Summary Highlights:

- Iron Mountain (IRM, Financial) raises its 2025 outlook, propelled by strong Q1 performance.

- Analysts predict an average price target of $114, indicating potential upside.

- Current brokerage recommendations position IRM as an "Outperform" investment.

Iron Mountain (IRM) has recently revised its projections for 2025 following an impressive first quarter. The company witnessed an 8.8% surge in service revenue alongside a 7.2% growth in storage services. Consequently, the forecast for adjusted funds from operations (FFO) per share is now set between $4.95 and $5.05, exceeding previous expectations.

Wall Street Analysts Forecast

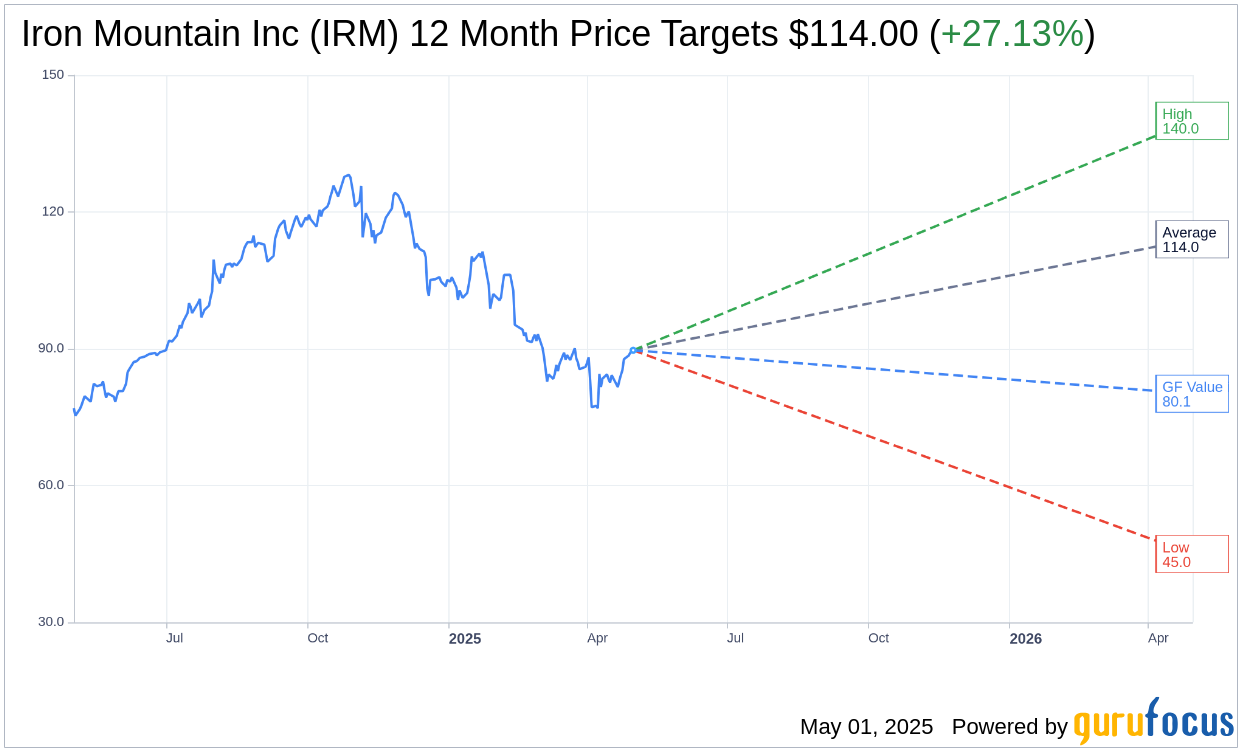

According to the one-year price targets provided by eight analysts, Iron Mountain Inc (IRM, Financial) is projected to have an average target price of $114.00. This figure includes a high estimate of $140.00 and a low of $45.00. This average target suggests a potential upside of 27.13% from the current share price of $89.67. For more comprehensive estimate data, visit the Iron Mountain Inc (IRM) Forecast page.

The consensus recommendation from ten brokerage firms currently rates Iron Mountain Inc (IRM, Financial) with an average brokerage recommendation of 2.2, which aligns with an "Outperform" rating. This rating scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the GF Value for Iron Mountain Inc (IRM, Financial) over the next year is anticipated to be $80.14. This suggests a potential downside of 10.63% from the current market price of $89.67. The GF Value represents GuruFocus' calculated fair value for the stock, considering historical trading multiples, past growth, and future performance projections. Detailed data can be accessed on the Iron Mountain Inc (IRM) Summary page.