth.

- Operating expenses increased by 5% from the previous quarter, driven by higher sales and incentive-related expenses.

- The company faces challenges in converting design wins into revenue, with some design wins going stale.

- The industrial and medical markets have been difficult, with ongoing inventory corrections and a slow recovery expected.